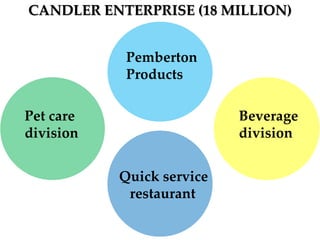

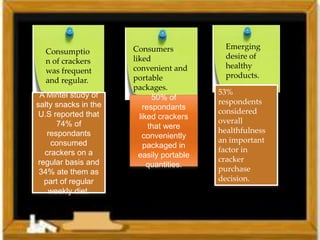

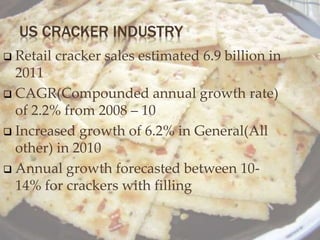

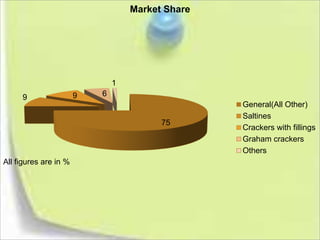

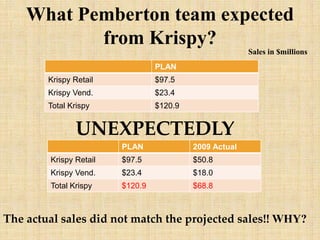

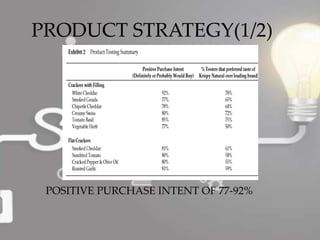

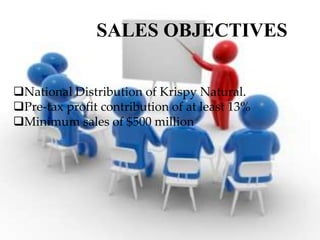

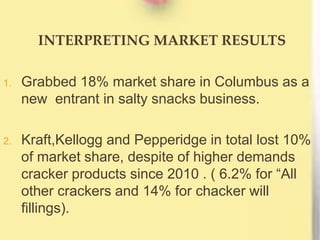

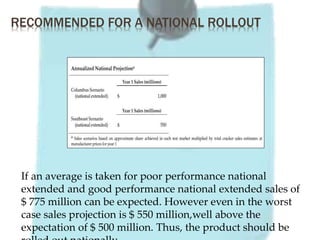

Pemberton acquired Krispy Inc. to enter the salty snack market. It rebranded Krispy's single-serve crackers as Krispy Natural, improving quality, taste, and adding options. Market tests in Ohio and Southeast US showed Krispy Natural gaining significant share from competitors. Analysis found consumers preferred Krispy Natural's taste and packaging. Given projected national sales exceeding $500 million, it was recommended Pemberton rollout Krispy Natural nationwide, using a pull marketing strategy and continuous innovation to compete against major brands.