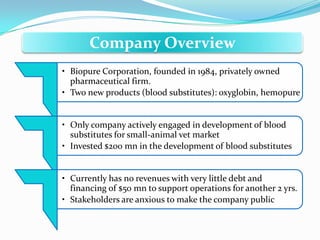

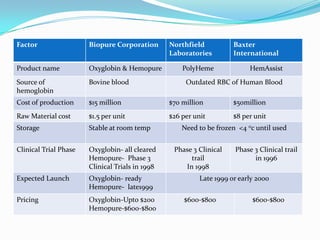

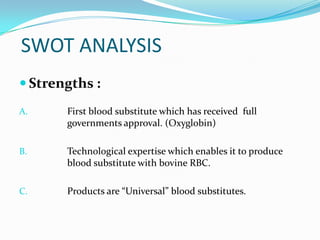

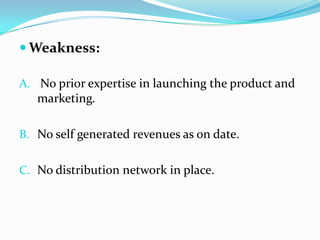

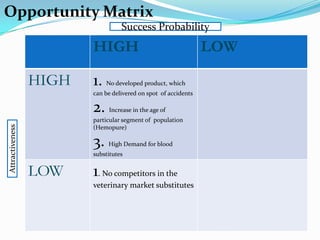

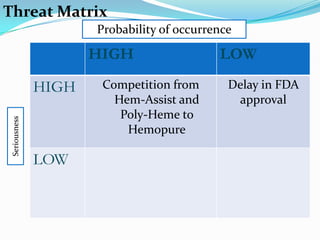

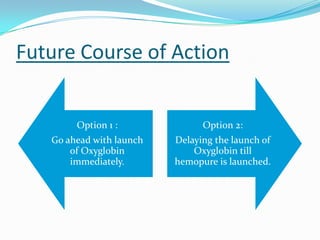

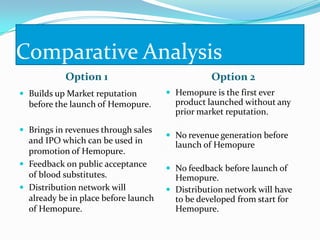

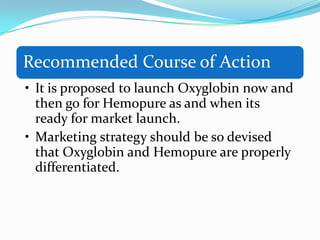

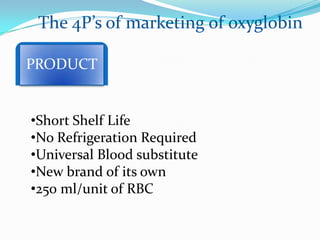

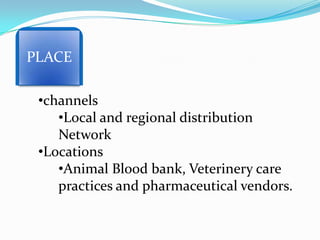

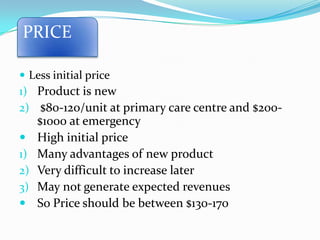

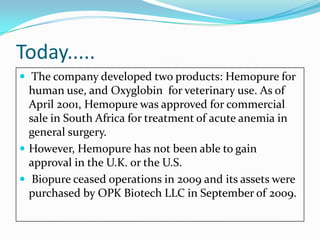

Biopure Corporation is a pharmaceutical firm that has invested $200 million developing two blood substitute products - Oxyglobin for the veterinary market and Hemopure for human use. While Hemopure is still in Phase 3 trials, Oxyglobin has received all necessary approvals. The company currently has no revenue but $50 million in financing. It is recommended that Biopure launch Oxyglobin now to generate revenue and build distribution networks to support the future launch of Hemopure, once it gains FDA approval.