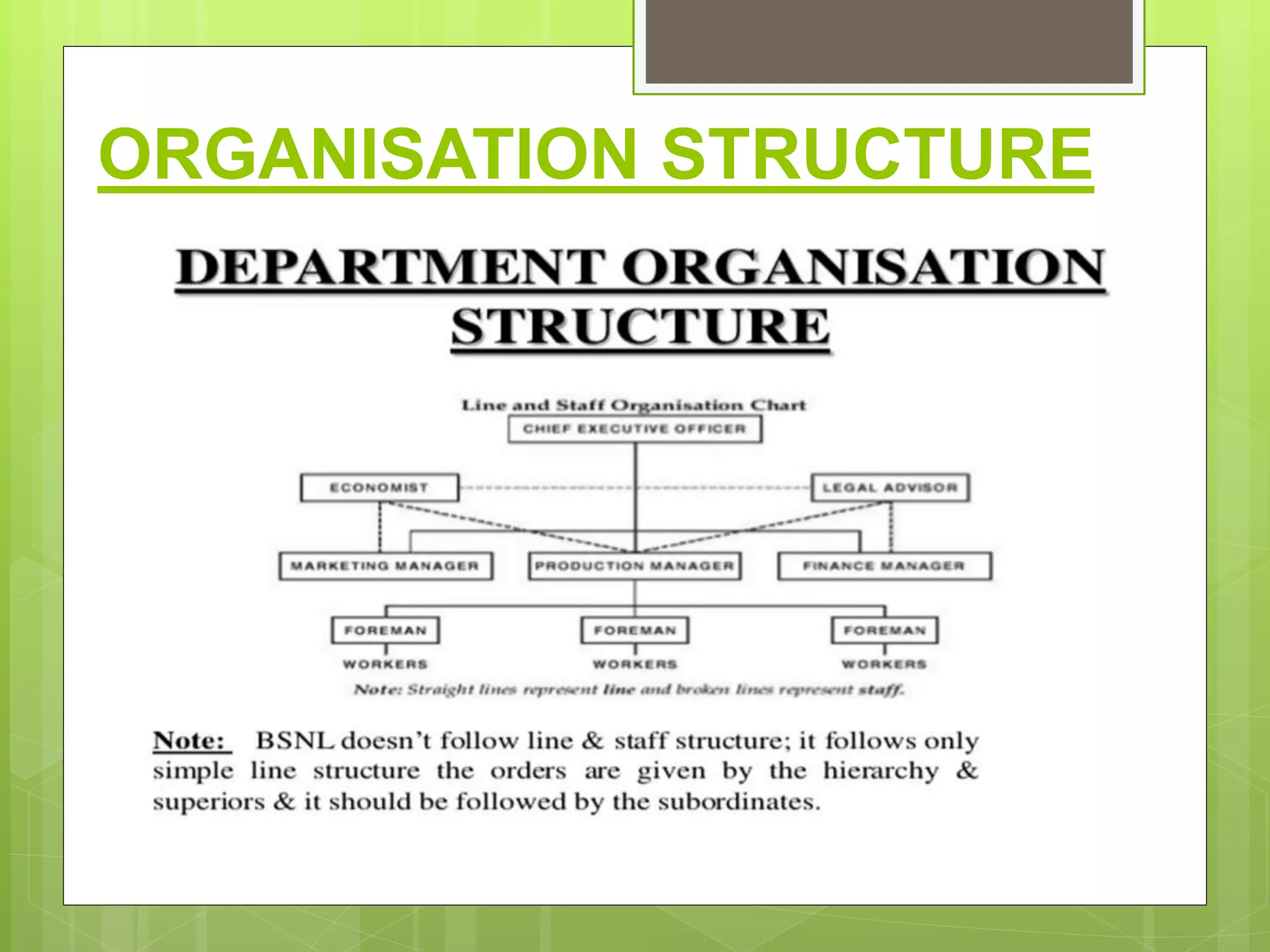

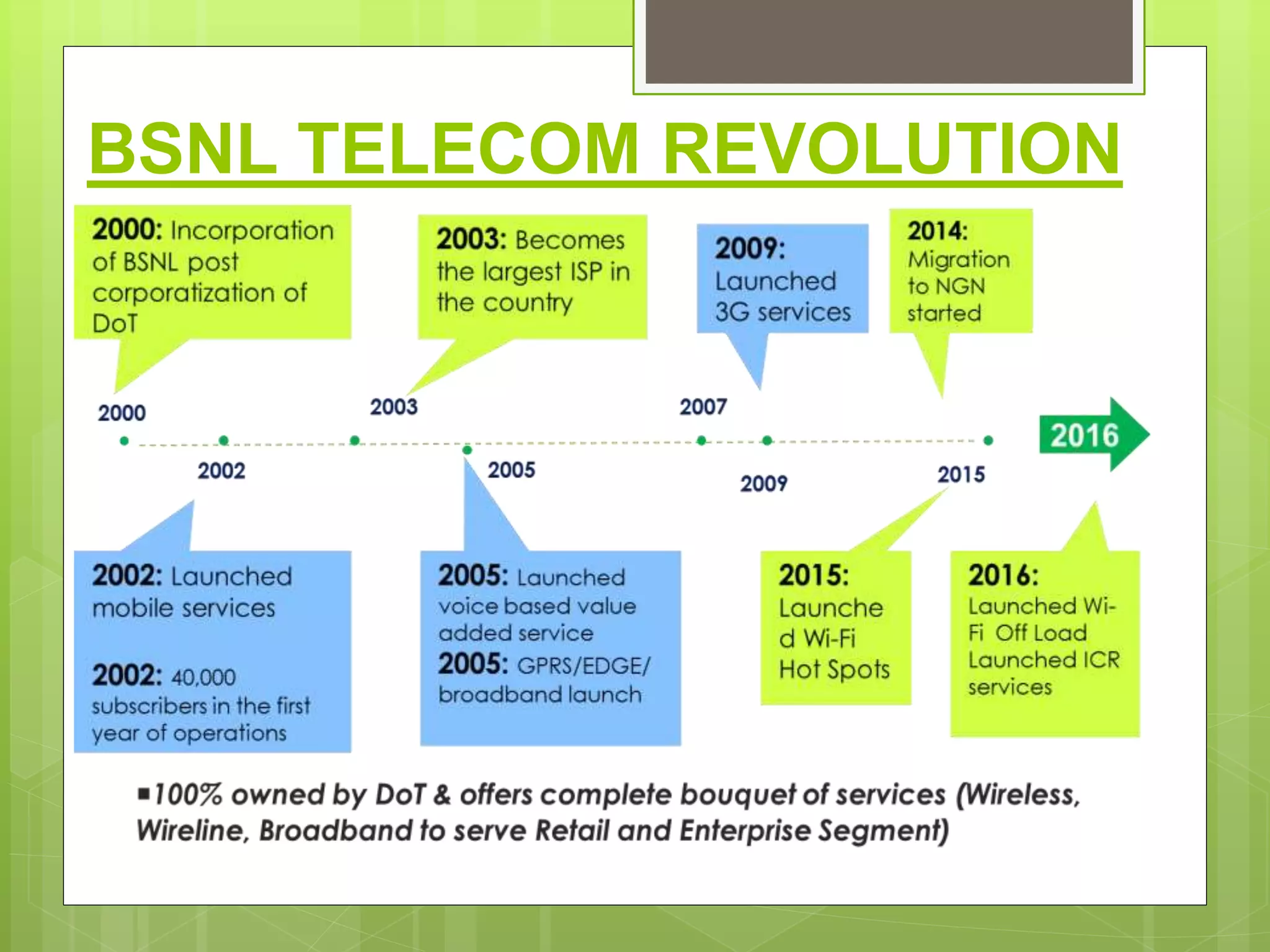

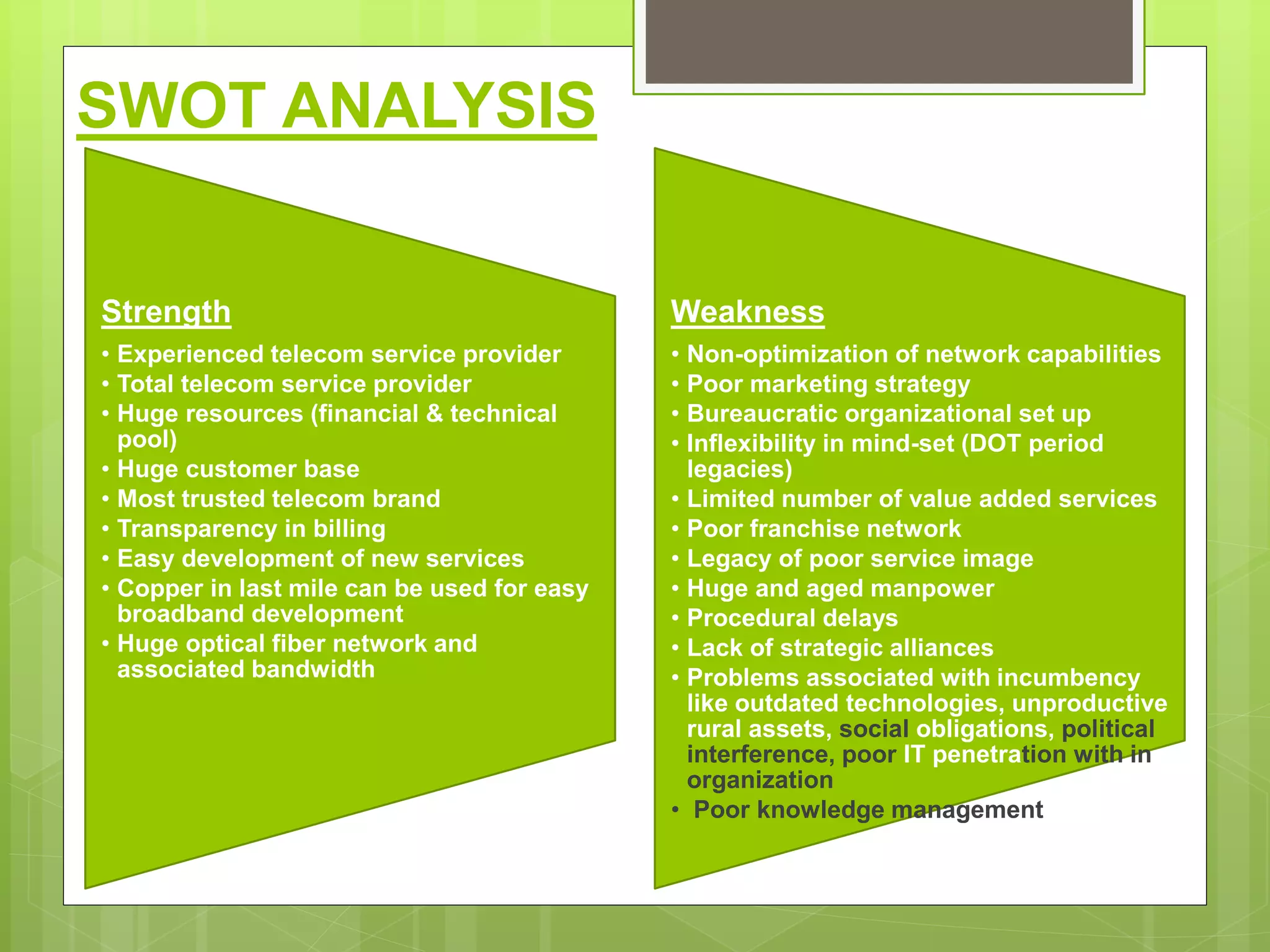

This document outlines a project report on Bharat Sanchar Nigam Limited (BSNL), a state-owned telecommunications company in India. The objectives of the study are to analyze BSNL's financial performance over five years, evaluate its financial position in terms of ratios, identify strengths and weaknesses, and suggest improvements. Key findings include increasing debt levels, declining revenues and profits, and high operating costs. Suggestions focus on improving efficiency, increasing revenue streams, maintaining assets, and conducting brand revitalization. The conclusion states that BSNL is facing financial difficulties but has potential to overcome challenges through management reforms.