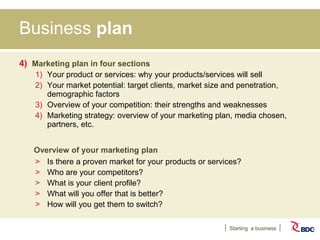

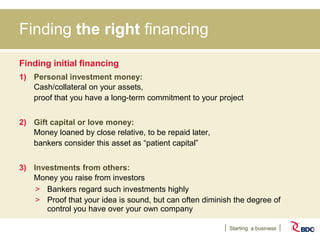

The document outlines resources and support for Canadian entrepreneurs seeking to start and grow their businesses, focusing on financing, venture capital, and consulting services. It emphasizes the importance of a well-structured business plan and provides details on the types of funding available, eligibility criteria, and key entrepreneurial skills needed for success. The Business Development Bank of Canada (BDC) aims to complement traditional financing institutions and assist businesses facing market gaps.