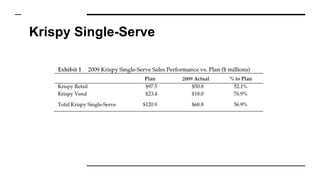

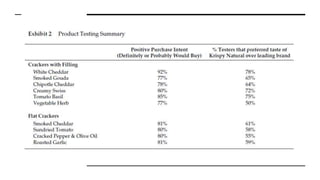

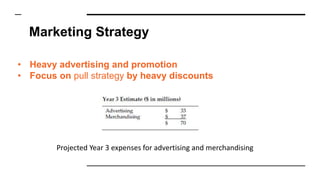

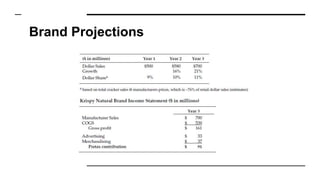

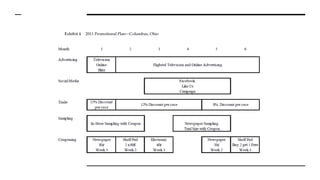

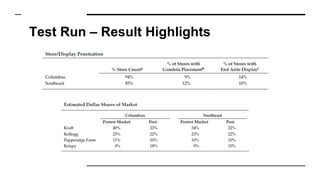

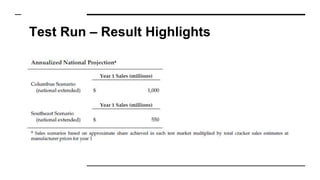

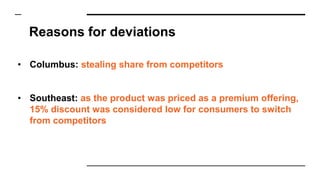

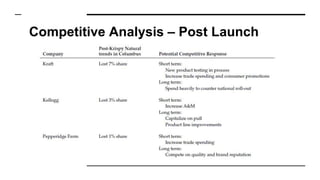

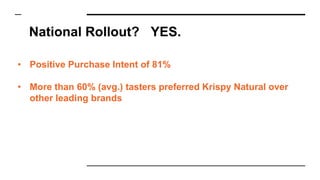

Pemberton Products launched a relaunch of Krispy crackers called Krispy Natural with whole grains and natural ingredients. A test run was conducted in Columbus, Ohio and the Southeast US. In Columbus, Krispy Natural exceeded expectations by gaining an 18% market share through promotions and stealing share from competitors. However, in the Southeast, it only gained 1% market share as consumers were not willing to switch from competitors for a premium priced product. While taste tests showed preference for Krispy Natural, critics argued the results were inflated and did not reflect real consumer behavior. The document recommends a national rollout but also expanding the product line to lower price points and better utilizing the existing distribution system.