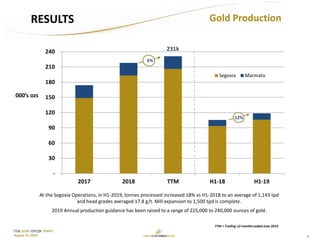

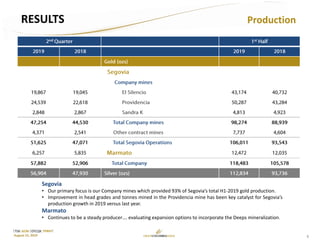

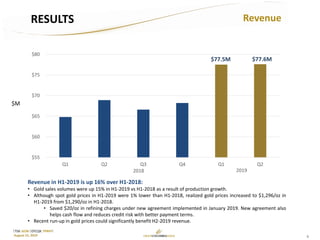

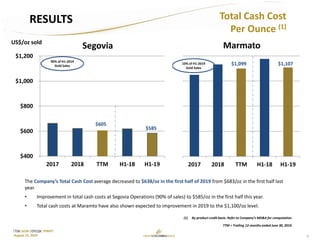

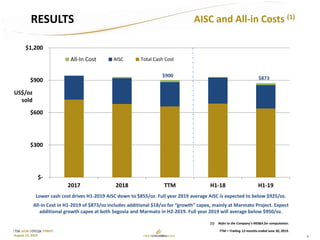

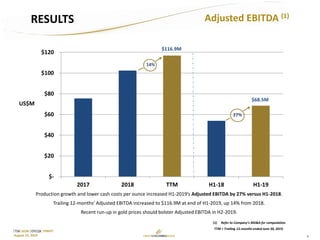

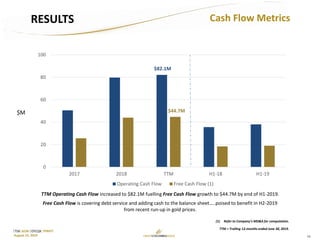

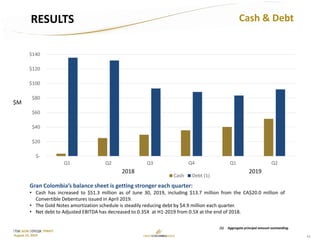

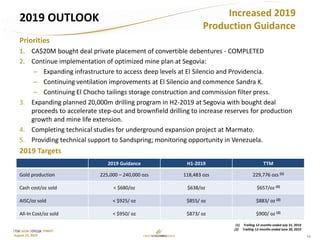

Gran Colombia Gold reported its financial results for the second quarter of 2019, highlighting increased production and lower costs compared to the same period last year. Gold production at its Segovia Operations increased 18% year-over-year to over 1,143 tonnes per day. Total cash costs per ounce decreased to $638, driving the company's all-in sustaining costs down to $855 per ounce. For the full year 2019, Gran Colombia has increased its gold production guidance to between 225,000 to 240,000 ounces and expects average all-in sustaining costs to remain below $925 per ounce.