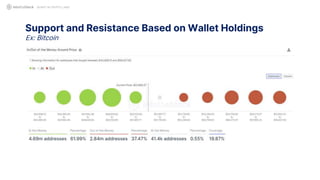

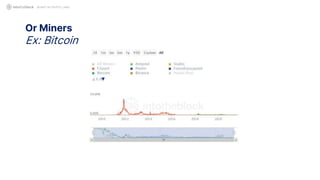

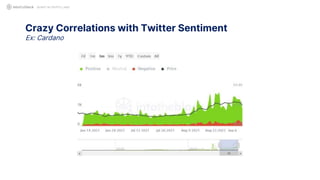

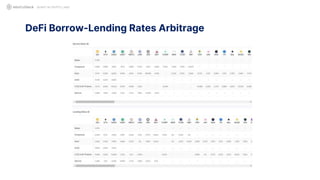

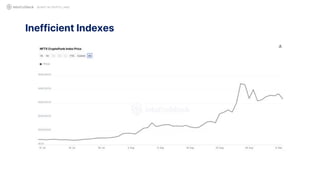

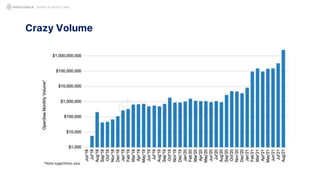

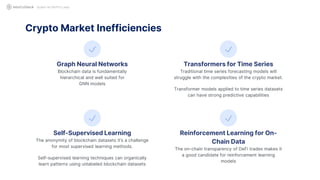

The document discusses the unique characteristics and opportunities of quantitative strategies in the cryptocurrency space, highlighting the challenges posed by small datasets and market inefficiencies. It emphasizes the potential of decentralized finance (DeFi) and new deep learning methods for developing informed trading strategies. Additionally, it addresses the importance of adapting traditional quant strategies to fit the dynamic nature of crypto assets.