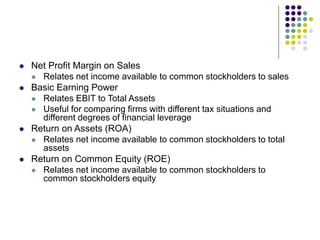

The document outlines the significance of financial statements and their analysis, focusing on their role in maximizing shareholder wealth and guiding corporate finance decisions. It details various types of financial statements, including income statements, balance sheets, and cash flow statements, while discussing ratio analysis as a tool to assess a firm's strengths and weaknesses. Additionally, it highlights the limitations and challenges faced in financial statement analysis, emphasizing the importance of adherence to GAAP standards and the necessity of annual audits.