The document provides an overview of the city of Kenner, Louisiana, highlighting its amenities and quality of life. Key points include:

- Kenner has a sub-tropical climate with average annual rainfall of 62 inches and temperatures between 77.5°F and 59.8°F.

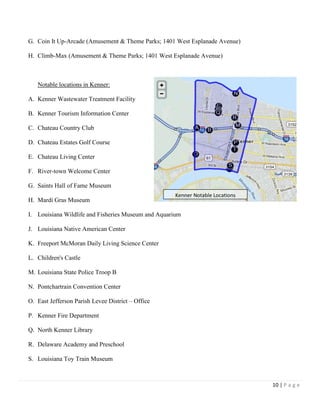

- Cultural and family attractions in Kenner include the River-town Historic District with art galleries, museums, and theaters, as well as the Cannes Brulees Native American Museum.

- Recreational amenities include Lake-Town on the shore of Lake Pontchartrain, with parks, trails, and entertainment venues, and Kenner City Park with fountains, ponds, and event spaces.