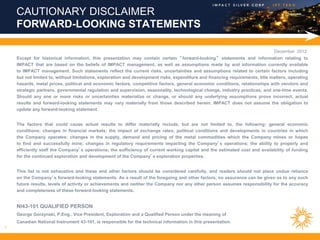

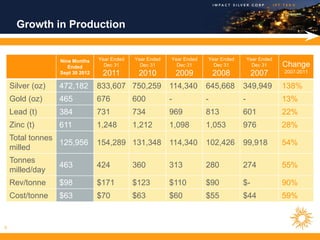

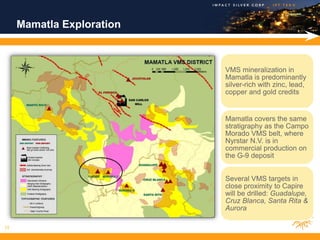

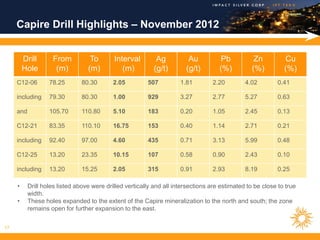

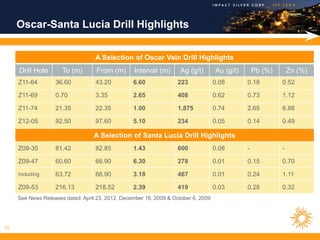

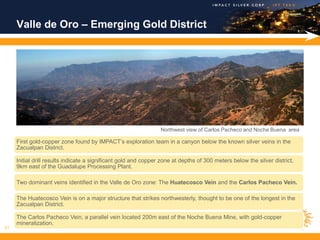

The document is a corporate presentation for IMPACT Silver Corp from December 2012. It summarizes that IMPACT operates two silver mining districts in Mexico, has a profitable track record of increasing silver production and earnings since 2006, and has a strong cash position with no debt. It also provides details on IMPACT's asset base, including active mines, development projects like the Capire Mine, and exploration potential across the districts.