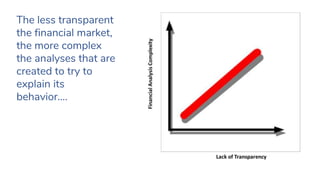

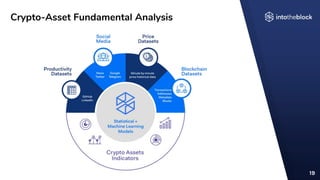

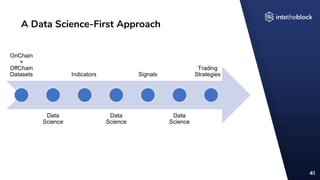

Crypto assets represent a new asset class that necessitates a distinct approach to fundamental analysis due to their unique characteristics, such as public ledgers and data richness. Traditional analytical techniques are insufficient for understanding this complex market, which requires a data science-first perspective for deeper insights. The document emphasizes the importance of integrating blockchain datasets to better analyze and comprehend investor behaviors and market dynamics in the crypto space.