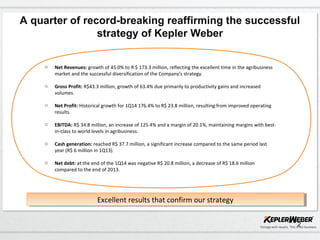

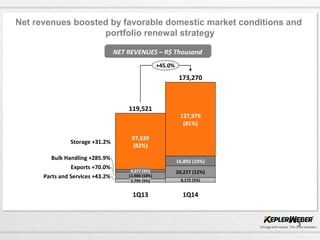

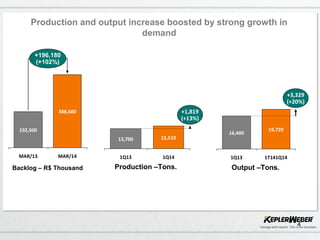

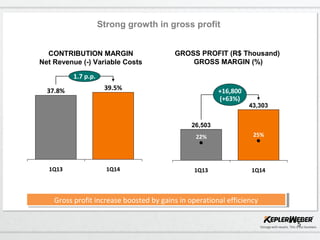

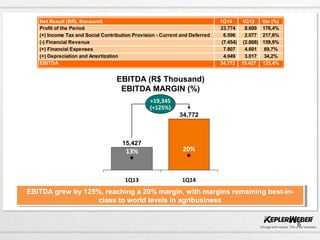

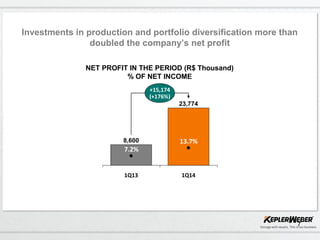

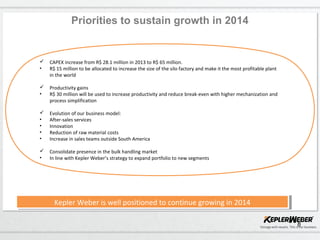

Kepler Weber reported record-breaking results in 1Q14, with net revenues growing 45% to R$173.3 million driven by strong demand in the agribusiness market and portfolio diversification. Net profit more than doubled to R$23.8 million due to improved operating results and productivity gains. EBITDA increased 125% to R$34.8 million with margins remaining best-in-class at 20.1%. The company is well positioned to continue growing in 2014 through investments in production capacity, productivity initiatives, and expanding its business model and market presence.