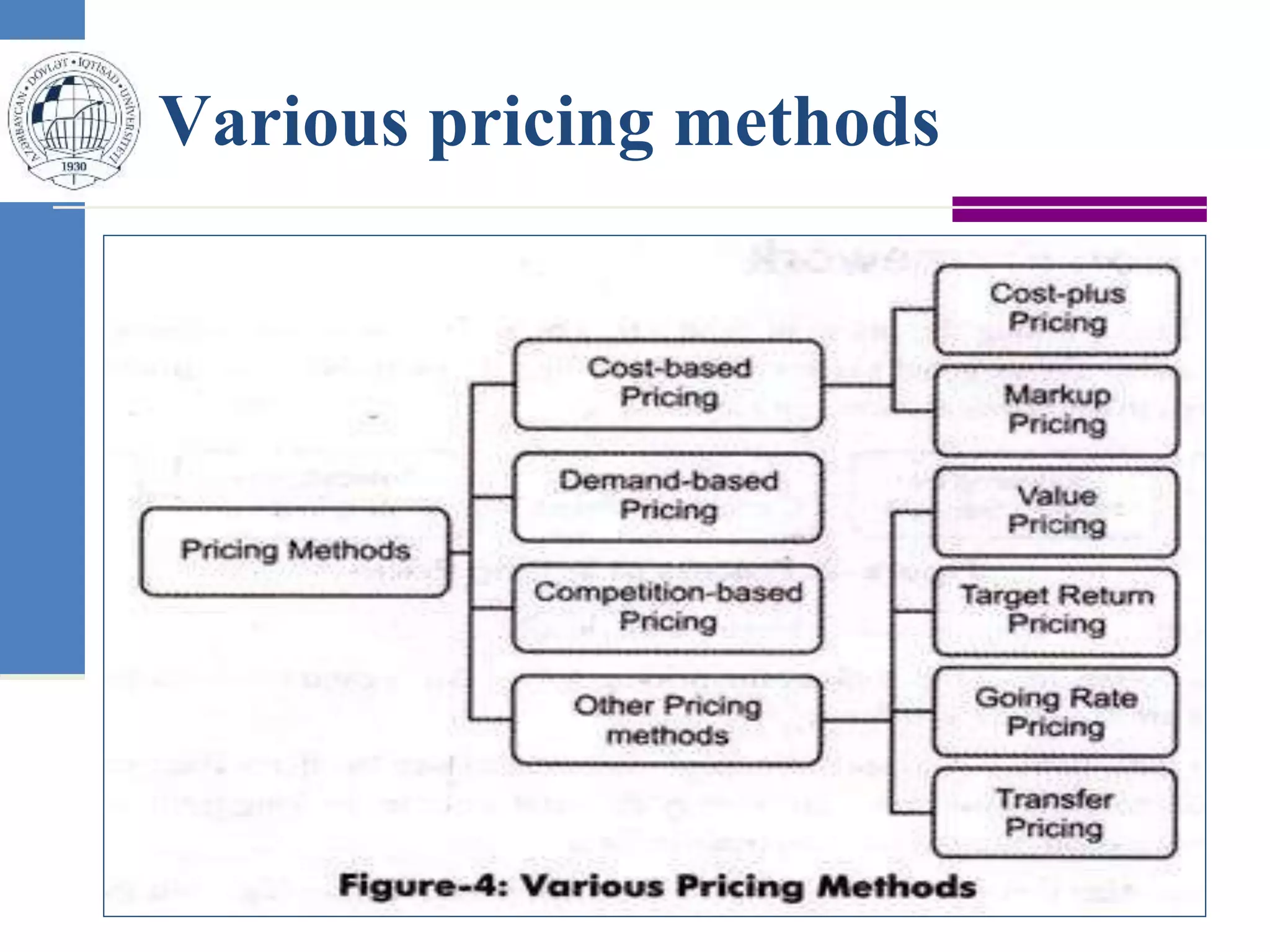

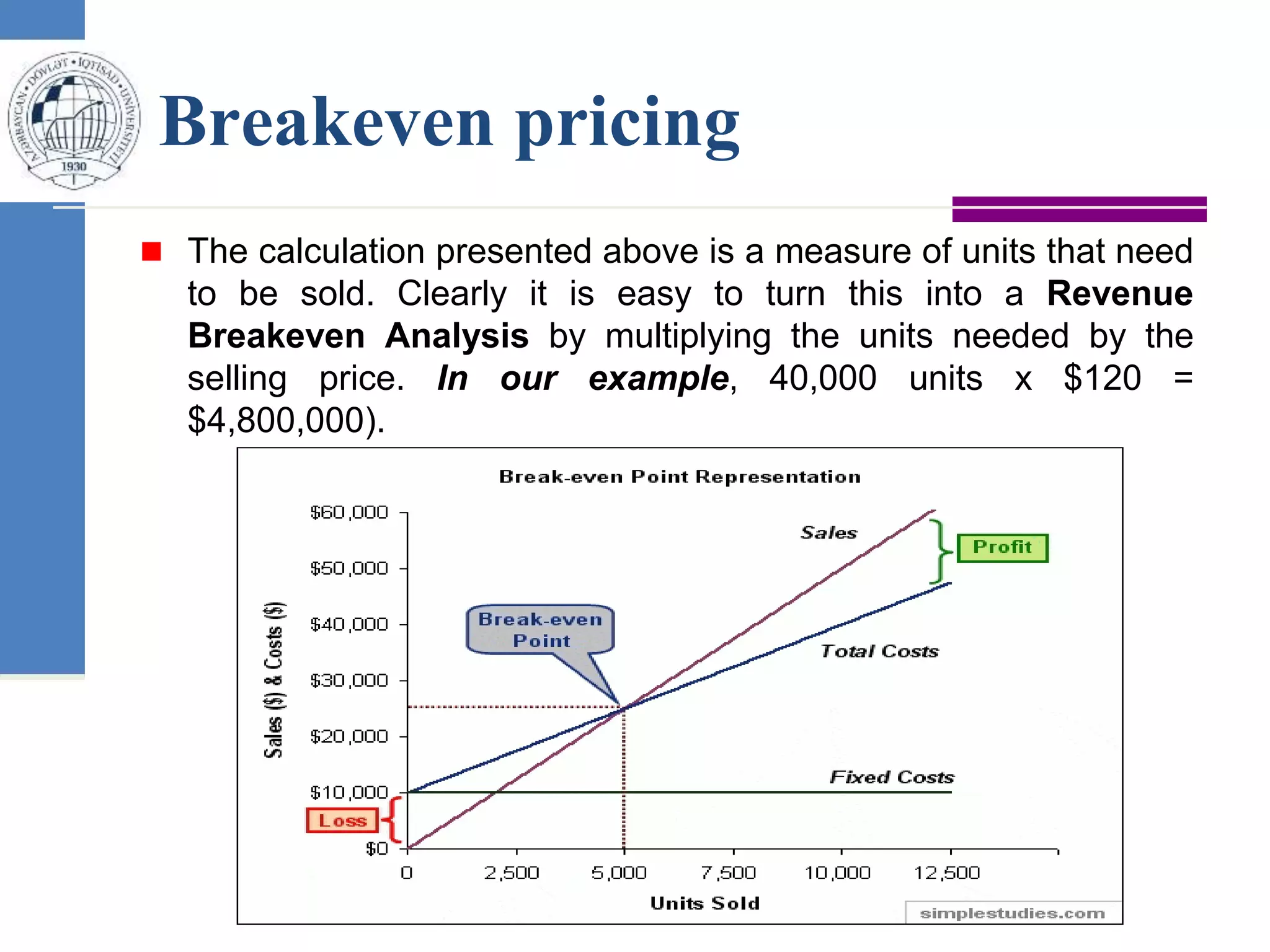

This document discusses various pricing methods used by firms. It covers cost-based methods like cost-plus pricing and mark-up pricing. It also discusses demand-based pricing, competition-based pricing, value pricing, target-return pricing, and breakeven pricing. The document provides examples and explanations of how different pricing methods are calculated and can be applied by organizations.