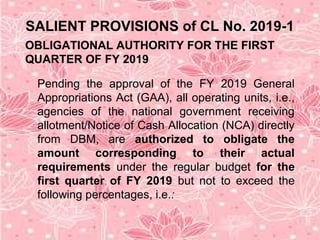

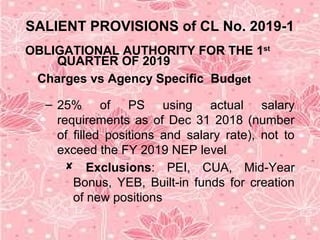

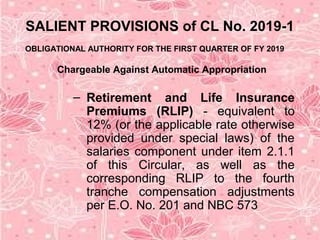

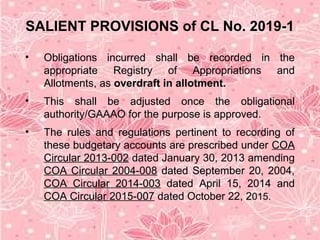

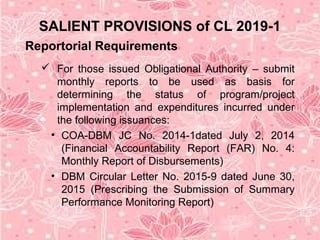

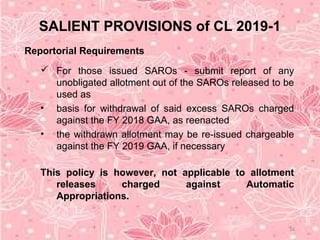

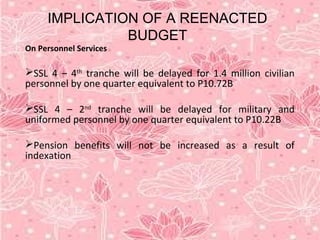

The document summarizes the key provisions of Circular Letter No. 2019-1 which provides obligational authority and guidelines for government agencies under the reenacted FY 2018 budget for the first quarter of FY 2019. It outlines that agencies can obligate up to 25% of their personnel services, MOOE and capital outlay budgets for Q1. It also describes items like automatic appropriations that are not covered by this authority and will require separate releases. The implications of the reenacted budget are delays to salary increases and new infrastructure projects.