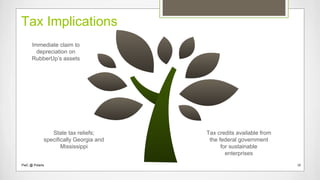

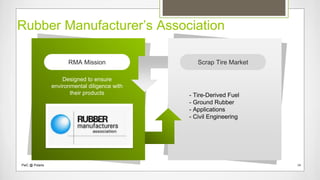

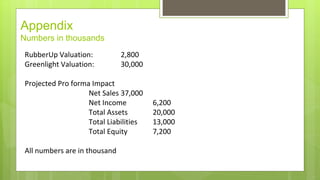

PwC provides a sustainability strategy and solution for Polaris to address discovered tire waste in wetlands and rebuild its public image. The solution involves Polaris purchasing 80% of RubberUp's stock, financed partially with cash and partially with debt. This acquisition would provide established recycling infrastructure and channels while generating revenue to fund marketing and research to further sustainability goals. Short-term initiatives include joining a recycling association, a marketing campaign, and increasing research funding. PwC's due diligence and financing guidance would support a tax-advantaged acquisition.