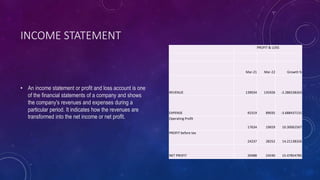

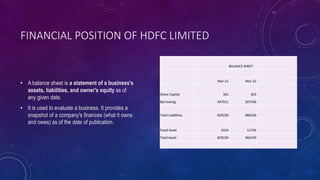

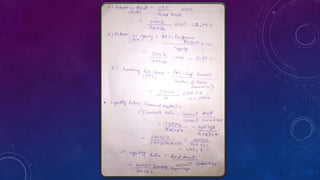

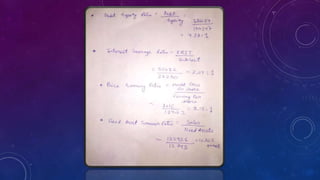

This document provides a summary of HDFC Limited's business model, financial statements, and financial position for the years ending March 2021 and March 2022. HDFC Limited is a leading housing finance company in India that deals primarily in mortgage lending. It has expanded into other financial sectors through subsidiaries. The summary highlights that HDFC Limited's revenues decreased slightly from 2021 to 2022 while expenses also declined, leading to an increase in net profit of over 15%. The balance sheet information shows increases in total assets and liabilities from 2021 to 2022. The document concludes with an analysis of using various financial ratios to evaluate a company's liquidity, profitability, efficiency, and solvency.