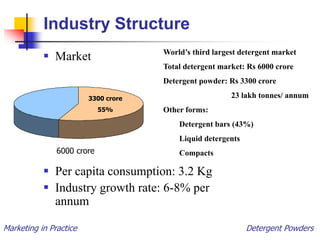

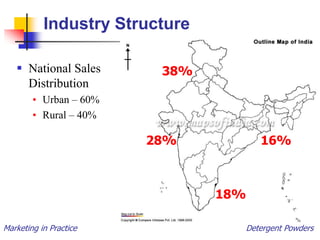

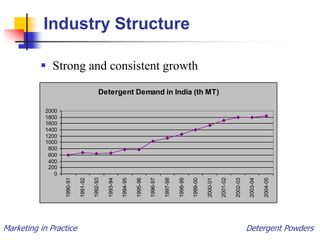

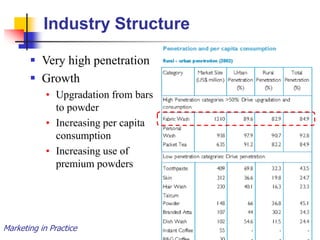

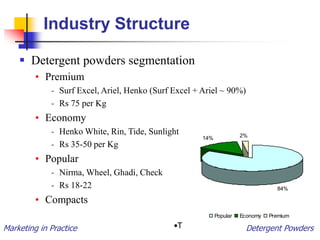

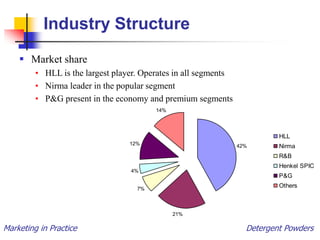

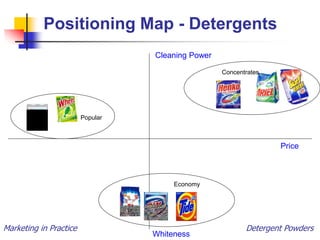

The document summarizes the detergent powder industry in India. It describes key metrics like market size, segmentation, major players and their market shares. Popular brands like Surf Excel, Ariel and Nirma are discussed along with their positioning, advertising campaigns and variants. Future trends of industry growth through upgradation and increasing consumption are also mentioned.