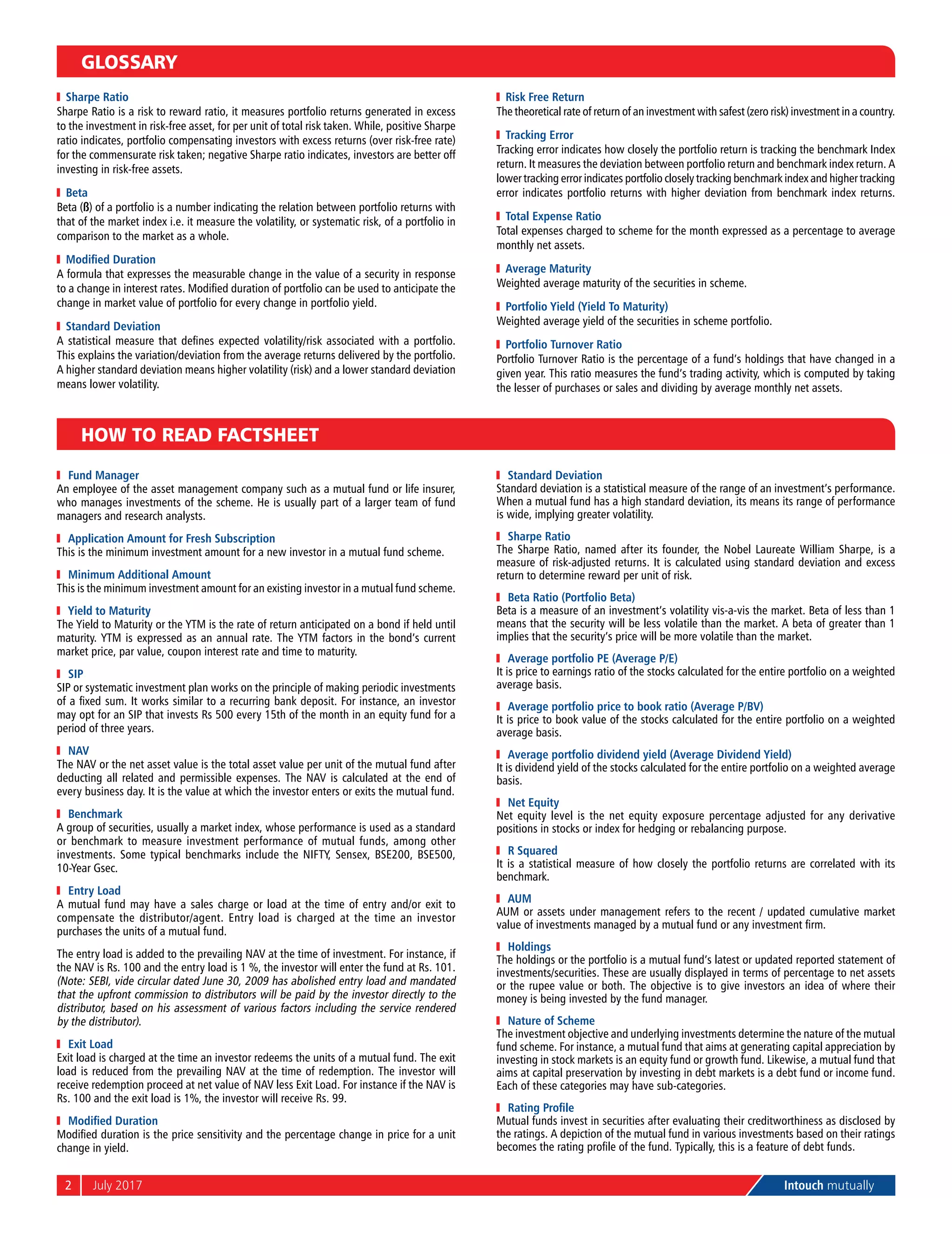

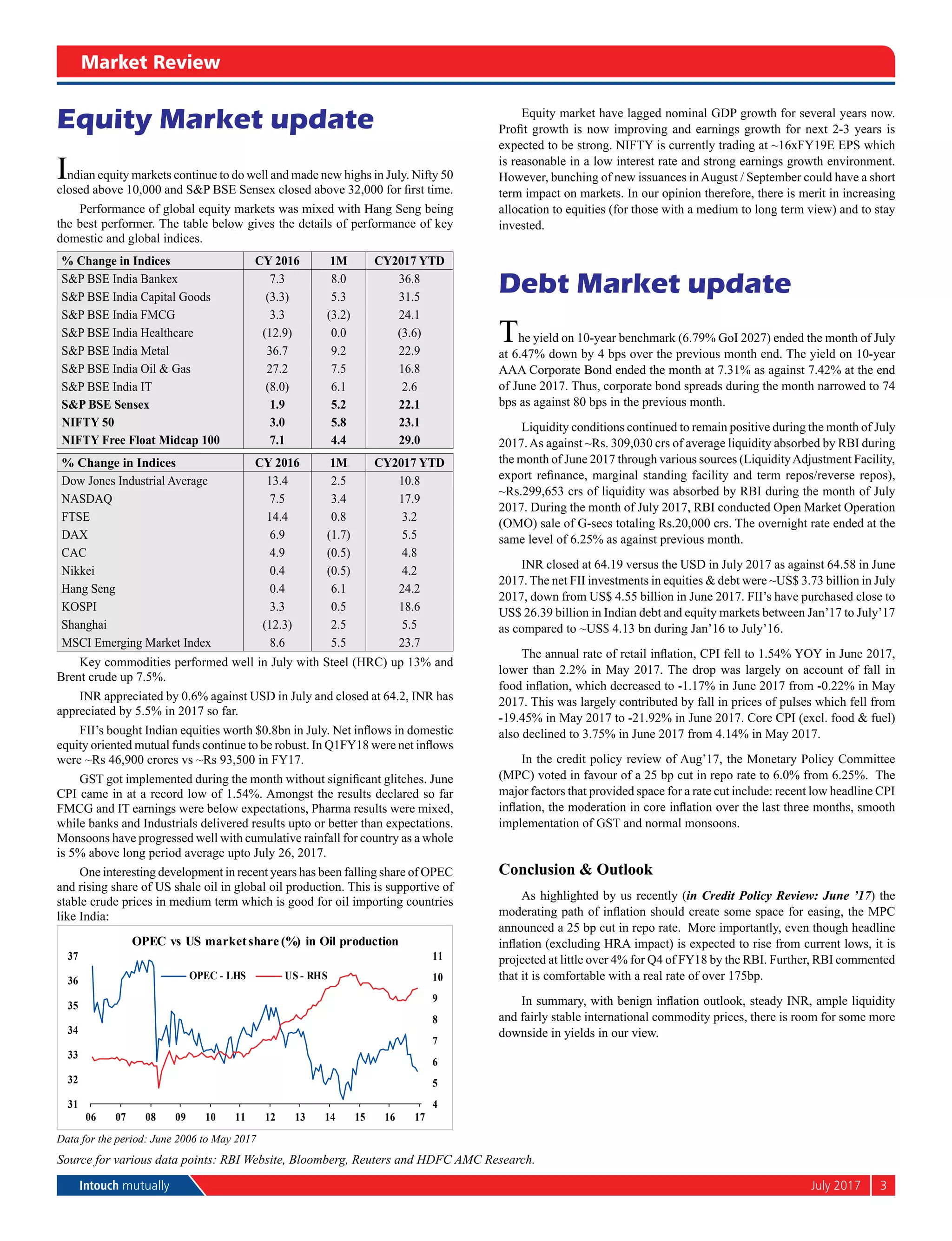

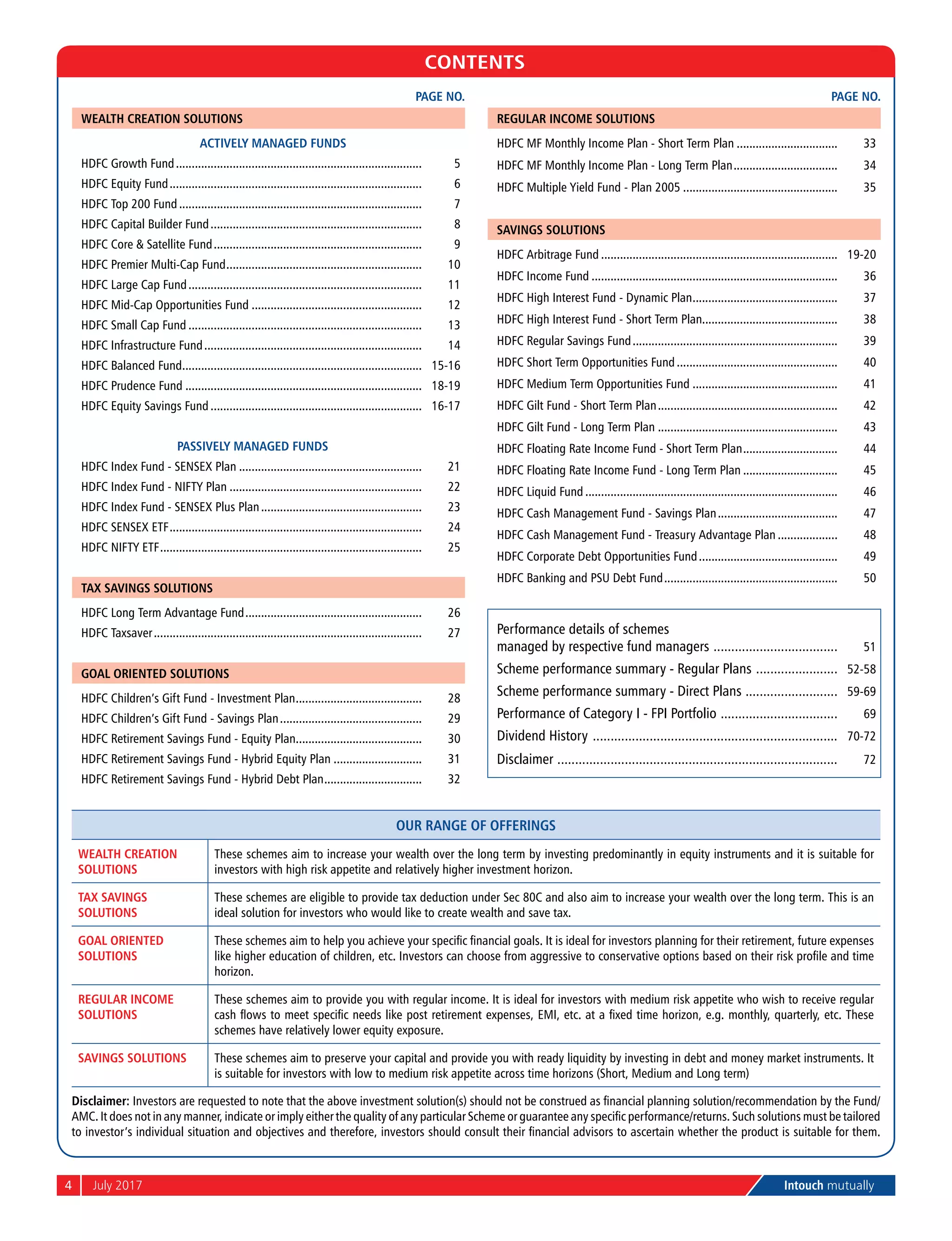

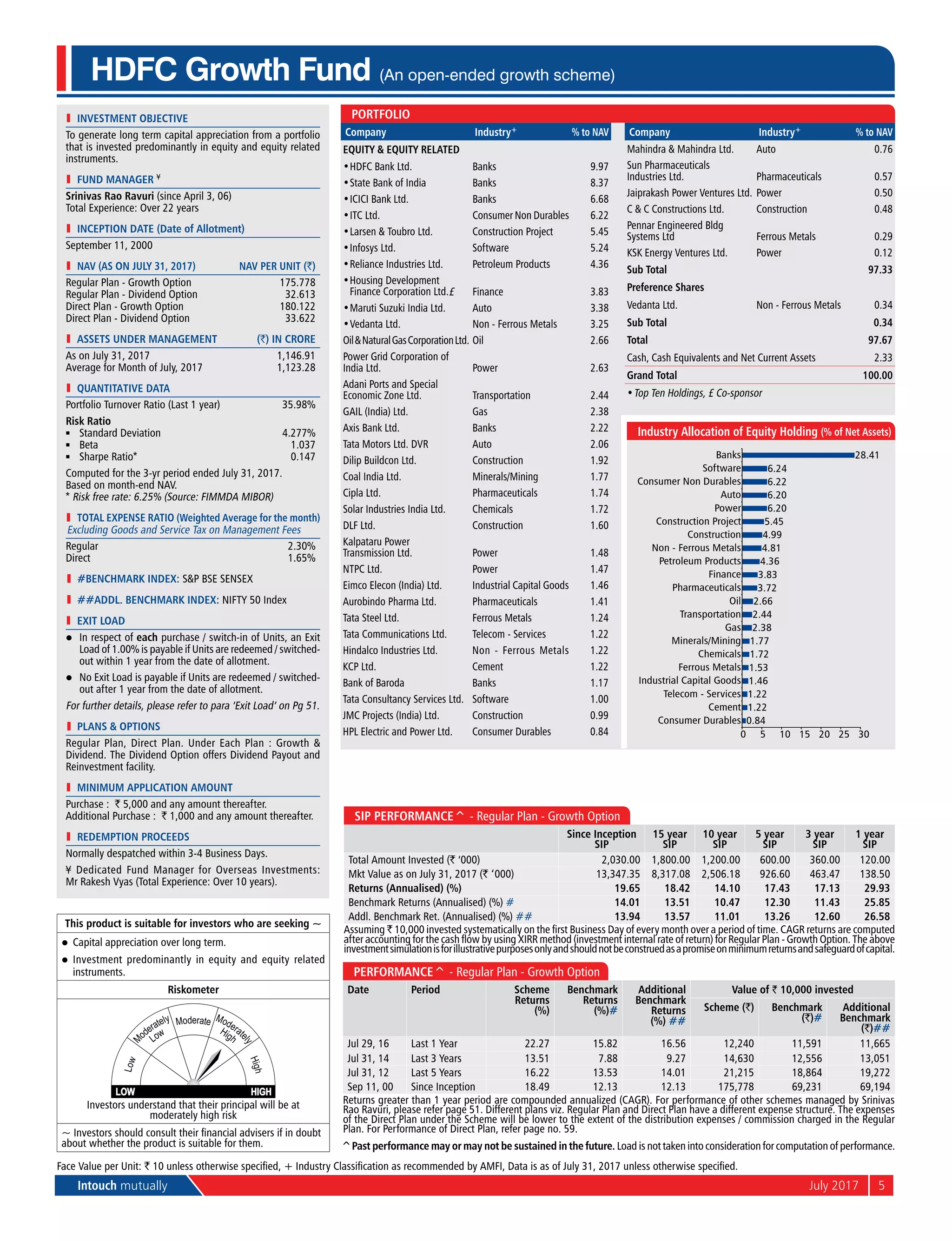

The document outlines various concepts related to mutual funds, including definitions of key terms like fund manager, yield to maturity, net asset value, and systematic investment plans. It also provides a review of the Indian equity market and highlights performance metrics for both domestic and global indices as of July 2017. Additionally, the document discusses debt market conditions, liquidity, inflation trends, and concludes with an outlook on interest rates and securities investment opportunities.