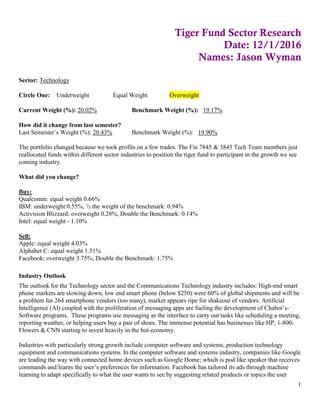

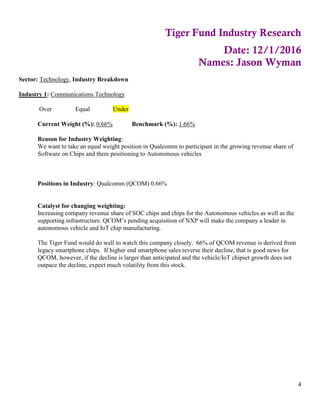

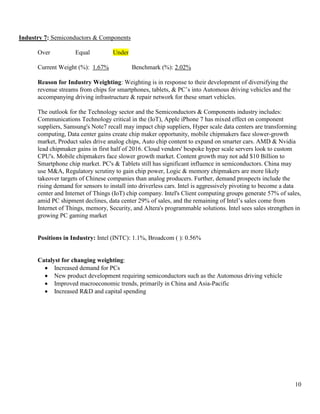

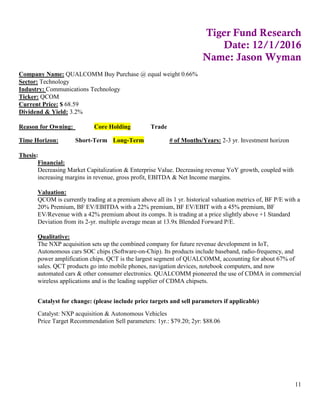

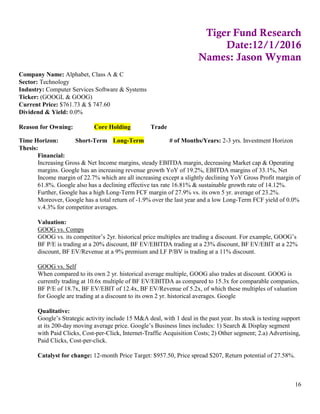

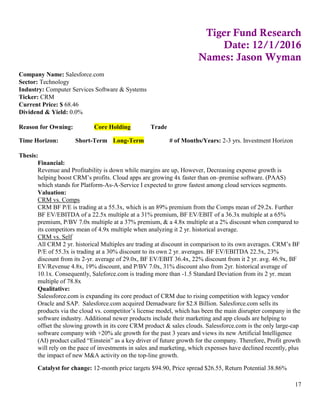

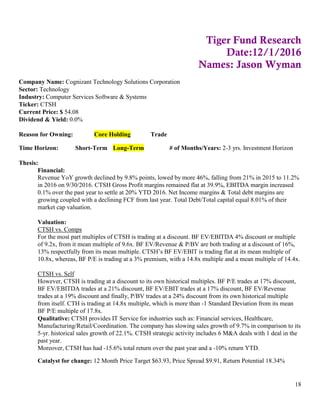

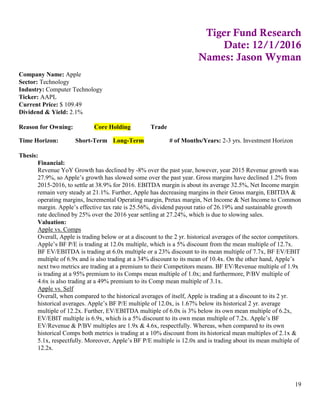

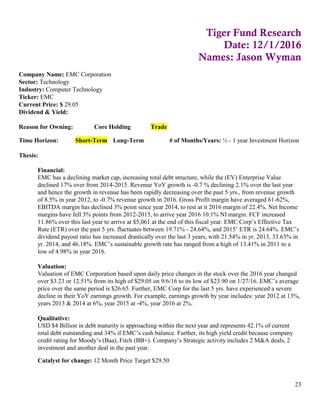

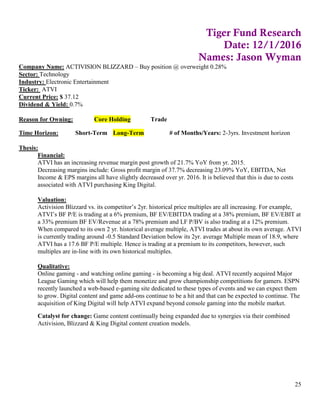

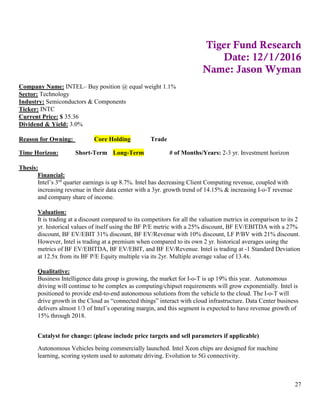

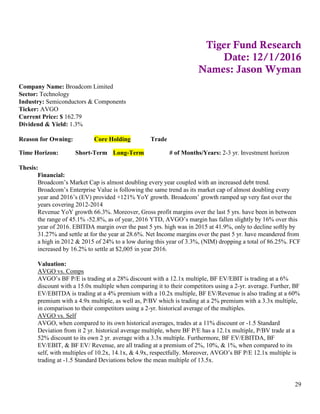

The document provides an analysis of sector and industry weightings for the Tiger Fund technology sector. It recommends an equal weight of 0.66% for Qualcomm in the Communications Technology industry and overweight positions in Microsoft, Facebook, Alphabet, and Salesforce in the Computer Services Software & Systems industry. It recommends an underweight position in the Computer Technology industry to decrease exposure to declining Apple phone sales and take a position in IBM to participate in its artificial intelligence initiatives. Catalysts that could trigger changes in weightings include company growth rates, smartphone market trends, and shifts in technology.