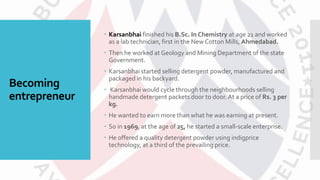

This document provides information about Karsanbhai Patel, the founder of Nirma, and the history and operations of Nirma. It discusses that Karsanbhai Patel started Nirma in 1969 at age 25 by selling affordable detergent door-to-door. Nirma revolutionized the detergent market in India and became very successful. However, in later years Nirma lost market share as consumers began perceiving it as an inferior brand. Today Nirma has less than 6% market share in India's detergent market.