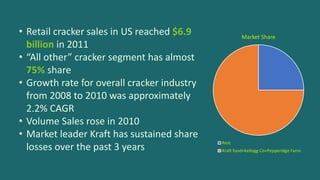

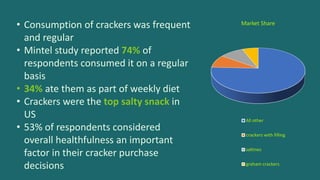

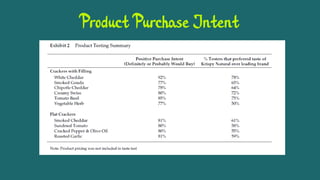

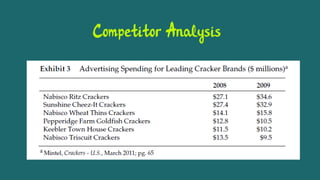

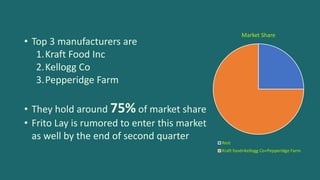

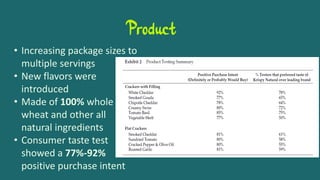

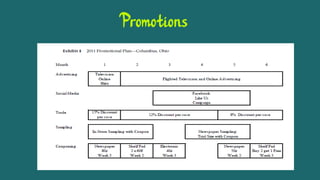

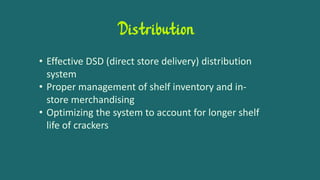

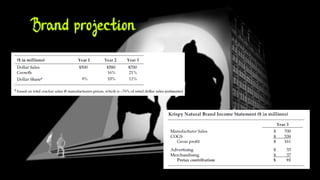

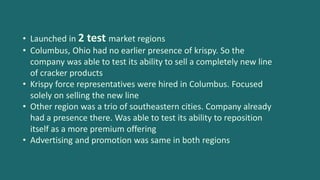

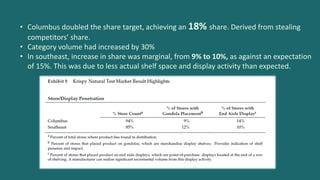

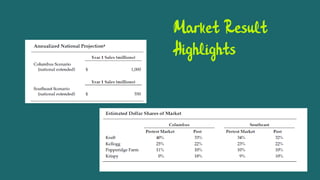

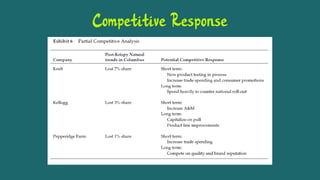

Krispy Natural is a cracker brand that was relaunched by Pemberton Beverage Division with improved taste, quality, and packaging. Market testing in two regions showed strong initial sales and share increases, though competitive response was a concern. While large retailers and buyers responded positively, some analysts questioned the sustainability of promotional discounts. Moving forward, the strategy is to position Krispy Natural as a premium, healthier cracker and use comparative advertising to differentiate it in competitive markets. If Frito Lay enters the category, Pemberton will emphasize Krispy Natural's natural ingredients and premium positioning to avoid direct competition.