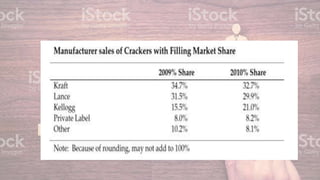

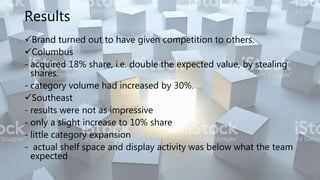

Pemberton, a division of Candler Enterprises, acquired Krispy Inc. to enter the growing cracker market, where crackers are favored over potato chips in consumer diets. After facing initial setbacks with their single-serve Krispy line, they rebranded as Krispy Naturals, focusing on improving taste and expanding packaging options, supported by an aggressive marketing strategy. The test market revealed mixed results, with Columbus outperforming expectations while the Southeast achieved only modest growth, highlighting ongoing challenges in meeting consumer taste preferences against established competitors.

![1] Building a collection of profitable

brands

Softies

cookies

Homestyle

muffins

and

doughnuts

Krispy Inc.

The brands

Pemberton hold,

with many more to

be possibly acquired.](https://image.slidesharecdn.com/krispies-170629070646/85/Krispies-8-320.jpg)

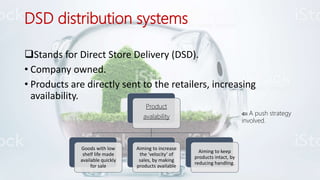

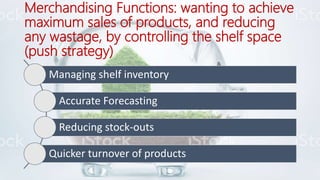

![2] Marketing, sales and DSD systems to

increase revenue and profits](https://image.slidesharecdn.com/krispies-170629070646/85/Krispies-9-320.jpg)

![3] Building or acquiring capabilities in salty snack

categories (extension of product line).

Kraft

Food

Inc.

Nabisco

brands

Kellogg

Co.

Sunshine,

Keebler, Carrs

and Austin

brands

Pepperid

ge Farm

Goldfish

brands

These brands

(competitors, 3/4th of

the market shares)

were dominating the

market of crackers, a

major salty snack

category. Being the

major competitors to

Pemberton, they were

hurdles for it to enter

the market.](https://image.slidesharecdn.com/krispies-170629070646/85/Krispies-12-320.jpg)