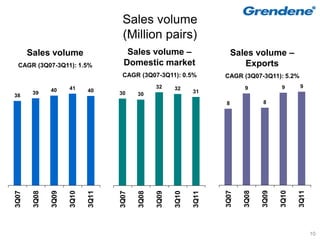

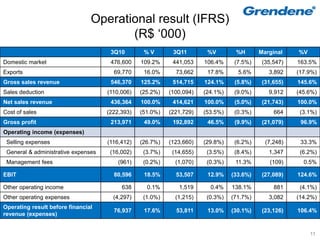

The document reports financial results for 3Q11, with net sales revenue down 9.9% to R$192.9 million due to a 7.5% decline in domestic market sales and gross margin declining to 46.5% from 49% in 3Q10. EBIT was down significantly to R$54 million from R$81 million in 3Q10 due to lower sales volumes and margins. The company cautions that actual results could differ from expectations due to economic conditions and uncertainties in its business.