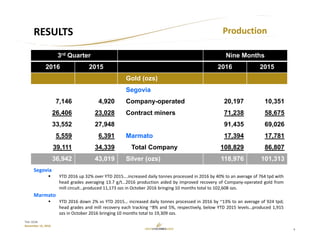

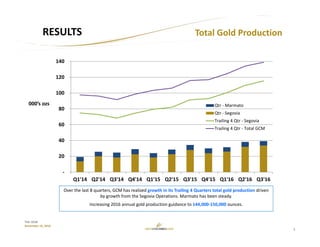

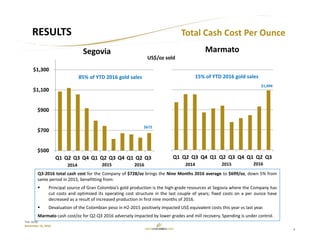

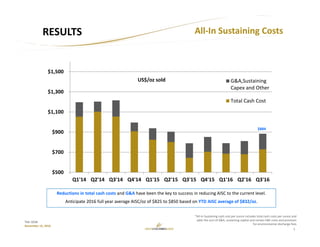

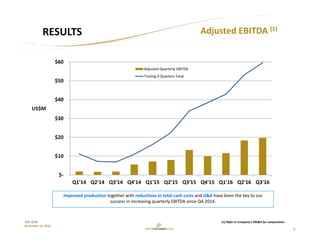

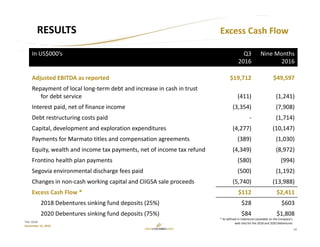

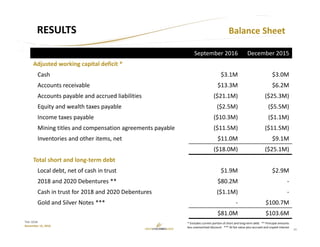

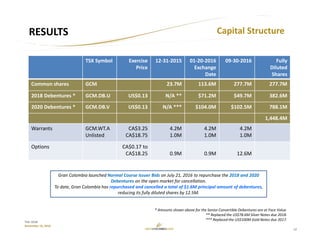

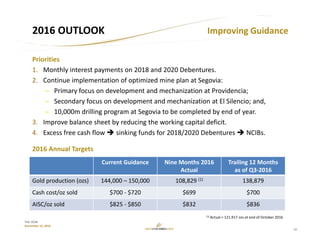

Gran Colombia Gold reported its third quarter 2016 results, with gold production of 39,111 ounces. Year-to-date gold production was 108,829 ounces, up from 86,807 ounces in the same period of 2015. Cash costs per ounce decreased to $728 for the quarter and $699 year-to-date. The company expects full year gold production of 144,000 to 150,000 ounces and average AISC of $825 to $850 per ounce. Gran Colombia also improved its balance sheet by replacing its senior notes with new convertible debentures.