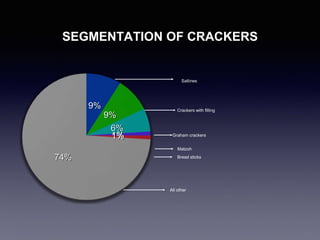

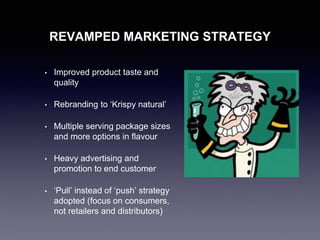

Pemberton, a snack food division of Candler Enterprises, is looking to launch a new line of healthier crackers called Krispy Natural. They test marketed the product in Columbus, Ohio and the Southeastern US, achieving mixed results. While the product was well received and gained market share in Columbus, it struggled in the Southeast. The document recommends a national rollout of Krispy Natural with a modified marketing strategy for different regions. It also suggests partnering with entertainment companies to target children and developing healthier options for specific demographics.