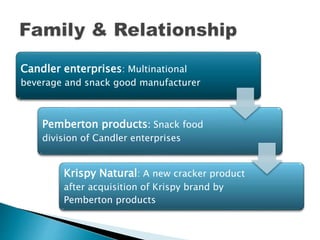

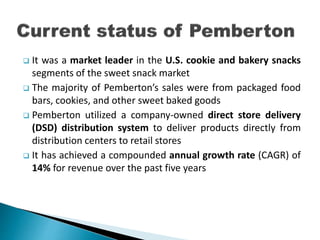

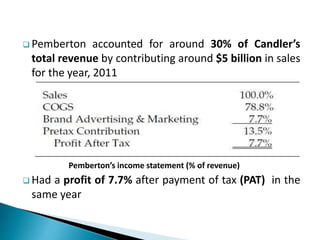

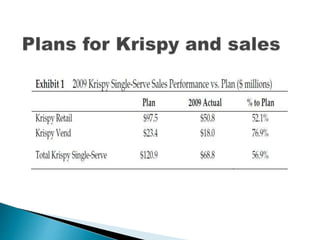

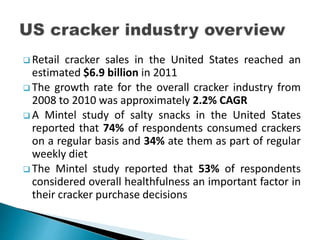

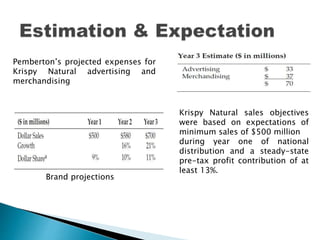

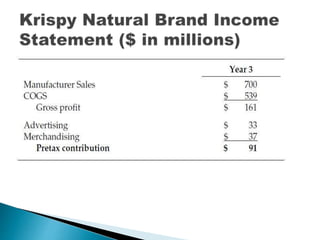

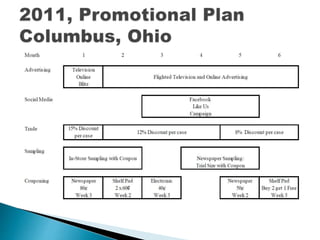

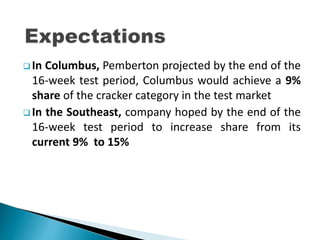

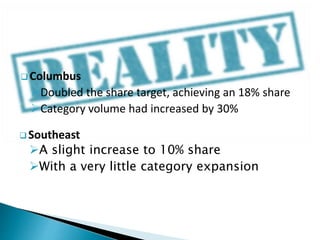

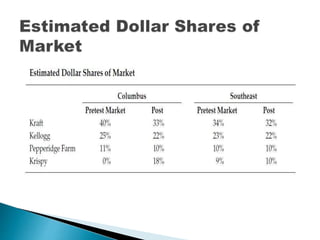

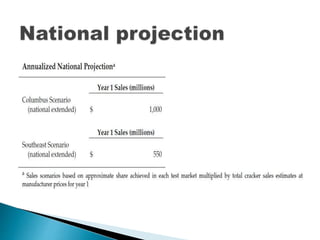

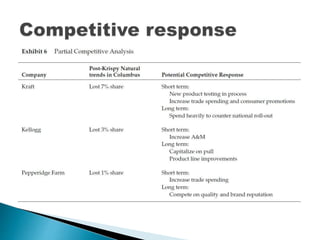

The document discusses Pemberton Products' launch of a new cracker product called Krispy Natural. It provides market research on the cracker industry, Pemberton's product and marketing strategies for Krispy Natural, and results from test launches in two regions. In Columbus, Krispy Natural doubled its category share target, achieving an 18% share with a 30% increase in category volume. In the Southeast, it achieved a slight category share increase to 10% with little overall growth. The test launches demonstrated Krispy Natural's potential and helped Pemberton refine its innovative marketing approach.