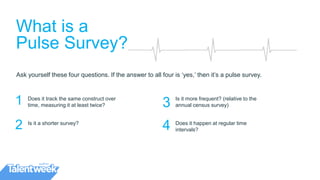

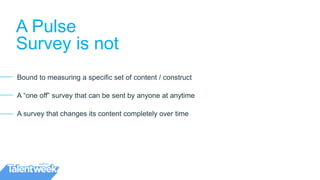

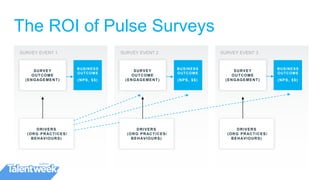

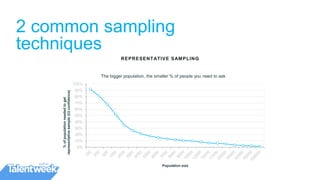

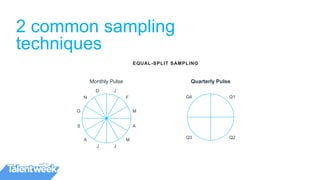

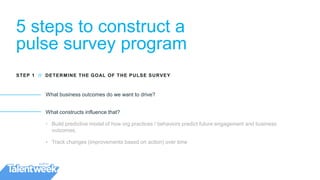

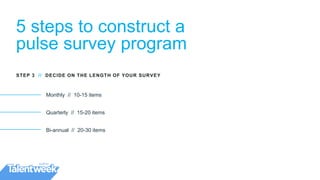

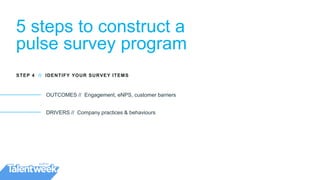

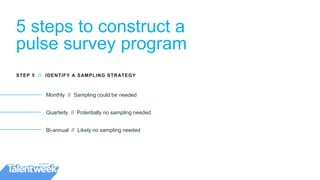

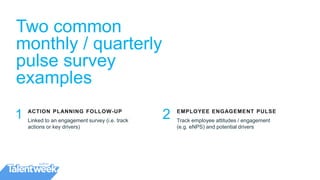

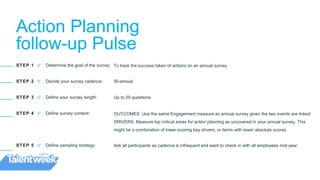

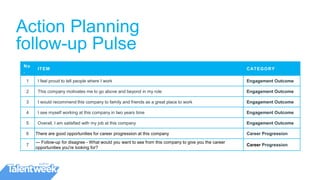

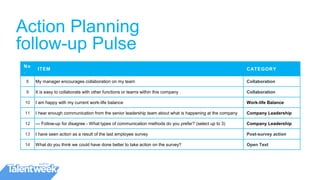

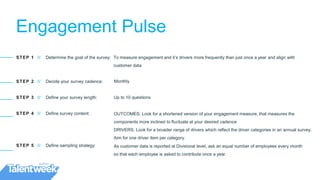

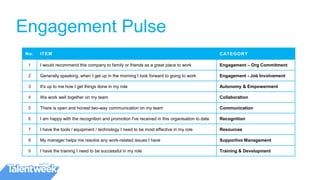

This document discusses pulse surveys, which are shorter, more frequent surveys that track the same constructs over time to measure changes. The presentation discusses why organizations conduct pulse surveys, considerations for their design such as length, cadence and sampling, and how to construct an effective pulse survey program. Two common examples of pulse surveys are presented: an action planning follow-up survey to track progress on issues identified in an annual survey, and an engagement pulse survey to measure employee attitudes more regularly than annually.