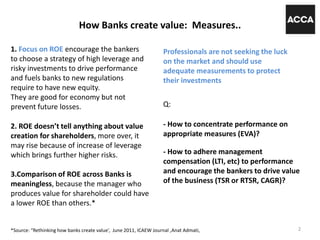

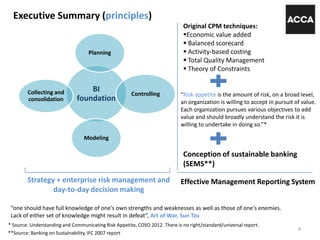

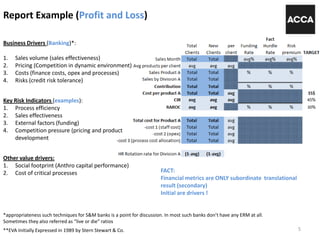

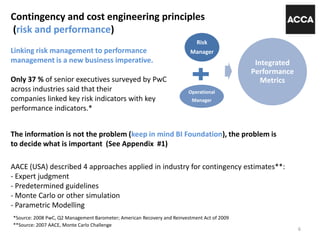

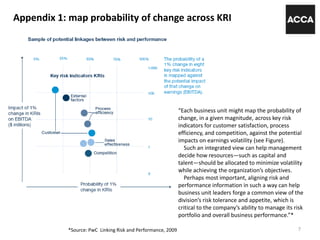

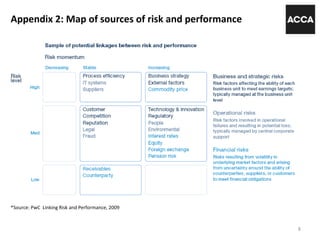

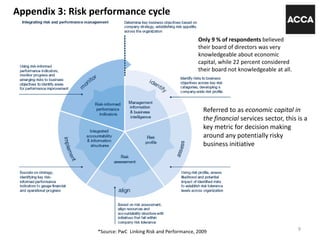

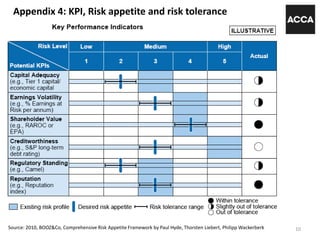

This document discusses effective management reporting systems for banks to measure value creation. It proposes using a value measuring methodology (VMM) with three components: a value structure identifying key areas that create value for customers, society, operations etc.; a cost structure; and a risk structure. Key performance indicators (KPIs) should be linked to key risk indicators (KRIs) to integrate risk and performance management. Appendices provide examples of mapping KRIs against potential impacts; sources of risk and performance; the risk-performance cycle; and how KPIs relate to risk appetite and tolerance. The document advocates a holistic approach linking financial, operational and risk metrics to truly reflect how value is created and destroyed.