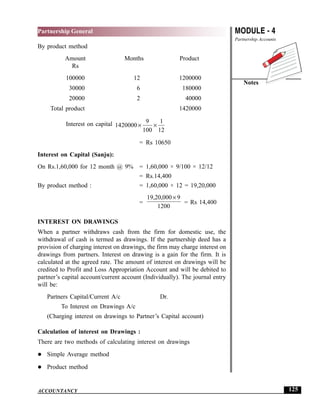

The document discusses partnership accounts and accounting treatment of specific issues related to partnerships. It begins by explaining that a partnership allows two or more persons to join together to start and run a business by sharing profits and losses. It notes that while the accounting process is similar to a sole proprietorship, partnerships have additional accounting issues like appropriating profits, treating goodwill, interest on capital, etc. The objectives are then stated as understanding the meaning and characteristics of a partnership, partnership deed, accounting treatments in the absence of a deed, capital accounts, interest calculations, and profit and loss appropriation.