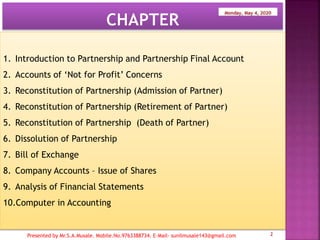

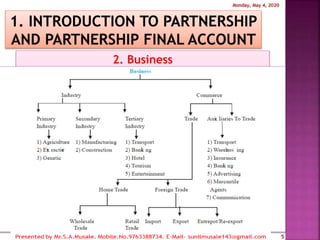

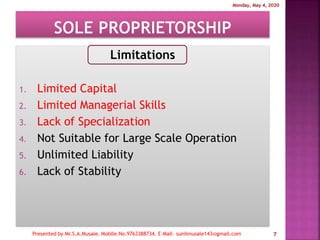

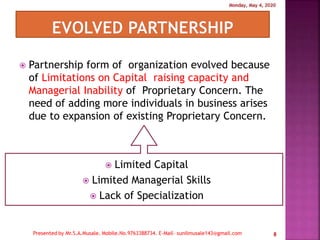

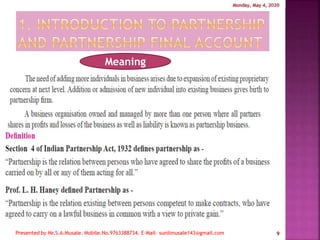

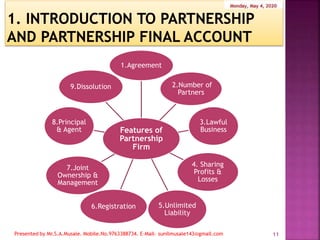

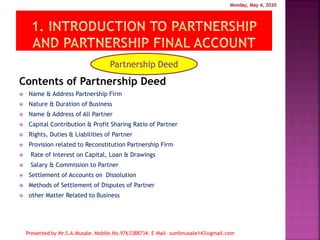

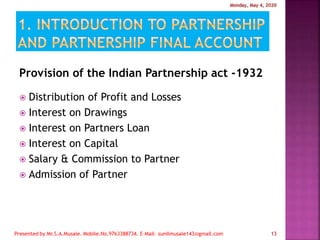

The document, presented by Mr. S.A. Musale, outlines the key topics in book-keeping and accountancy for class 12 commerce, focusing on partnership and partnership final accounts. It covers various aspects of partnership including reconstitution, dissolution, and company accounts, as well as the limitations and features of partnership firms. Additionally, it details the contents of partnership deeds as per the Indian Partnership Act of 1932.