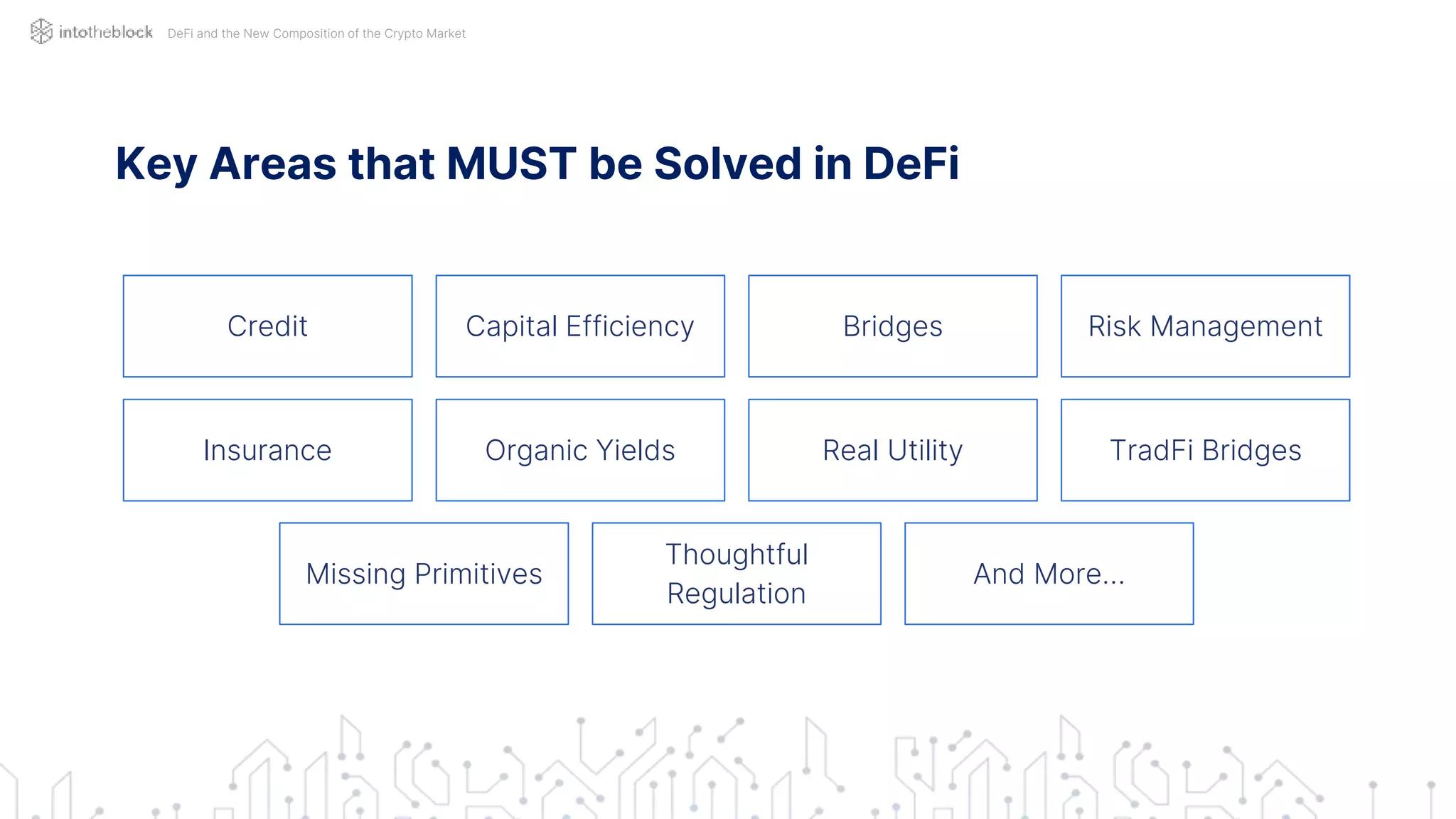

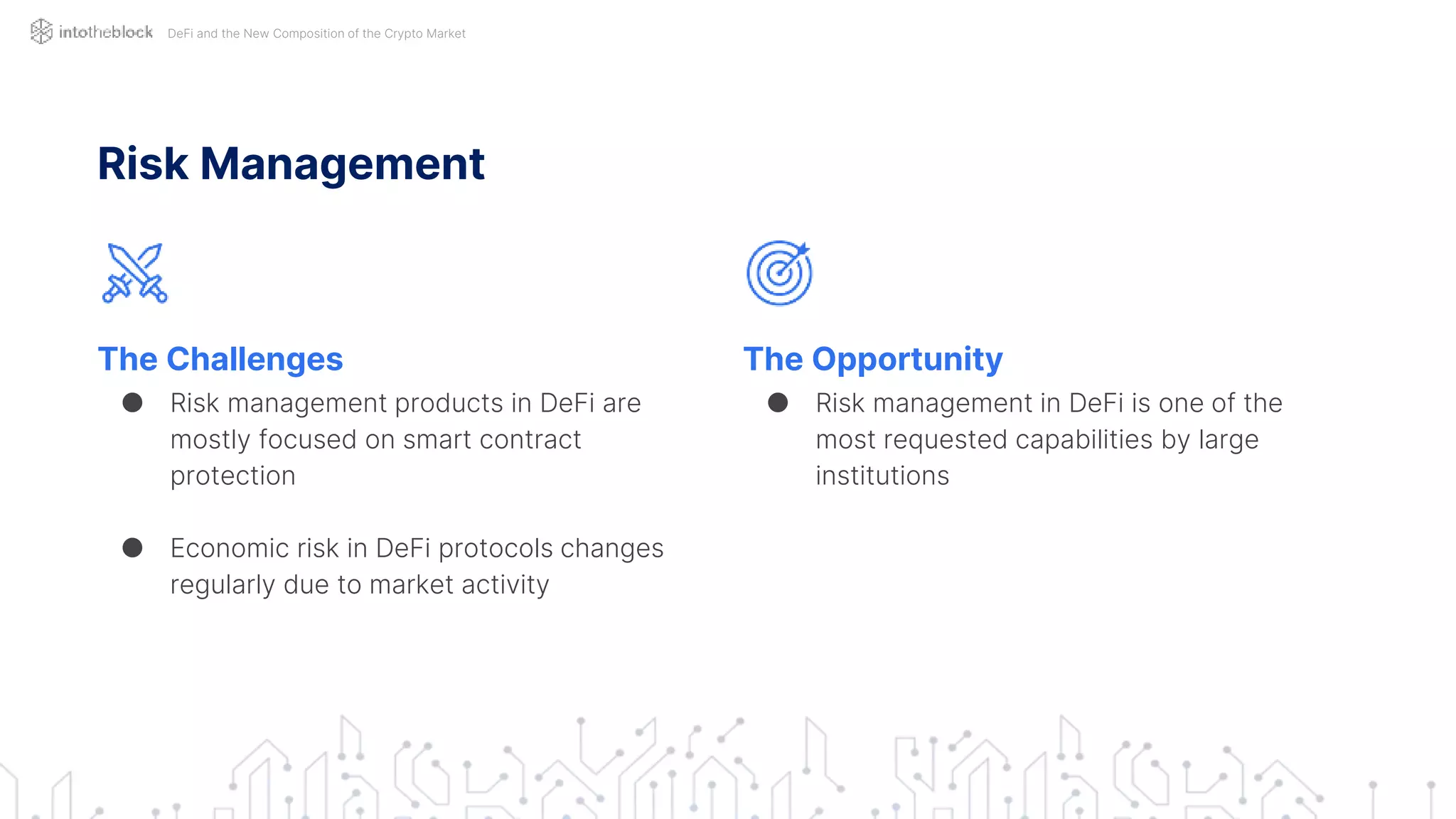

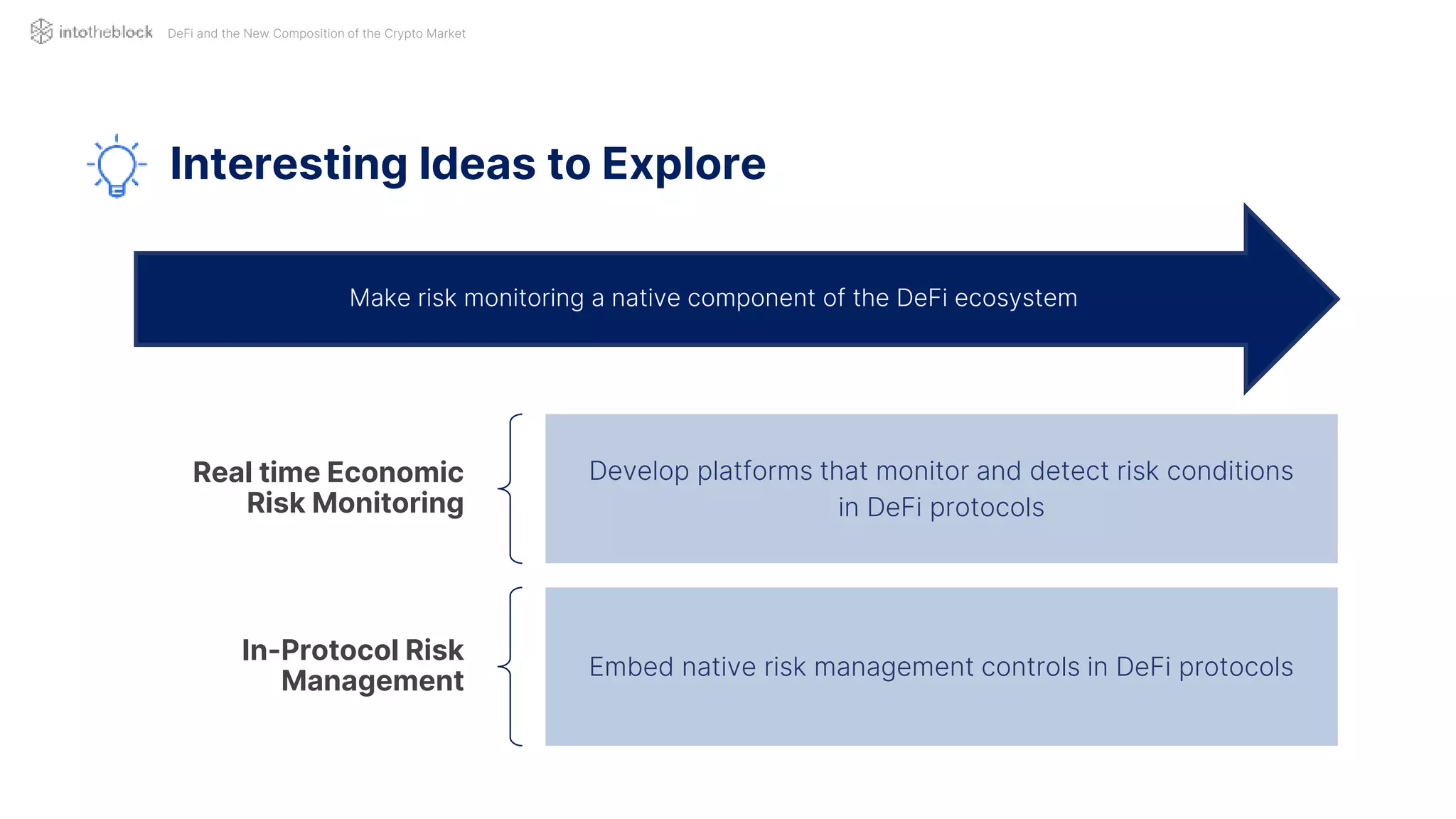

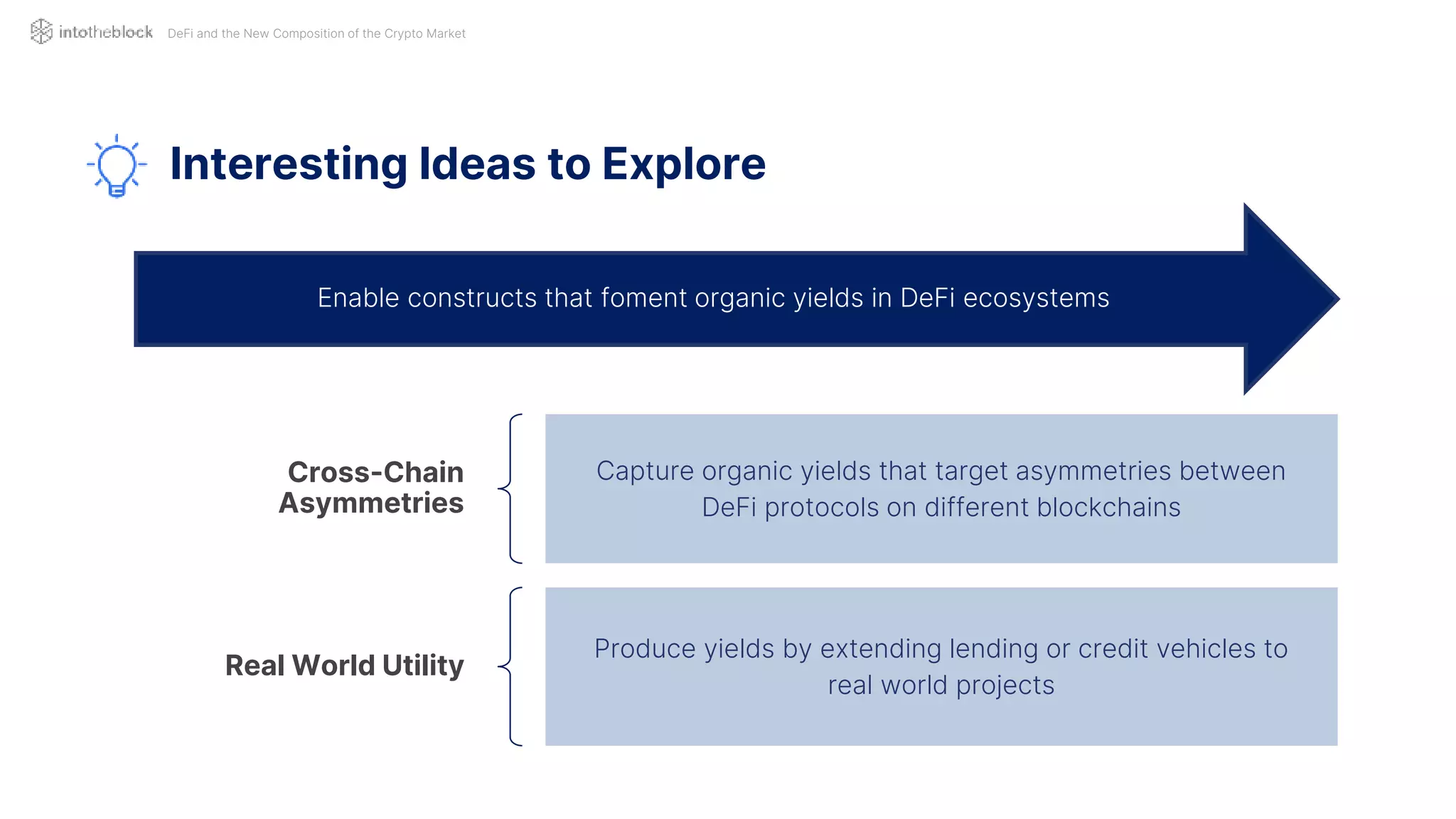

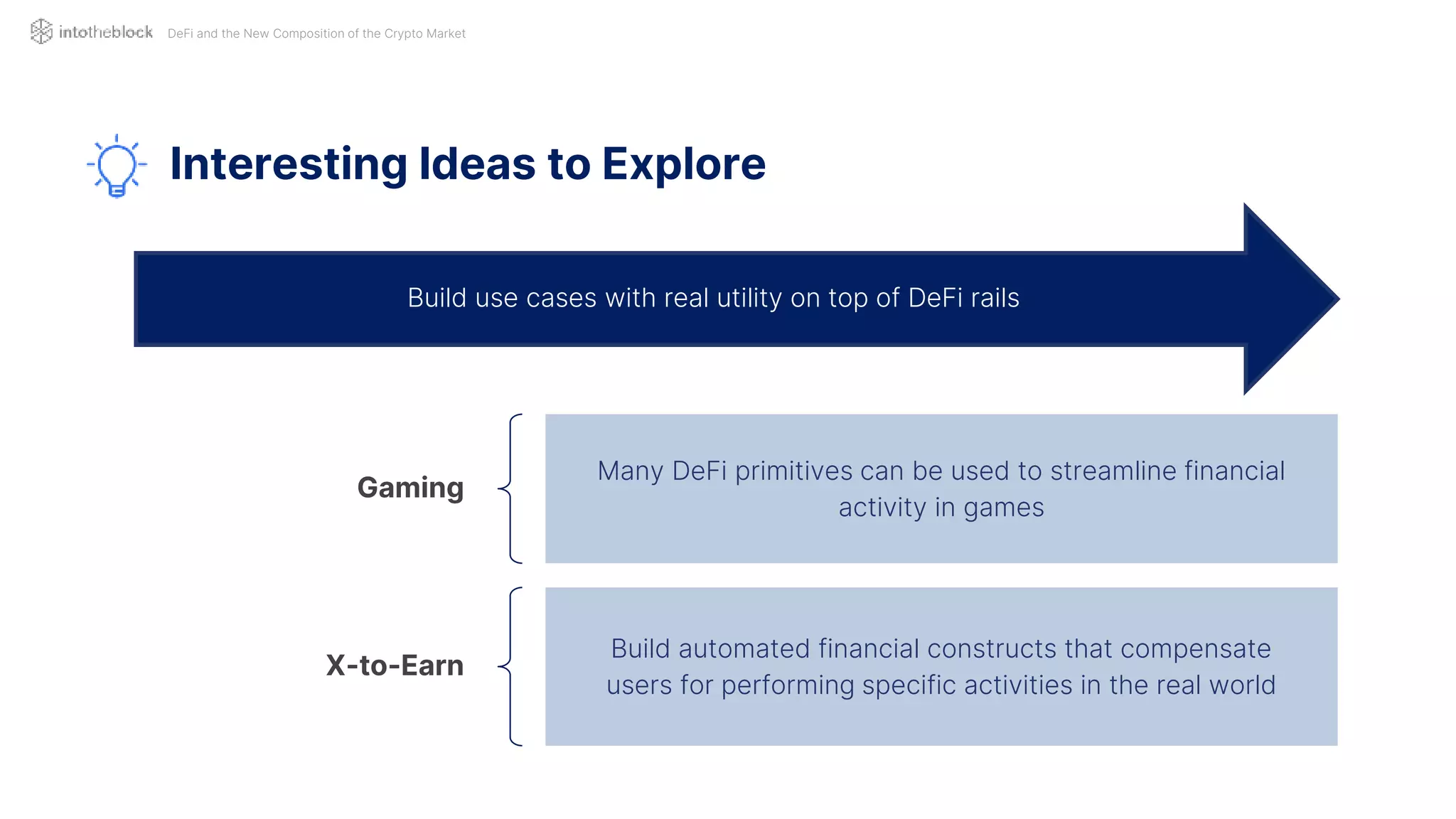

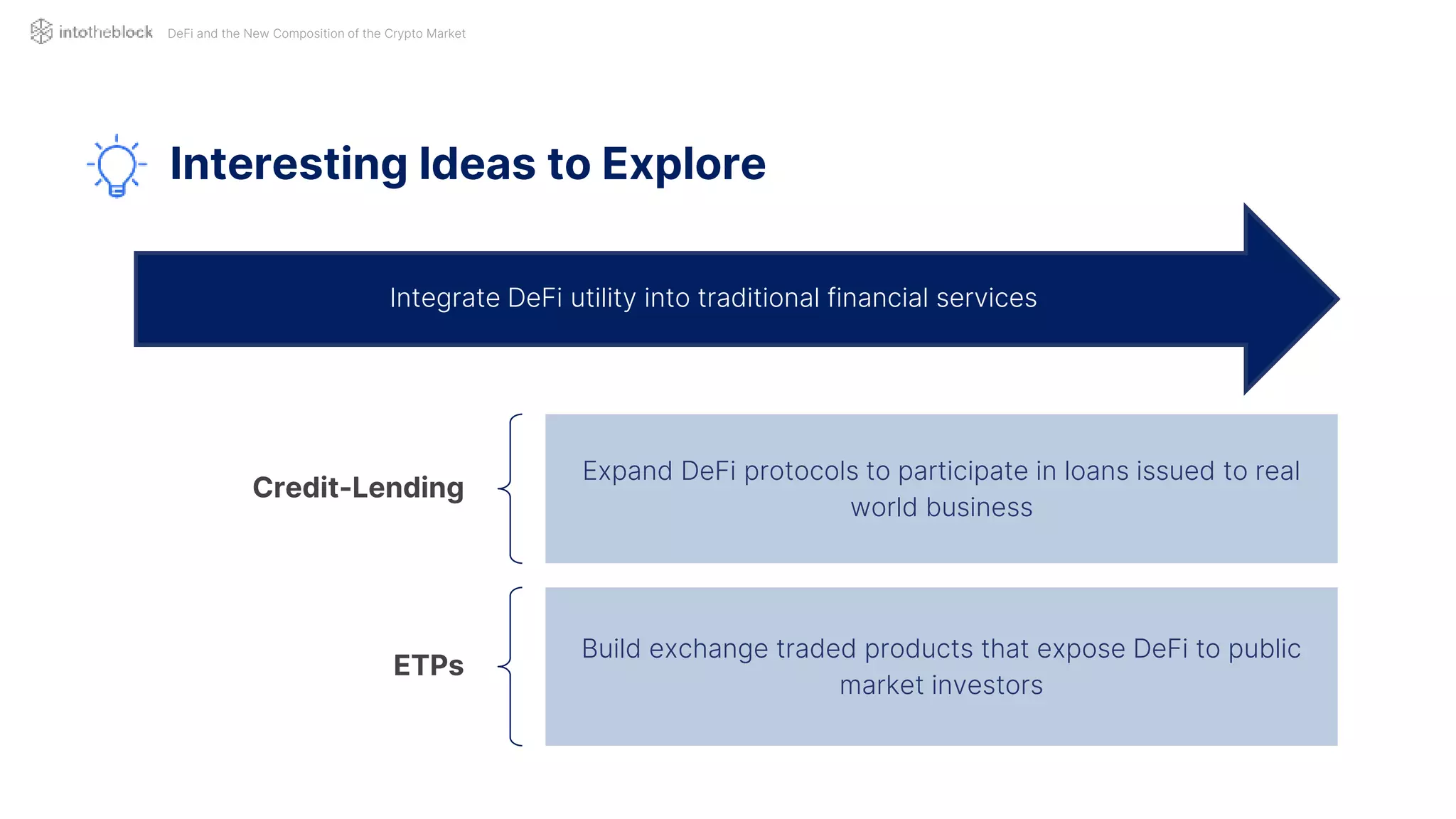

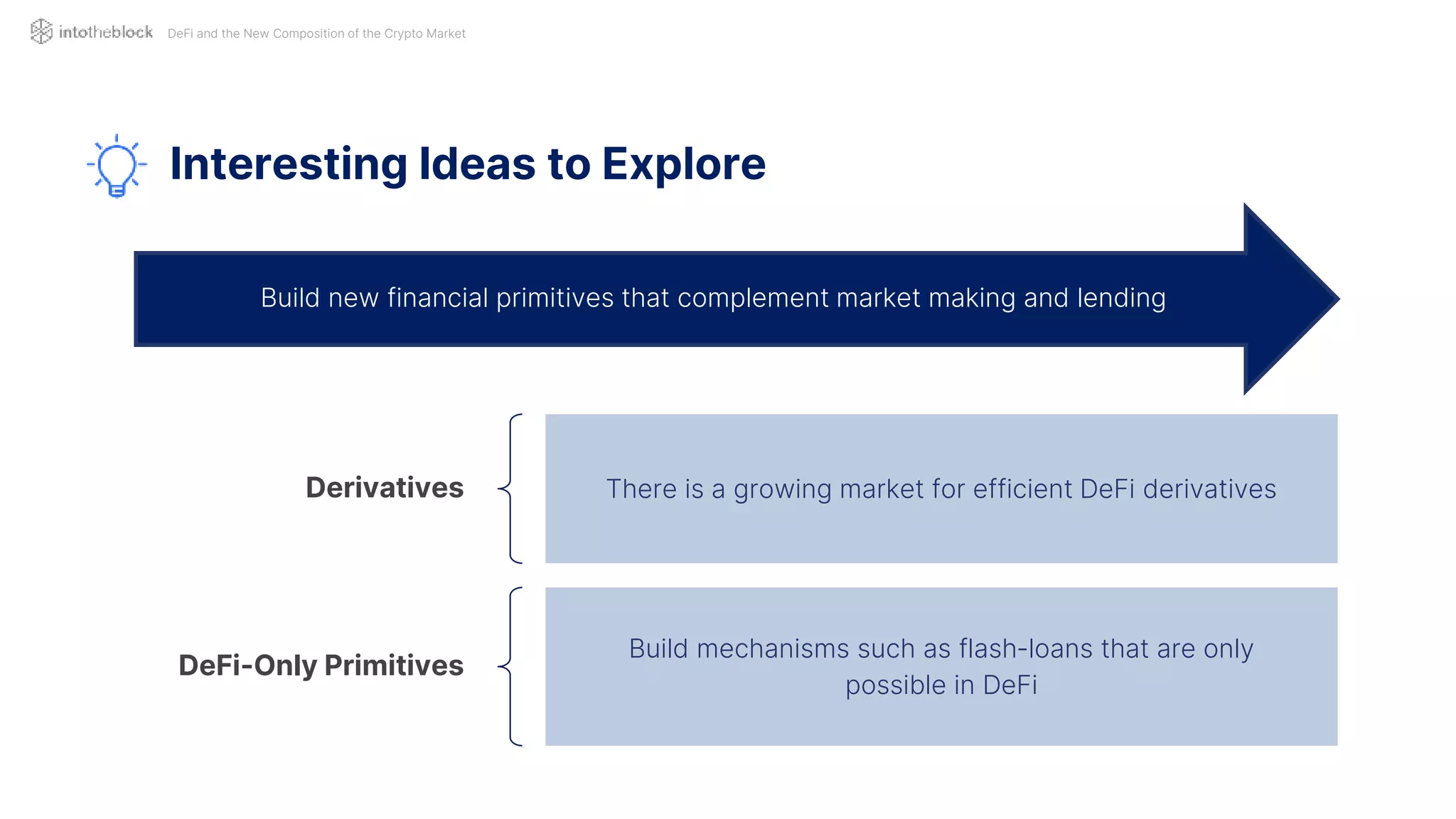

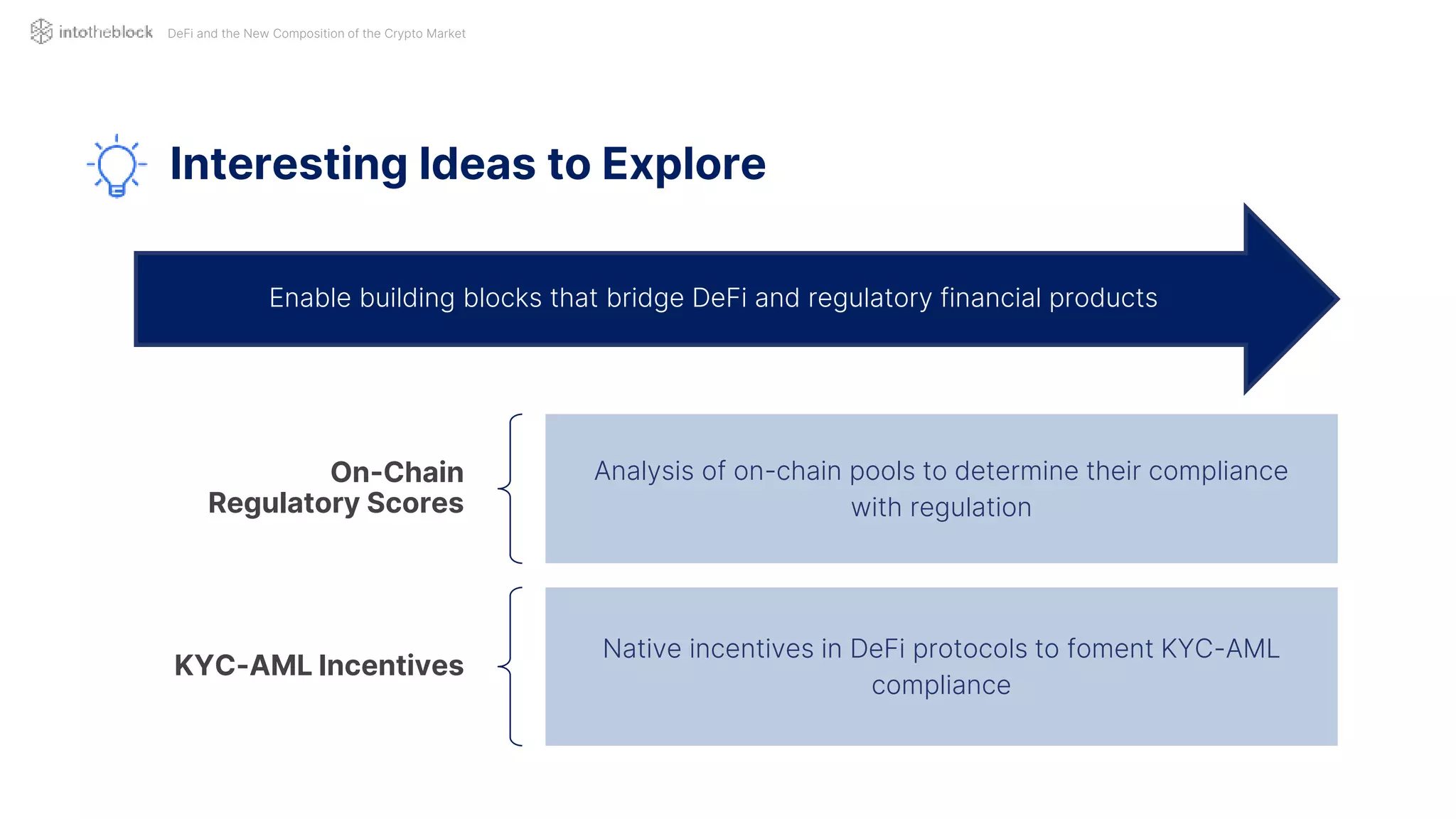

The document discusses the ongoing dislocation in the crypto market and highlights the opportunities and challenges within the DeFi space. Key areas such as credit solutions, capital efficiency, risk management, and integration with traditional finance present significant prospects for innovation. However, it emphasizes that successful execution of these ideas is critical for DeFi to capitalize on market conditions before the next bull cycle.