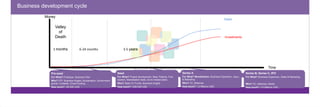

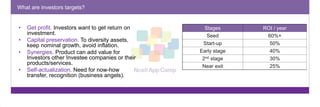

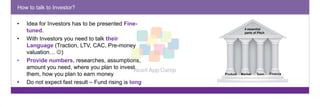

Tomas Martunas discusses key elements for developing an idea into a sustainable business. He outlines the typical business development cycle from pre-seed to later stage funding. Martunas also discusses factors that show the attractiveness of an idea such as addressing large markets, focusing on rich customers, and solving important problems for customers. Additionally, he notes important elements of sustainable startups include having a clear purpose, focus, thinking differently than competitors, and building an agile team. Martunas advises founders on presenting ideas to investors by discussing traction, revenues, costs, valuation, and plans for investment.