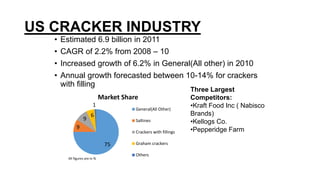

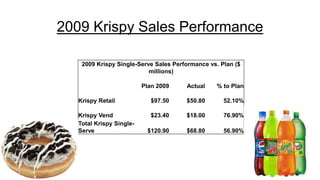

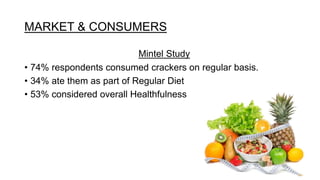

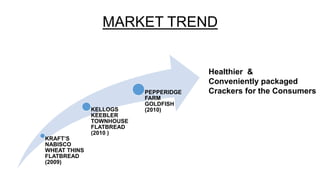

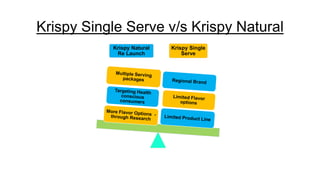

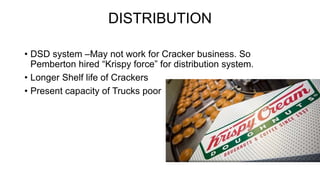

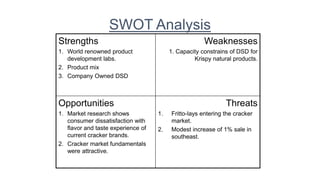

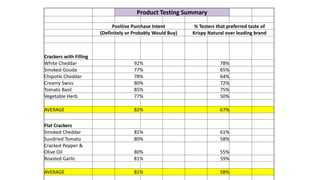

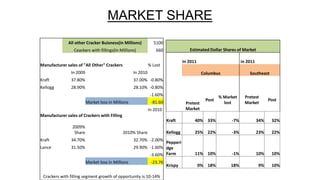

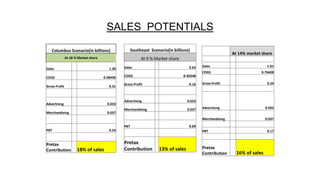

The document discusses the launch of Krispy Natural by Candler Enterprises, aiming to enter the cracker market with a unique product strategy focused on healthiness and appealing flavors. The analysis includes market trends, consumer preferences, competitive landscape, and potential market share across various scenarios, concluding with recommendations for a national rollout based on favorable testing results. Key objectives include achieving a minimum of $500 million in sales and stabilizing pre-tax profits at 13% or higher.