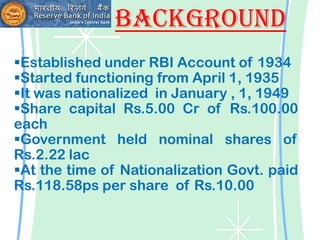

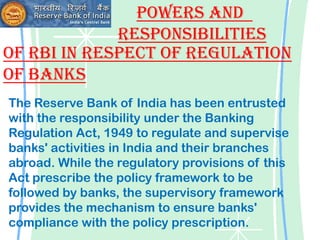

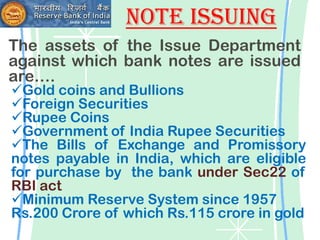

The Reserve Bank of India (RBI) was established in 1934 and nationalized in 1949. It regulates the country's banking system and monetary policy. The RBI has the following key objectives: to stabilize the monetary unit, maintain the bank's monopoly on note issuing, not operate for profit, and act as banker to the government. It controls credit and money supply using various tools like the bank rate, cash reserve ratio, statutory liquidity ratio, open market operations, and selective credit controls. The RBI is governed by a central board and local boards advise on regional matters.