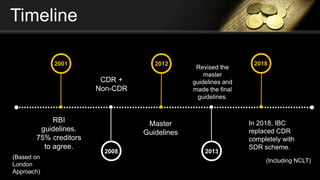

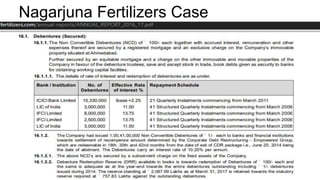

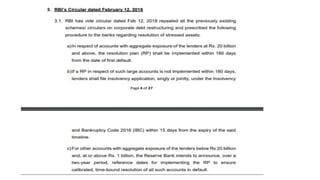

The document outlines corporate debt restructuring (CDR) in India, detailing its definition, purpose, and the timeline of its development from 2001 to 2018 when it was replaced by the insolvency and bankruptcy code (IBC). It describes the structure and implementation of CDR, including the roles of various groups involved and methods used for restructuring. Additionally, it mentions significant cases and the current scenario of corporate debt restructuring in India.