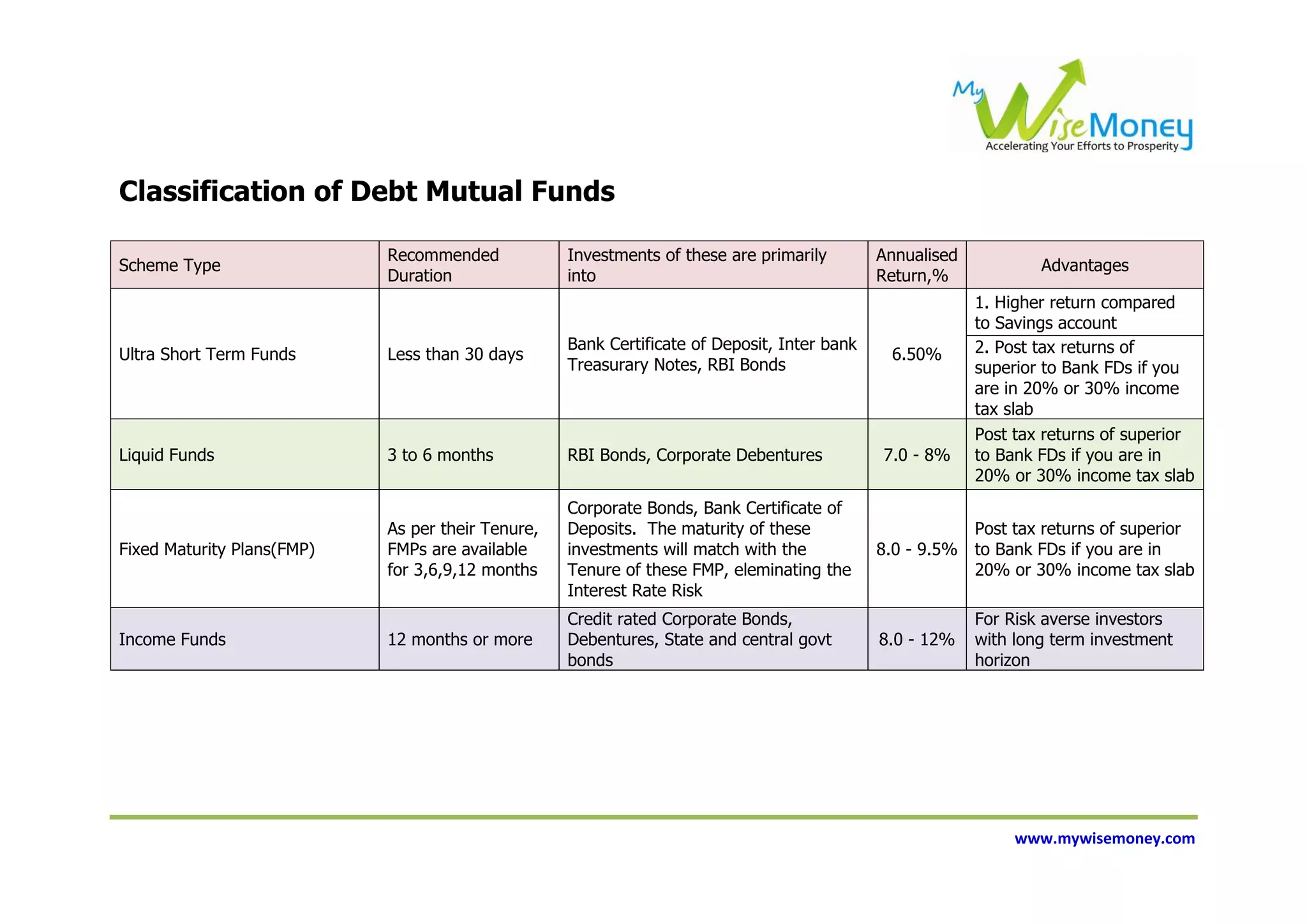

The document outlines the classification and recommended investments for debt mutual funds, highlighting their advantages such as higher returns compared to savings accounts and bank fixed deposits. It discusses post-tax returns for various types of funds based on different income tax slabs and investment tenures. Additionally, it suggests suitable options for risk-averse investors looking for fixed maturity plans and income funds.