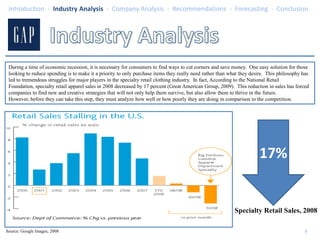

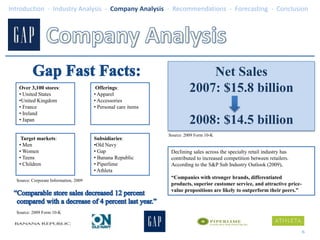

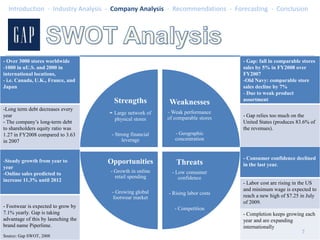

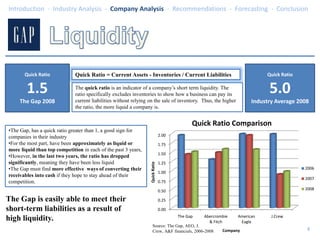

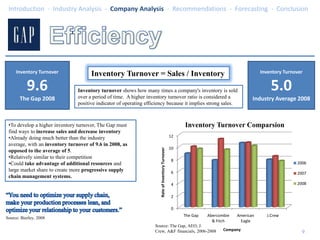

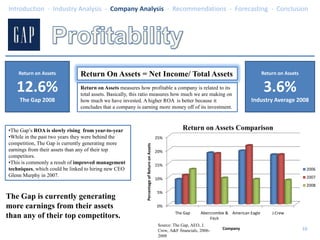

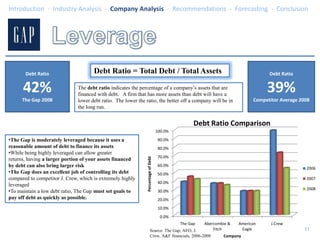

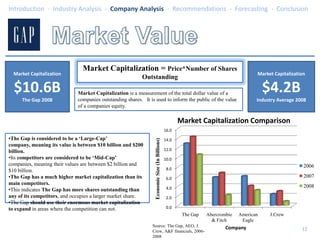

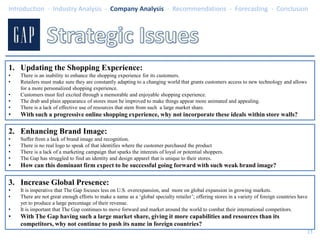

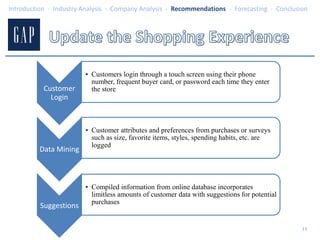

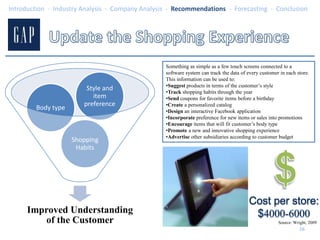

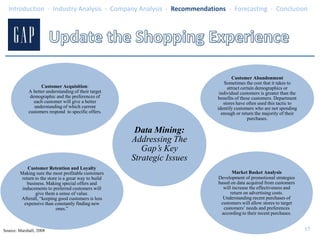

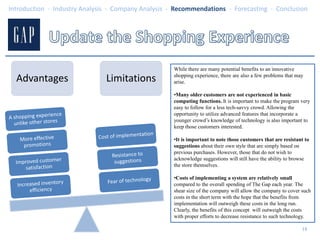

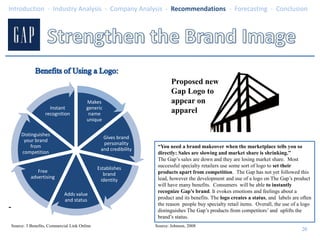

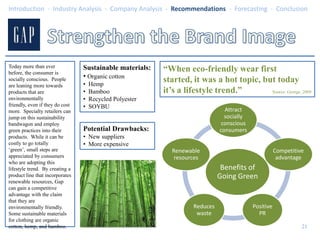

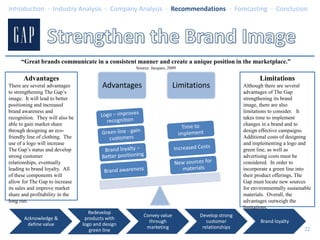

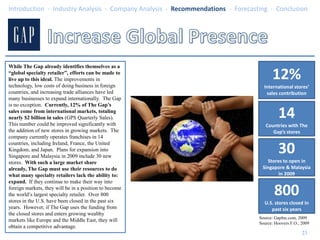

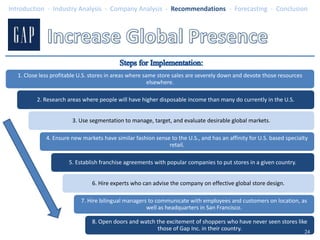

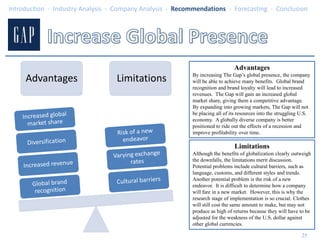

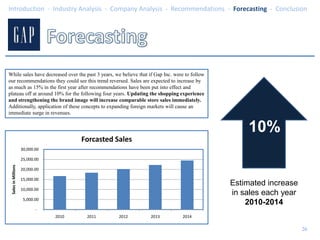

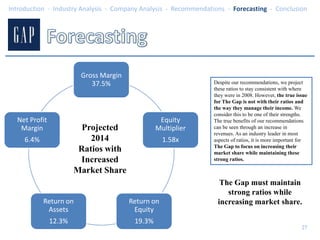

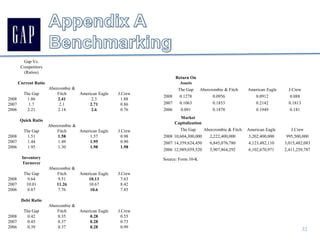

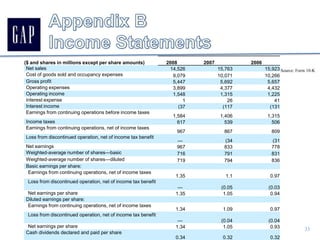

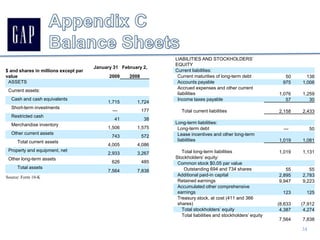

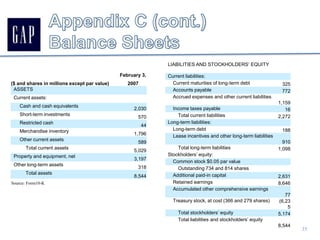

The document discusses the challenges faced by Gap Inc. due to the recent economic downturn, highlighting the need for the company to adapt strategies such as enhancing shopping experiences, strengthening brand image, and increasing global presence to maintain market competitiveness. Financial analyses indicate areas of potential improvement, especially in liquidity, profitability, and inventory turnover. By leveraging its resources and implementing innovative marketing and operational strategies, Gap aims to regain its status as a leading specialty retailer.