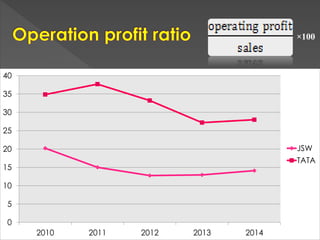

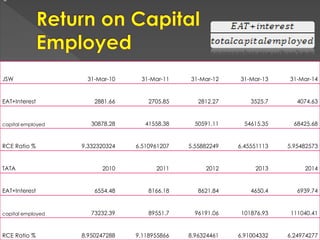

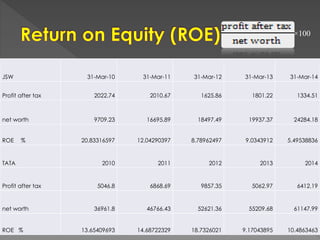

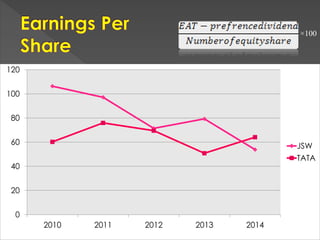

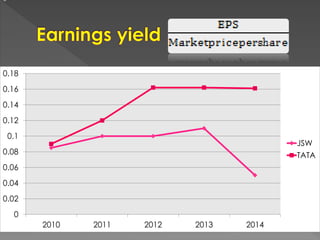

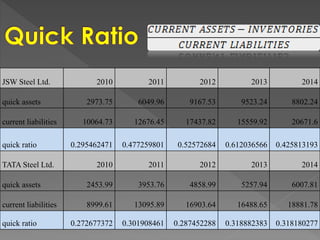

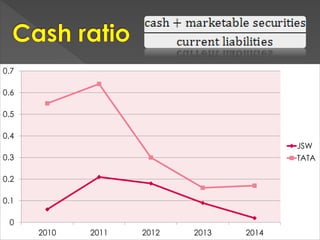

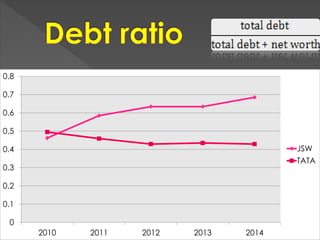

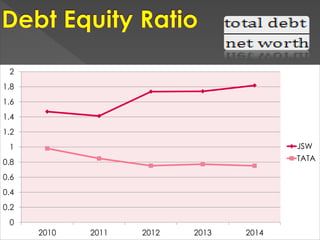

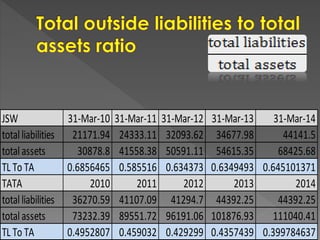

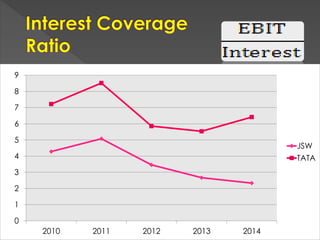

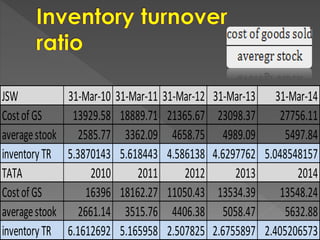

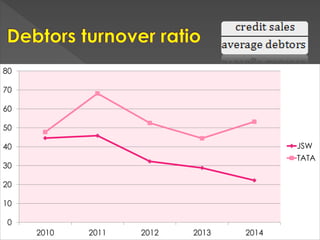

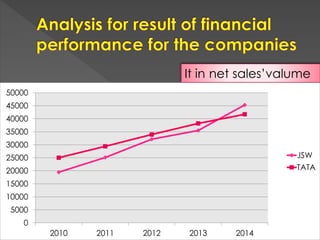

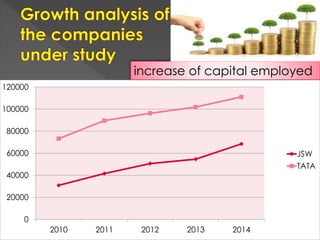

The document presents a comparative study of financial performance and growth between Tata Steel Ltd and JSW Steel Ltd, which includes chapters on the nature of the study, financial performance concepts, ratio analysis, company profiles, and findings with suggestions. Key findings indicate JSW's aggressive expansion resulted in increased debt and financial risk, while Tata maintained a stronger financial position despite slower growth. Recommendations are provided for both companies, highlighting debt management for JSW and market share enhancement strategies for Tata.