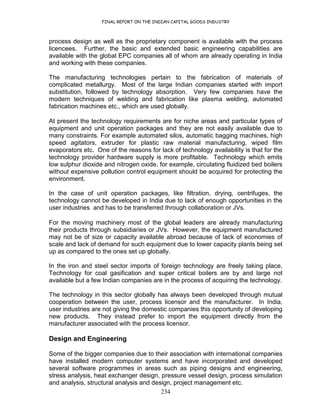

This document provides a summary of the process plant equipment industry in India. It discusses the background and historical trends of the industry, including its establishment and growth. It then discusses international trends in heavy engineering and shifts in manufacturing bases. Current status of the Indian industry is also examined, including major companies, products, market shares and the structure of the sector. The industry is projected to potentially consolidate in the future as smaller players may act as sub-contractors to larger companies.

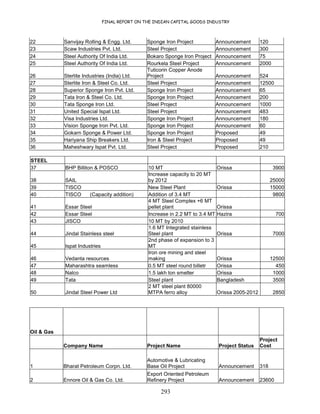

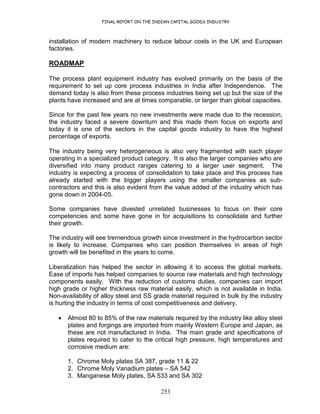

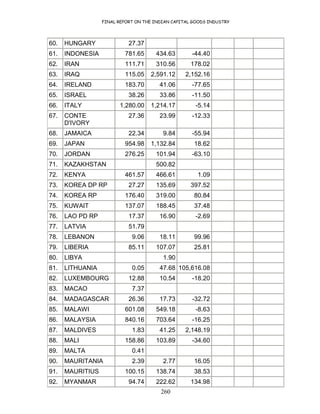

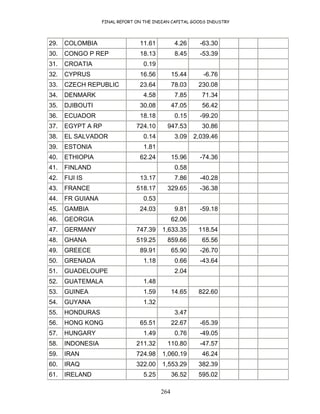

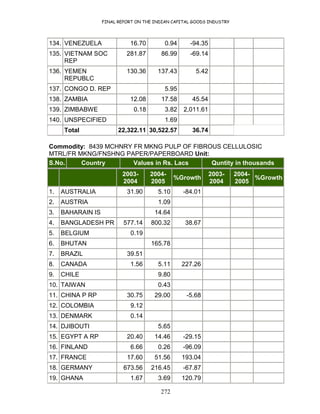

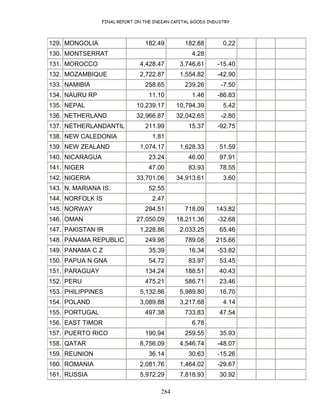

![FINAL REPORT ON THE INDIAN CAPITAL GOODS INDUSTRY

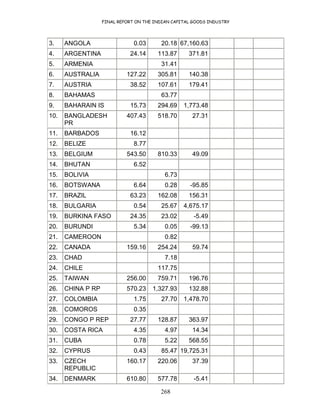

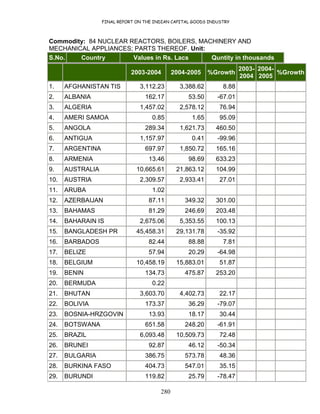

289

Authorizer

Home

Country

Description

of Projects

Capacity Host Country

Projected

Amount

(Rs.Crores)

[1 USD=

Rs45.27] and

1 RAND =

RS.6.78 and

1 EURO =

Rs 53.65

Date of

Expiry

Funding

Authority

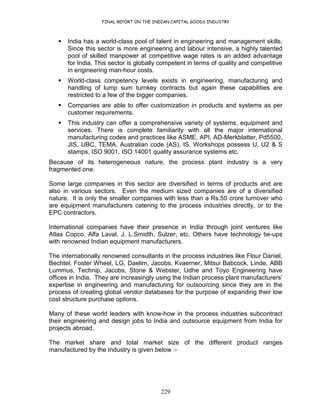

1

Minera

Escondida Australia

Building a cathode

copper plant Chile 3938.49

2

South African

Government

& Industrial

Development

Corporation

South

Africa

Construction of a

greenfield plant as

part of its mineral

beneficiation strategy South Africa 18984

3

Maritsa East

2 Bulgaria

Maritsa East II Supply

and Installation of

plant and Equipment

project Bulgaria 478.77 EBRD

4 Cameroon

Construction of

Infrastructure for

Petroleum Industry

Project Cameroon 289.72 AFDB

5

Lukoil

Overseas Azerbaijan

Lukagip-Shas Deniz

Gas condensate field

development project Azerbaijan 497.97 EBRD

6

Huntsman

Corporation Europe

Expanding capacity of

plant from 130 mnpa

pounds to 990 mnpa

990mnpa

Geismar

7

Huntsman

Corporation Europe

Expanding capacity of

plant from 220 mnpa

pounds to 880 mnpa

880mnpa

Rozenburg

8

Sempra

Energy Europe

Salt Cavern natural

gas storage facility Louisiana End 2006

9

Black &

Veatch led

consortium Mexico

Construction of LNG

terminal

160,000

cu.m

Mexico 2008

10

Suncor

Energy

USA Build third oil sand

upgrader America

Will begin

in 2007

11

Jacobs

Engineering

Group

USA Ultra Low Sulphur

Diesel Project Washington 339.52 End 2006

12

Flour

Corporation

USA

Refinery Project End 2006

13 Skanska

USA

Refinery Project Brazil 692.63 2007

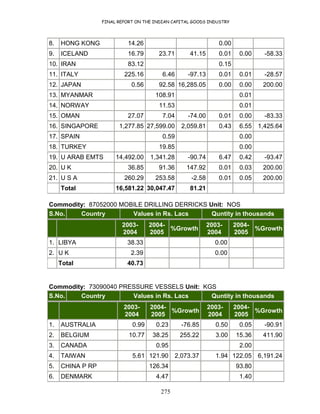

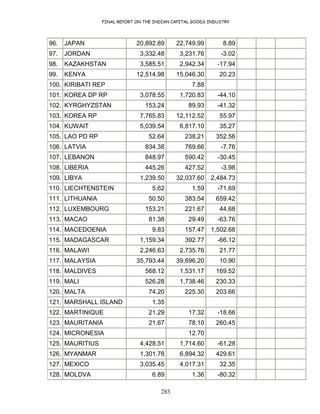

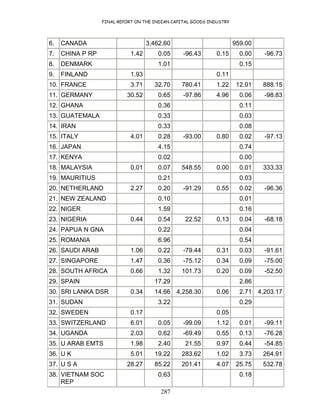

PROCESS PLANT PROJECTS ANNEXURE-X

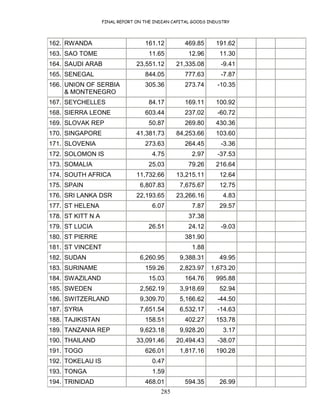

OVERSEAS](https://image.slidesharecdn.com/processplantequipment-130815055215-phpapp01/85/Process-plant-equipment-65-320.jpg)

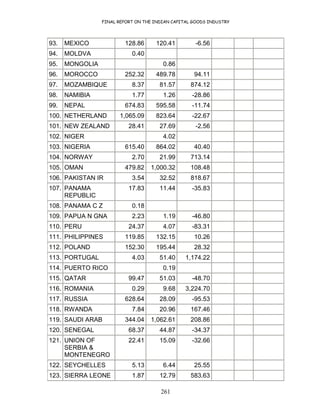

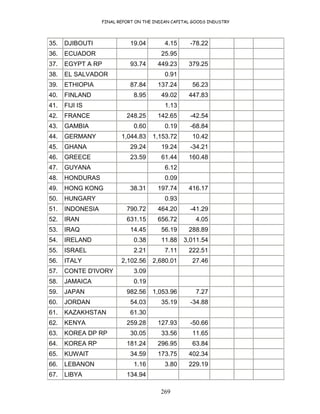

![FINAL REPORT ON THE INDIAN CAPITAL GOODS INDUSTRY

290

Authorizer Home

Country

Description of

Projects

Capacity Host

Country

Projected

Amount

(Rs.Crores)

[1 USD=

Rs45.27]

and 1

RAND =

RS.6.78

and 1

EURO =

Rs 53.65

Date of

Expiry

Fundi

ng

Auth

ority

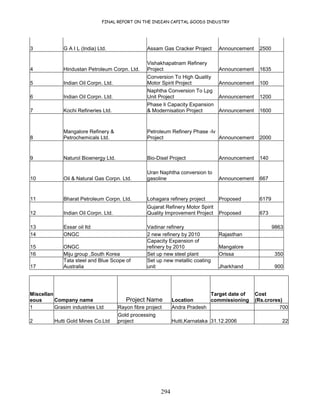

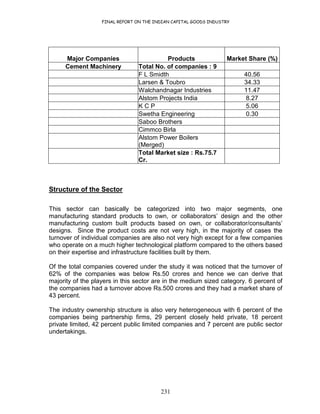

17 Technip America Refinery Project America

End

2006

18

Oman Oil

Company Middle East Refinery project

3000

metric

ton per

day Oman

End

2008

19

Snamproget

ti Middle East Refinery project

24400

tons/day

of NGL UAE 6473.61 2008

20 BP Indonesia LNG Project

Indonesi

a 22635 2007

21

Aker

Kvaerner Netherlands

New Polythylene

plant

400,000

tpa China 2008

22

Foster

Wheeler Australia LNG Project

4.2

mntpa 7152.66 2008

23

Kupe

Limited Australia

New Gas production

station 2007

Posco South Korea Setting up Steel Plant India 54324 2016

Other Global opportunities

EPC activity and

size

Region /

country

Thrust areas Competitive

landscape

Strategy for Indian firms

Refineries:

New capacity

(3.3 mn b/d)

China, Canada,

India, Iran,

Oman, Russia,

Venezuela

• Strategic partnership

with global majors

• Target lower scale

projects

• Strategic alliance with

Indian players owning

oil-fields abroad

Refineries:

Expansion

(271500 b/d)

France, Spain,

Germany, USA

Hydrotreater,

Hydrocracker,

De-sulphurisation

Profitable growth is

expected as new

projects emerge to

meet stricter

domestic regulations

and international

agreements

• Join hands with local

majors

• Target the operations

and maintenance

components of

contracts](https://image.slidesharecdn.com/processplantequipment-130815055215-phpapp01/85/Process-plant-equipment-66-320.jpg)