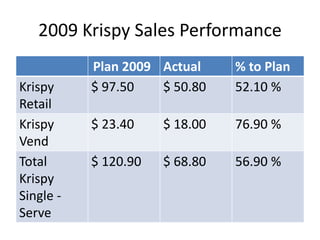

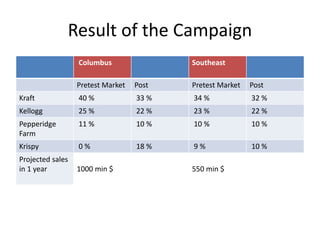

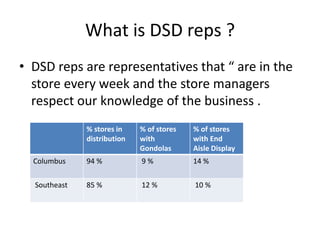

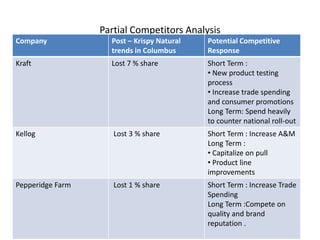

The document discusses Pemberton Products, the snack food division of Candler Enterprises, which is looking to expand into the growing salty snacks market by acquiring Krispy Inc., a manufacturer of single-serve cracker packages. Market tests of Krispy's product in Columbus and the Southeast showed an increase in Krispy's market share compared to competitors like Kraft, Kellogg, and Pepperidge Farm. Pemberton aims to leverage its marketing, sales and distribution systems to help drive further growth for Krispy in the salty snacks category.