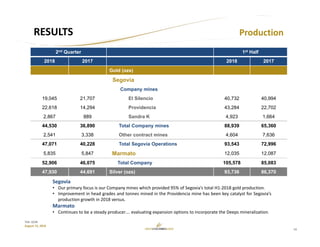

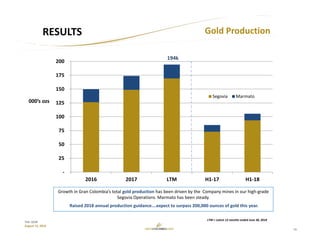

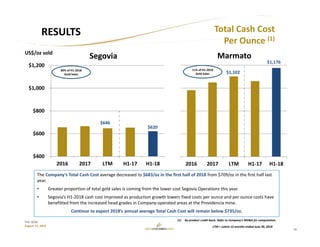

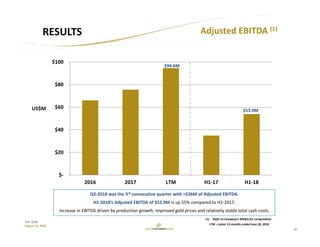

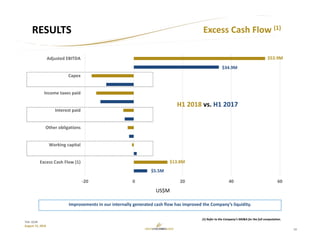

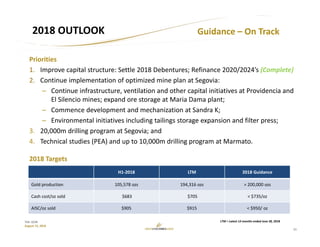

Gran Colombia Gold reported its Q2-2018 results, highlighting:

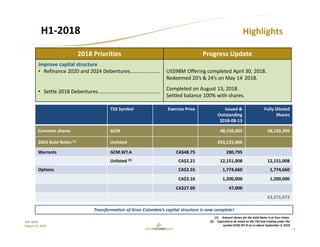

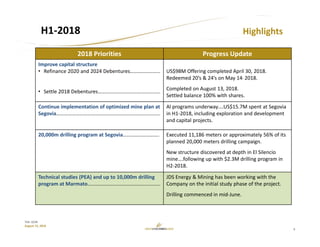

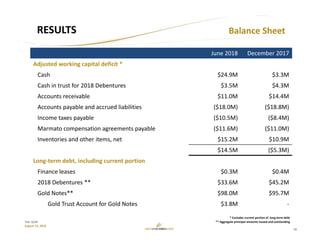

- Transformation of its capital structure is now complete after refinancing debt and settling debentures.

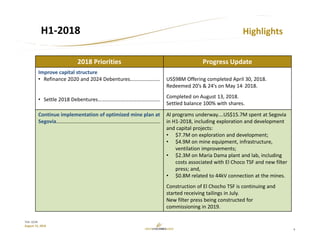

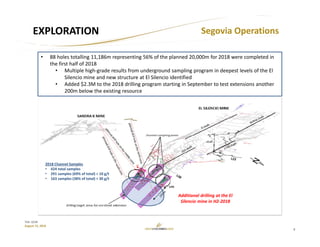

- $15.7 million spent at its Segovia operations in H1-2018 on exploration, development, and capital projects.

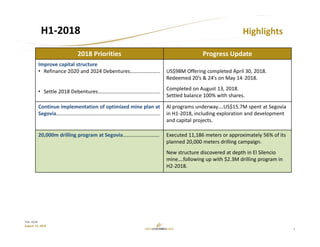

- Drilled 11,186 meters of its planned 20,000 meter drilling campaign at Segovia, discovering a new structure at depth in the El Silencio mine.

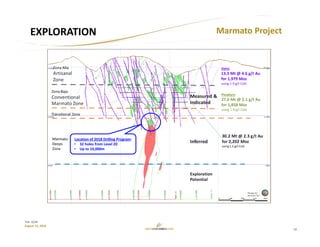

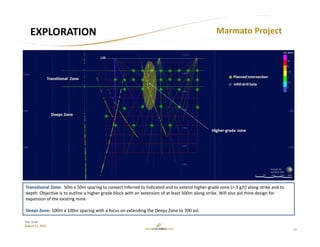

- Technical studies and up to 10,000 meters of drilling underway at its Marmato project.

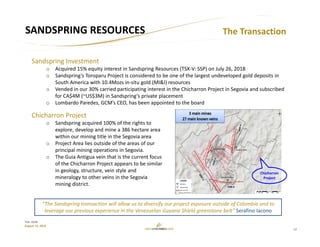

- Acquired a 15% equity interest in Sandspring Resources, whose Toroparu project hosts 10.4 million ounces of