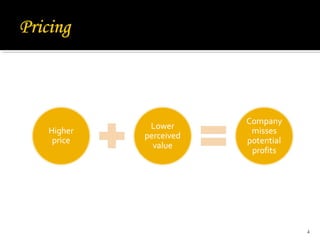

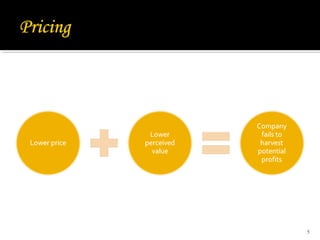

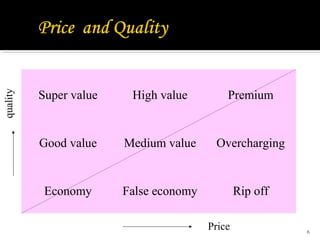

This document discusses pricing strategies and objectives. It outlines the key considerations in setting price, including determining demand, estimating costs, analyzing competitors, and selecting a pricing method. The document notes that companies must first decide on a pricing objective like maximizing profits or market share. It also discusses factors that influence demand elasticity like availability of substitutes. Finally, the document lists several common pricing methods like markup pricing, target-return pricing, and perceived-value pricing that companies can use to determine the final price.