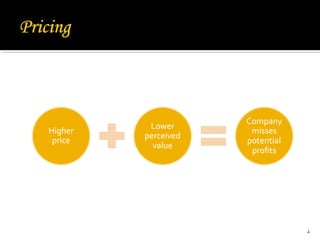

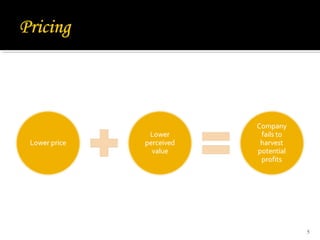

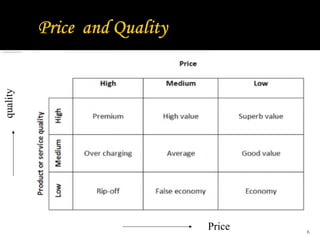

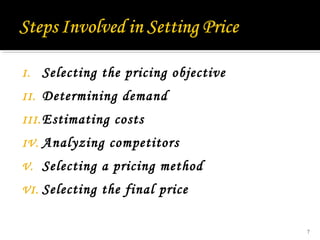

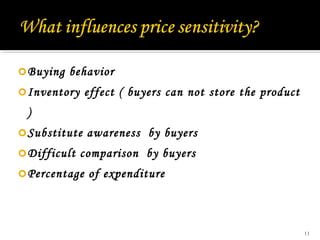

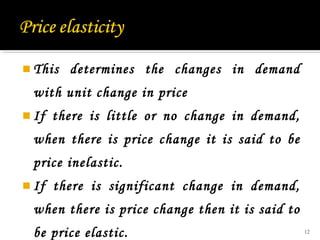

Price is defined as the amount charged by a seller to a buyer for a product or service. A company must set its price based on the value delivered to and perceived by the customer. Setting price involves selecting objectives, determining demand, estimating costs, analyzing competitors, selecting a pricing method, and choosing the final price. Demand and price are inversely related - as price increases, demand decreases. A company must consider price sensitivity and elasticity when setting prices.