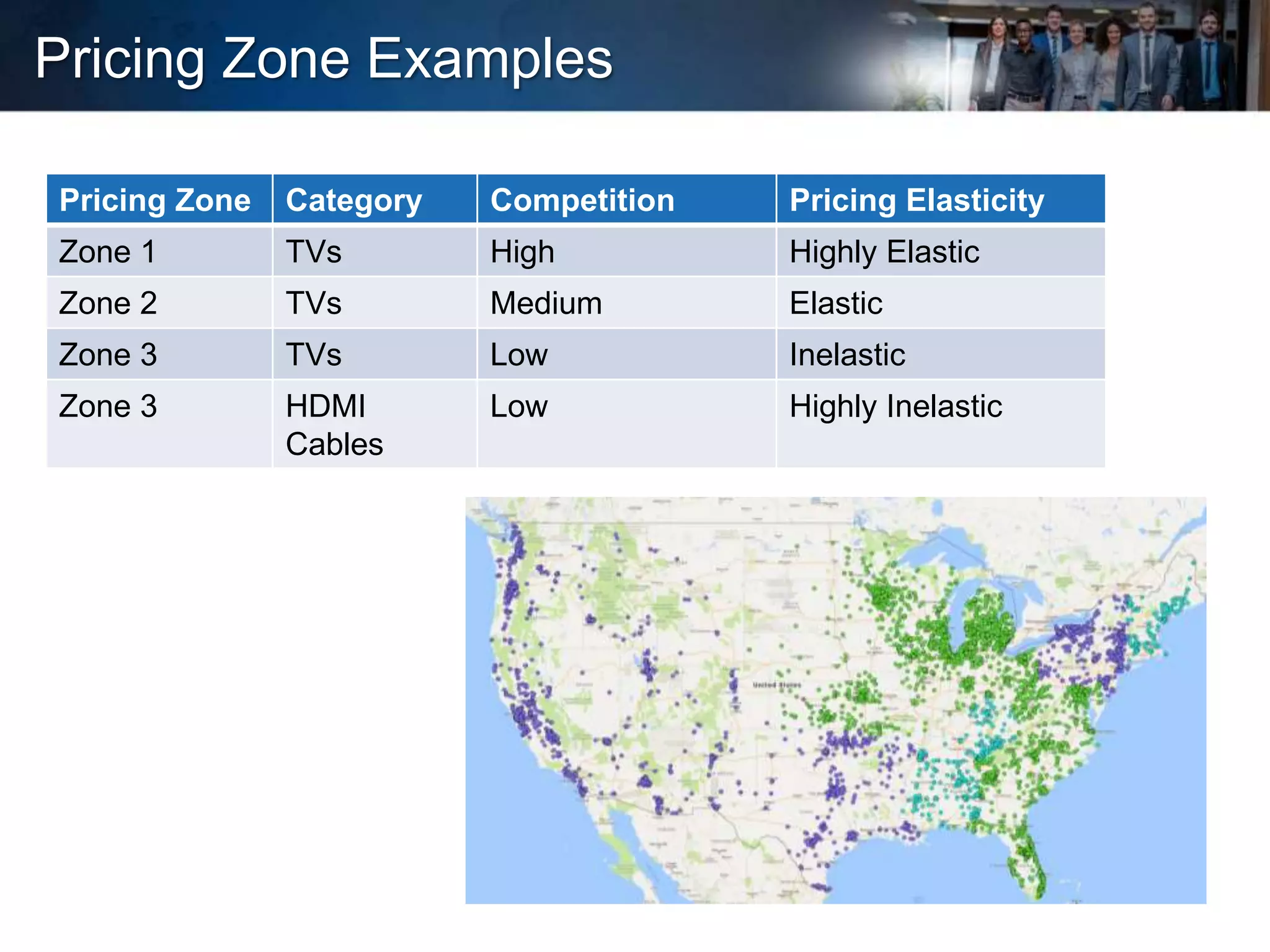

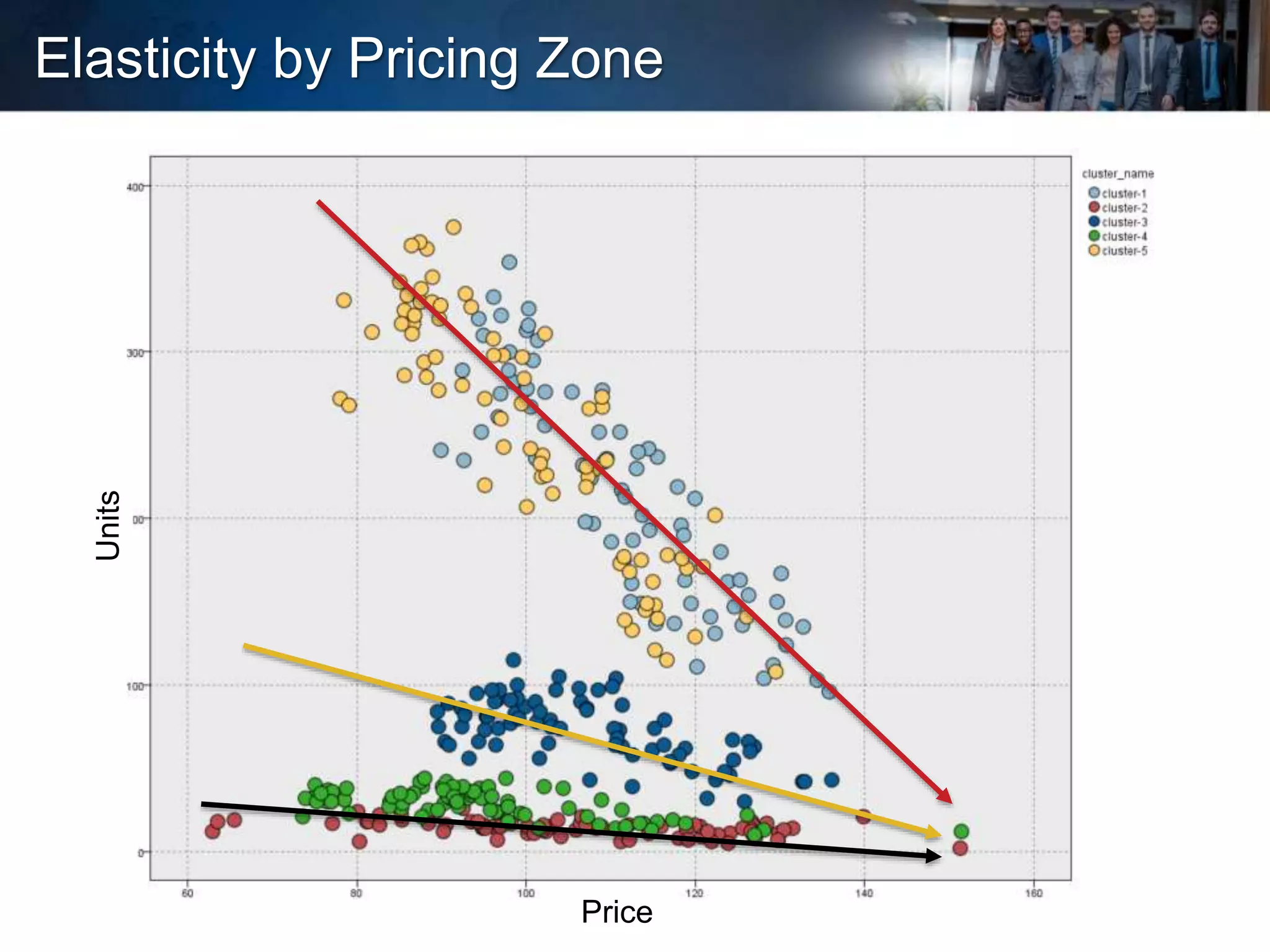

The presentation on predictive price optimization by Quebit discussed the importance of price optimization in enhancing revenue, margins, and market share through data-driven processes. It emphasized the need for behavioral customer segmentation to apply pricing strategies effectively and introduced Quebit's solutions for optimizing prices at the SKU and customer segment levels. Additionally, it highlighted the benefits of incorporating various demand drivers for more accurate pricing models and strategies.