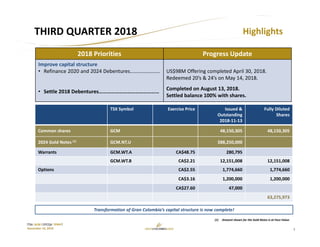

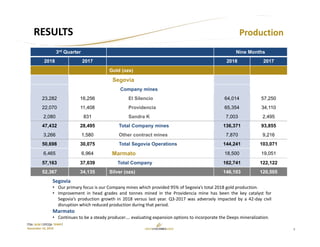

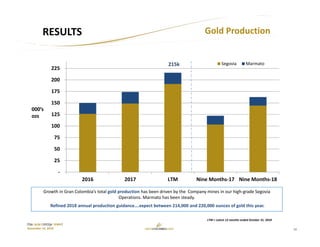

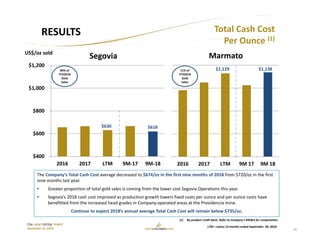

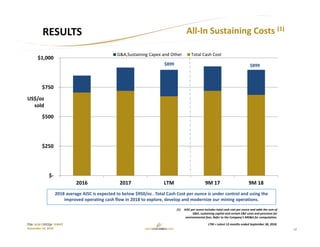

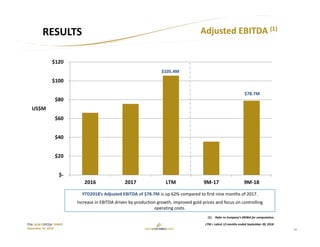

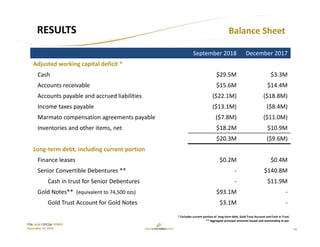

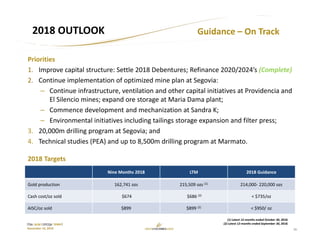

Gran Colombia Gold reported financial and operating results for the third quarter of 2018. Gold production increased to 57,163 ounces, up 54% compared to the third quarter of 2017. Revenue for the quarter was $66.6 million, an increase of 56% year-over-year. Cash costs per ounce averaged $657 for the quarter, a decrease from $748 in Q3 2017. For the first nine months of 2018, gold production totaled 162,741 ounces with revenue of $200.3 million and cash costs averaging $674 per ounce. Gran Colombia is on track to meet its 2018 annual production guidance of between 214,000 to 220,000 ounces of gold.