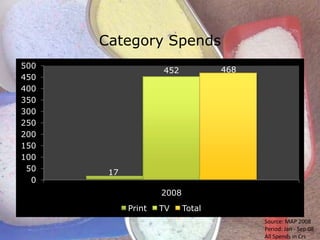

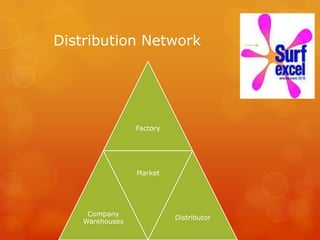

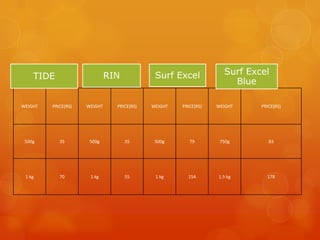

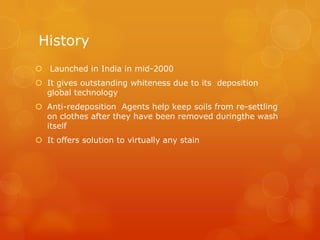

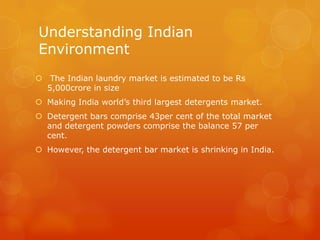

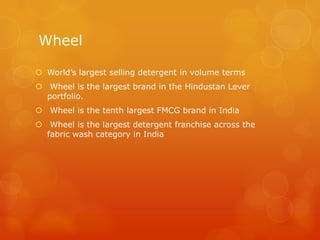

The document provides an overview of the detergent industry in India. It discusses that the total detergent market in India is Rs 6000 crore with detergent powder being Rs 3300 crore. It also discusses industry segmentation, major players like HUL, Nirma and their market shares. Popular brands in different price segments like Surf Excel, Ariel, Wheel, Nirma are also mentioned along with their marketing strategies.