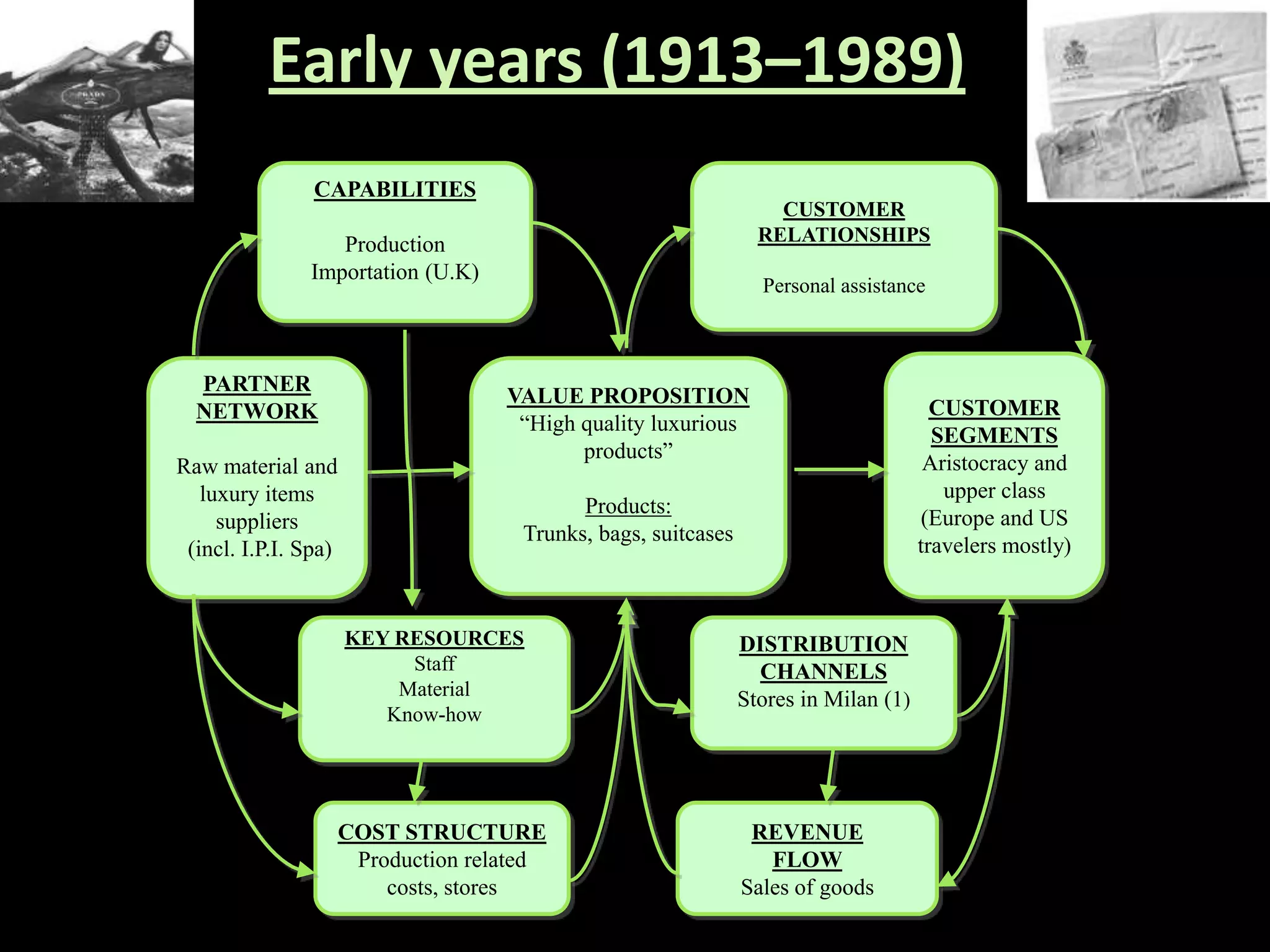

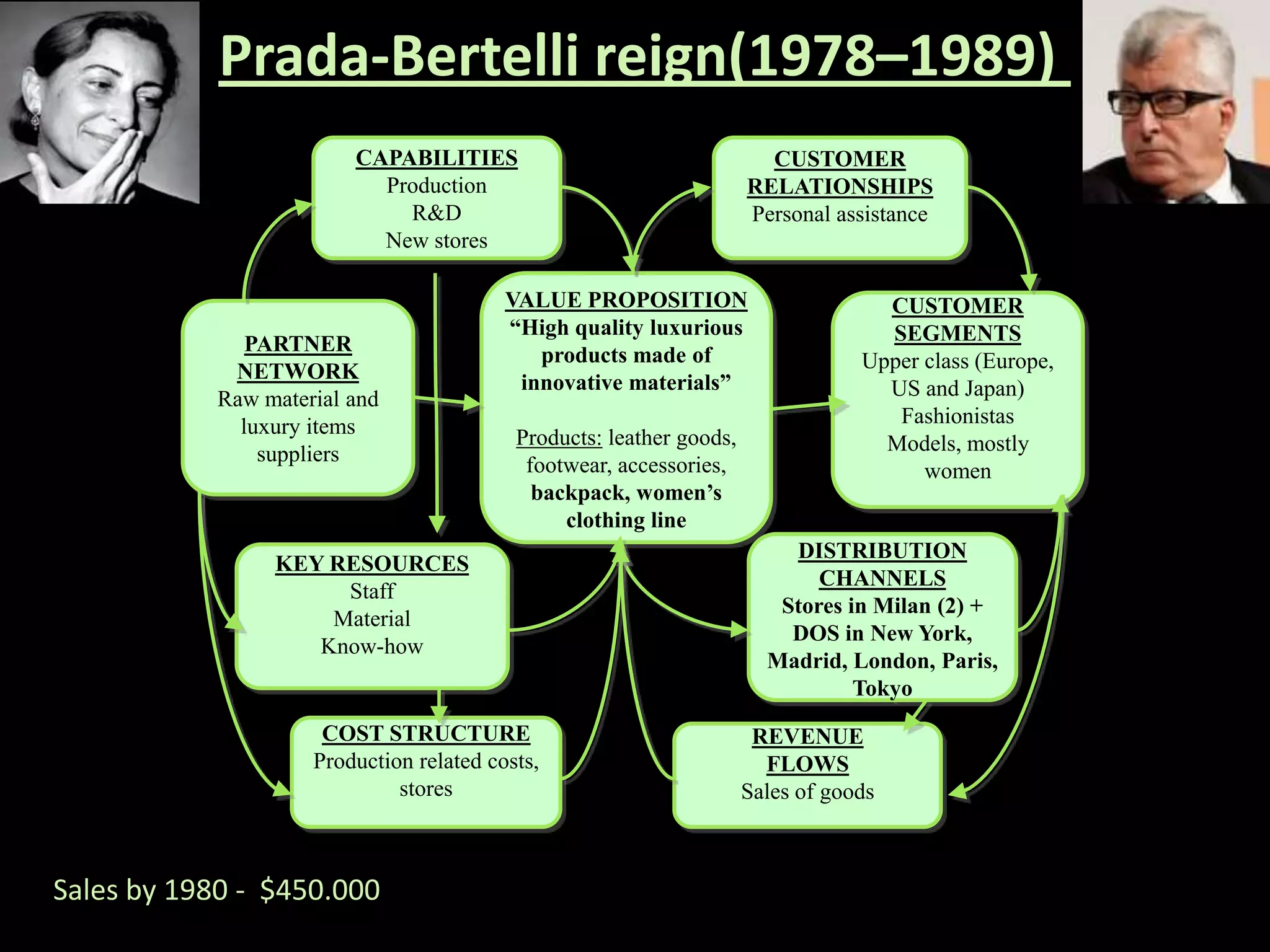

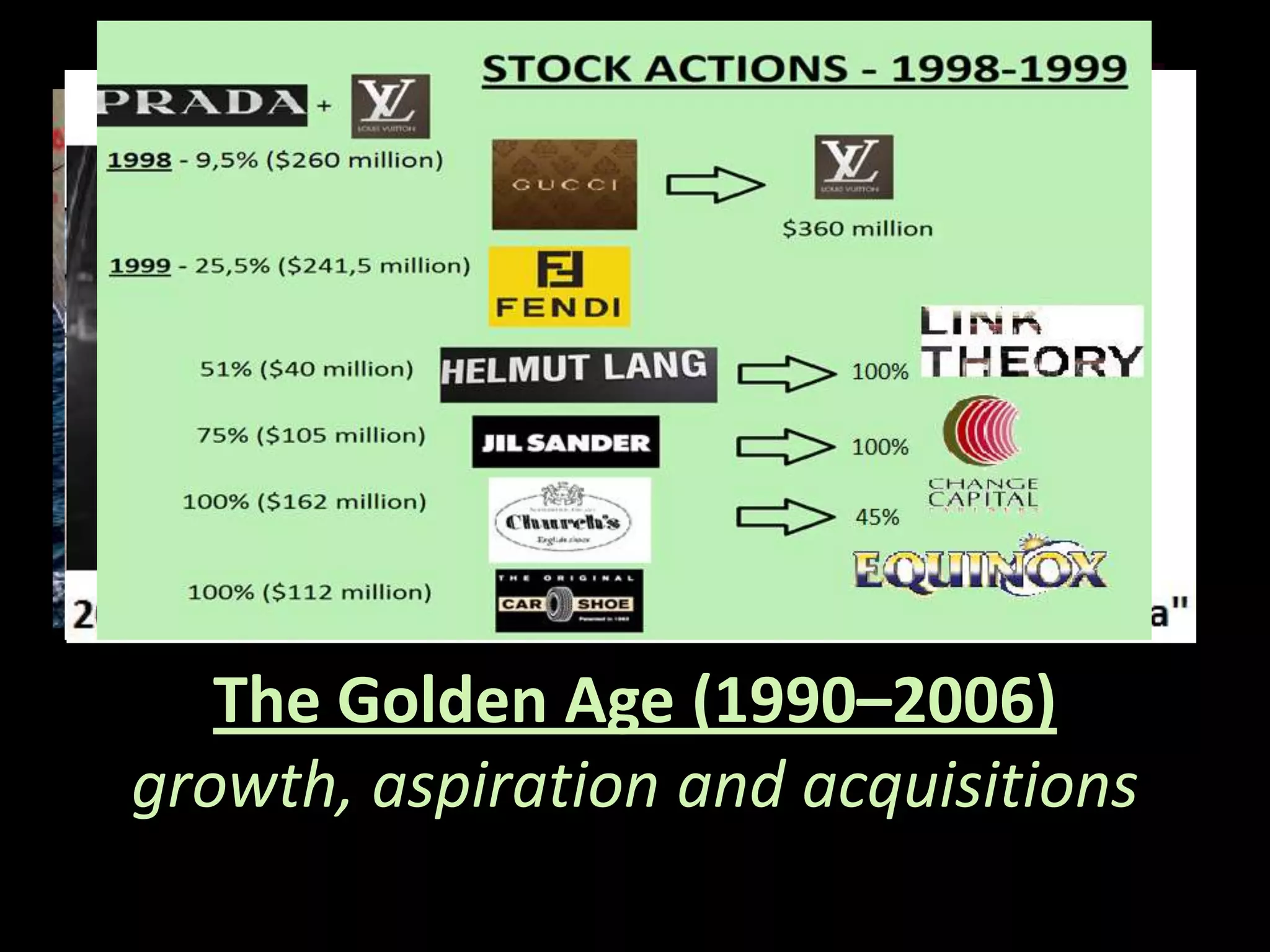

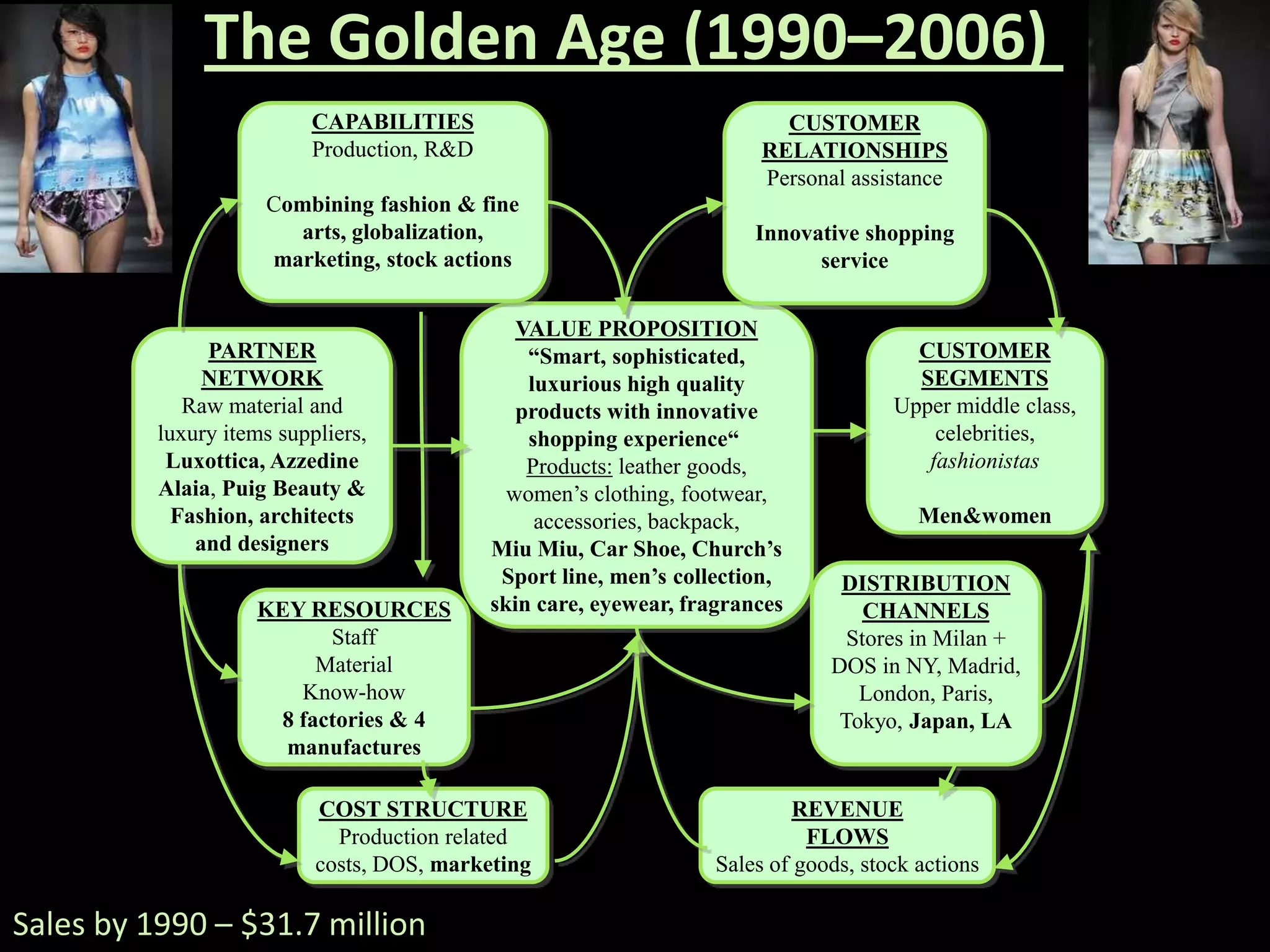

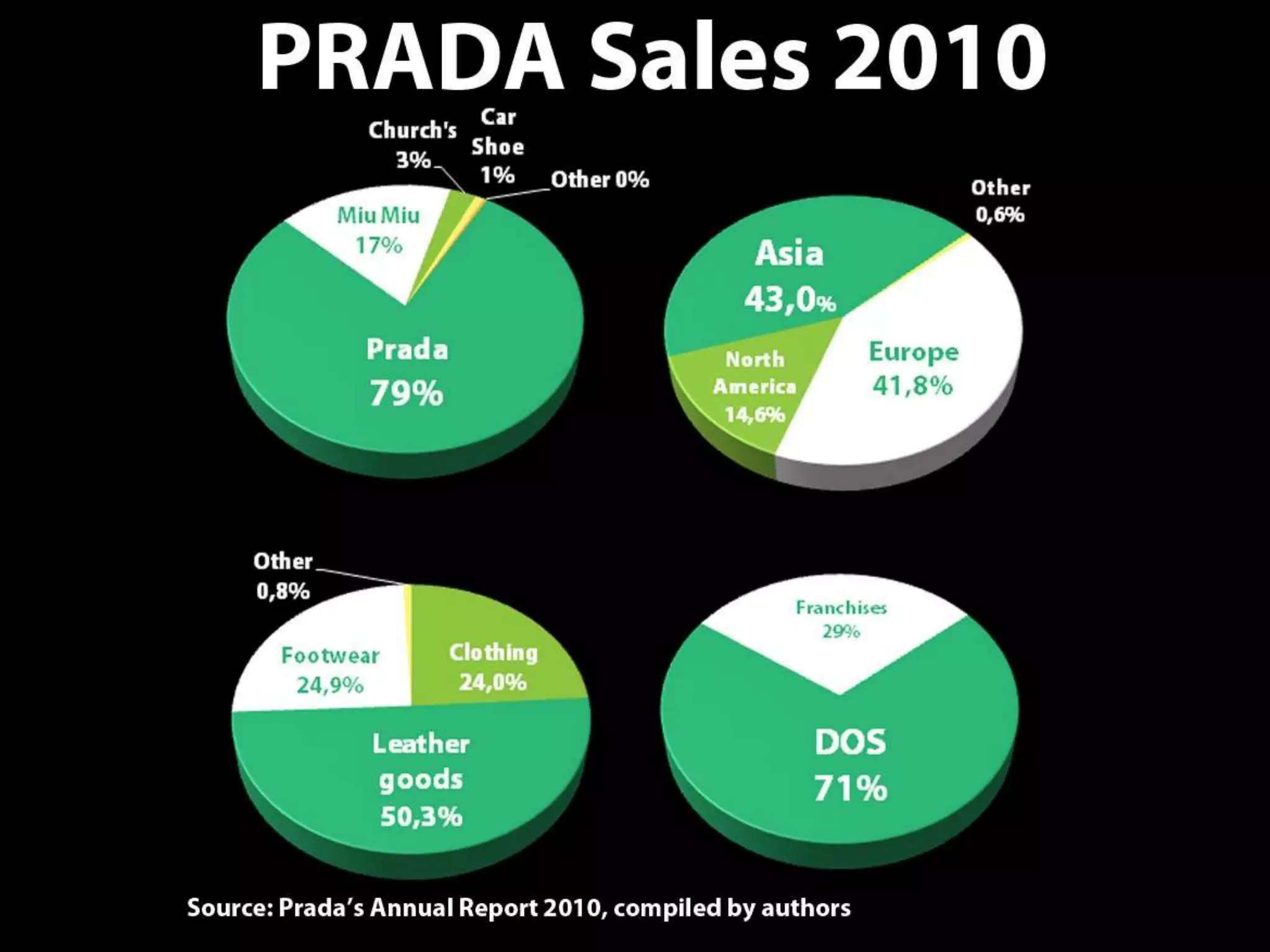

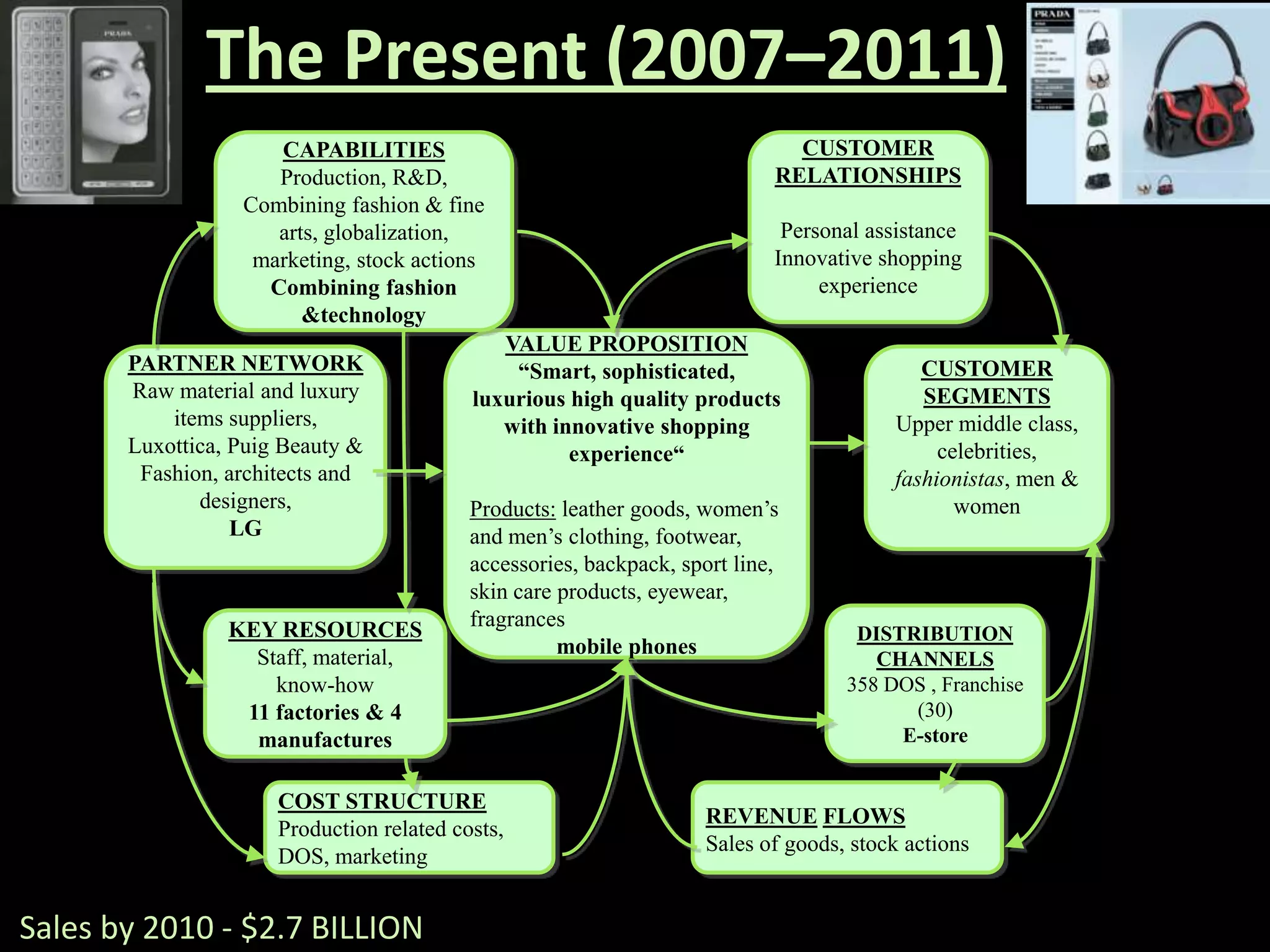

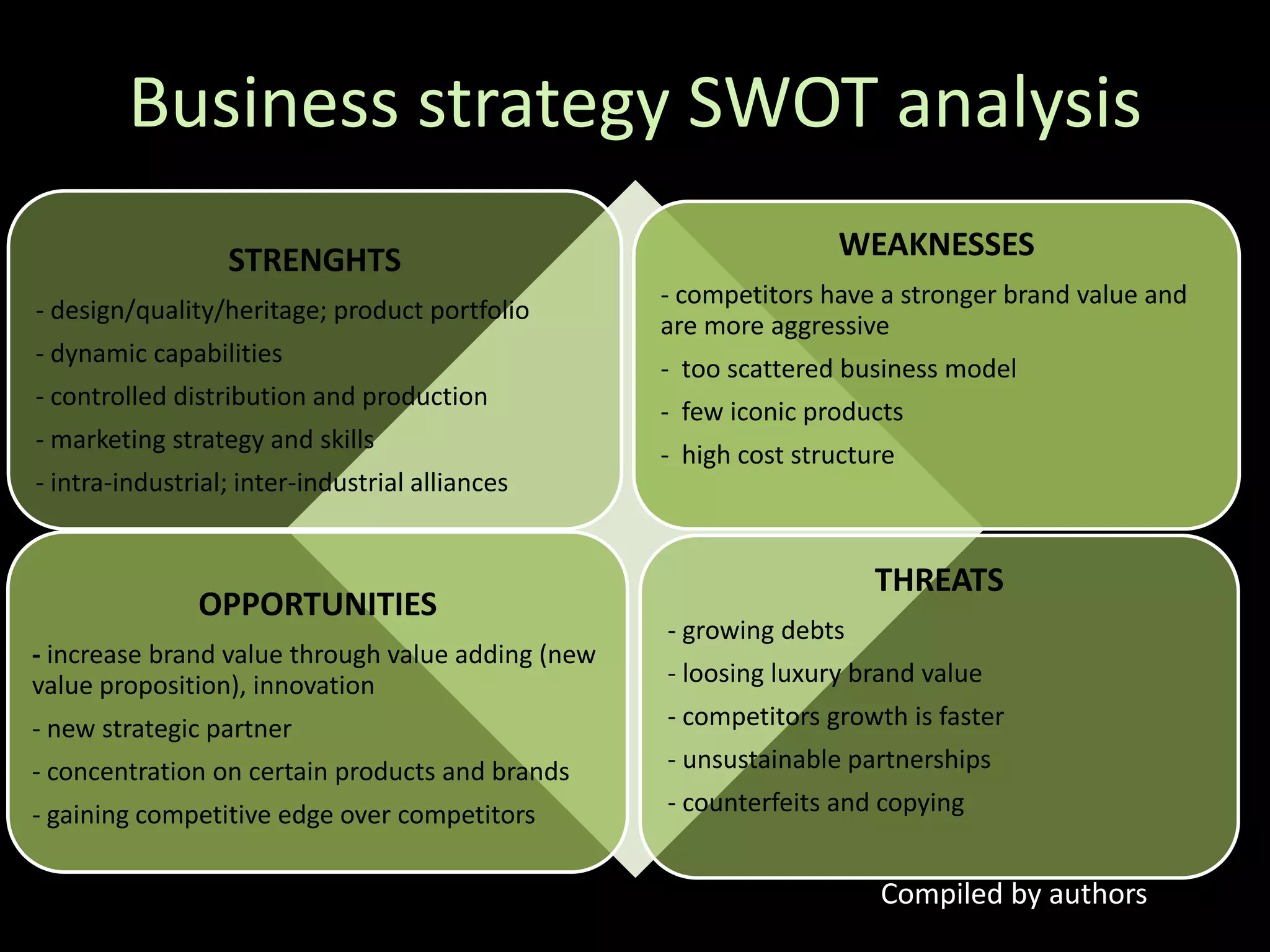

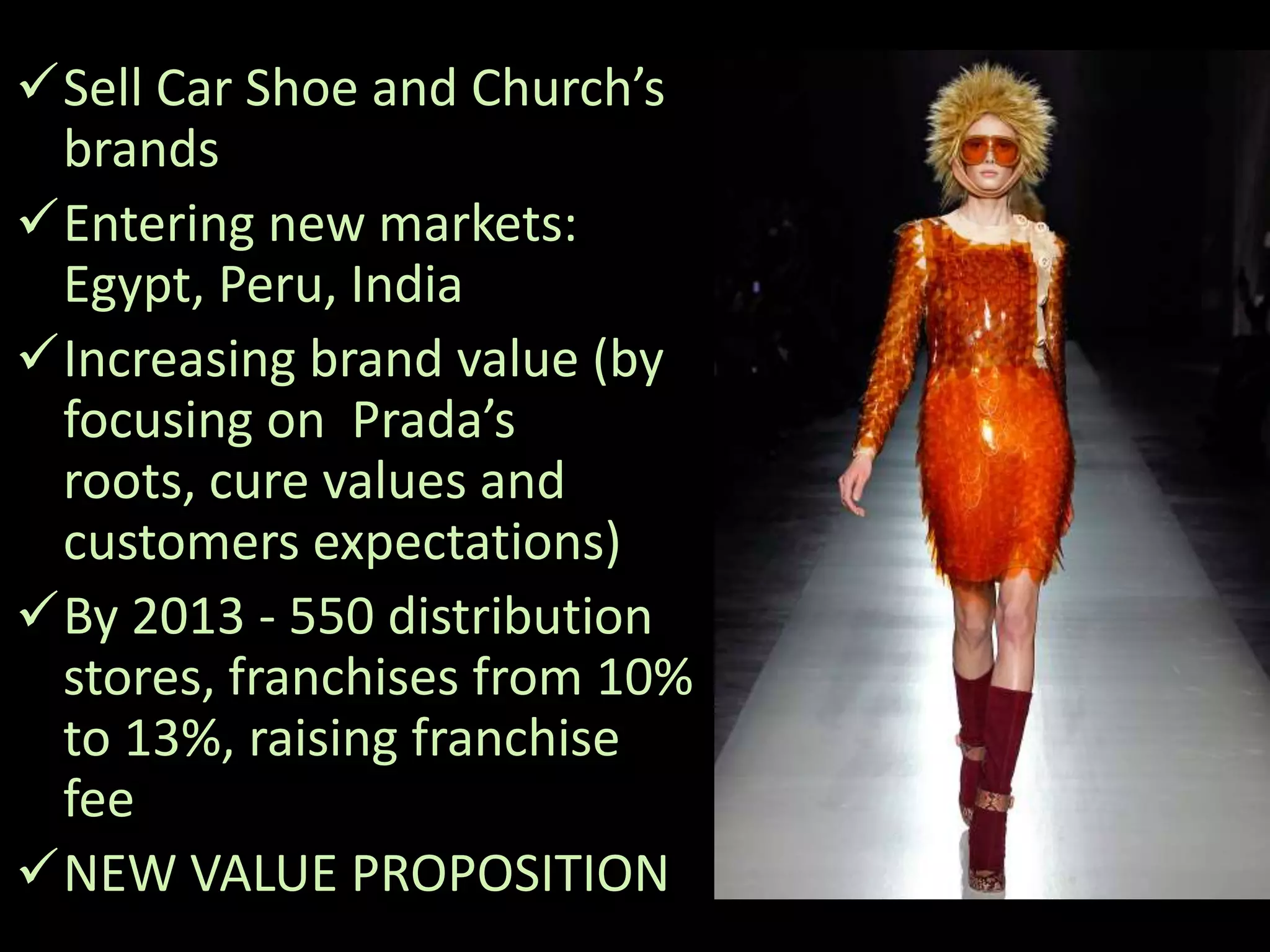

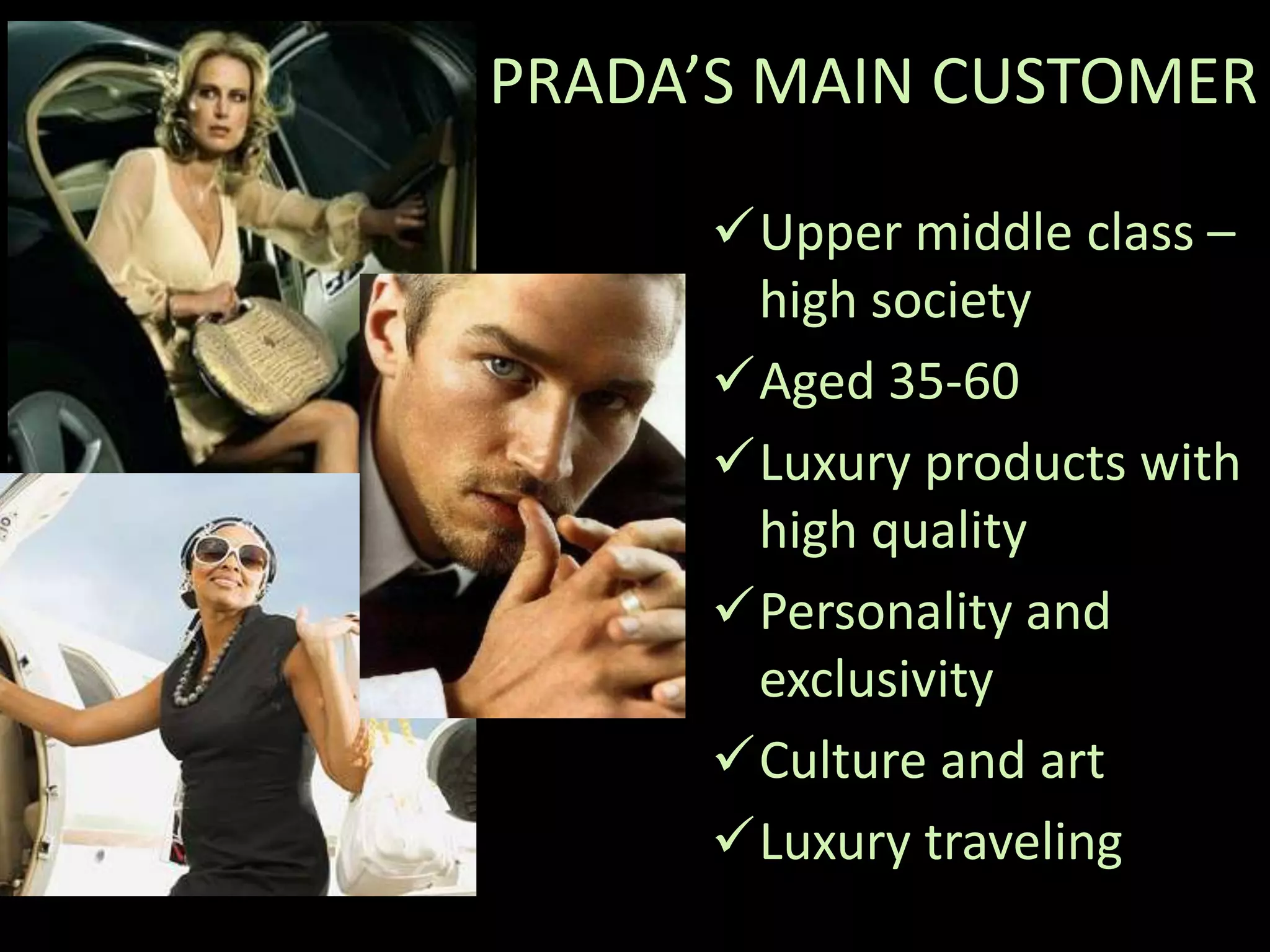

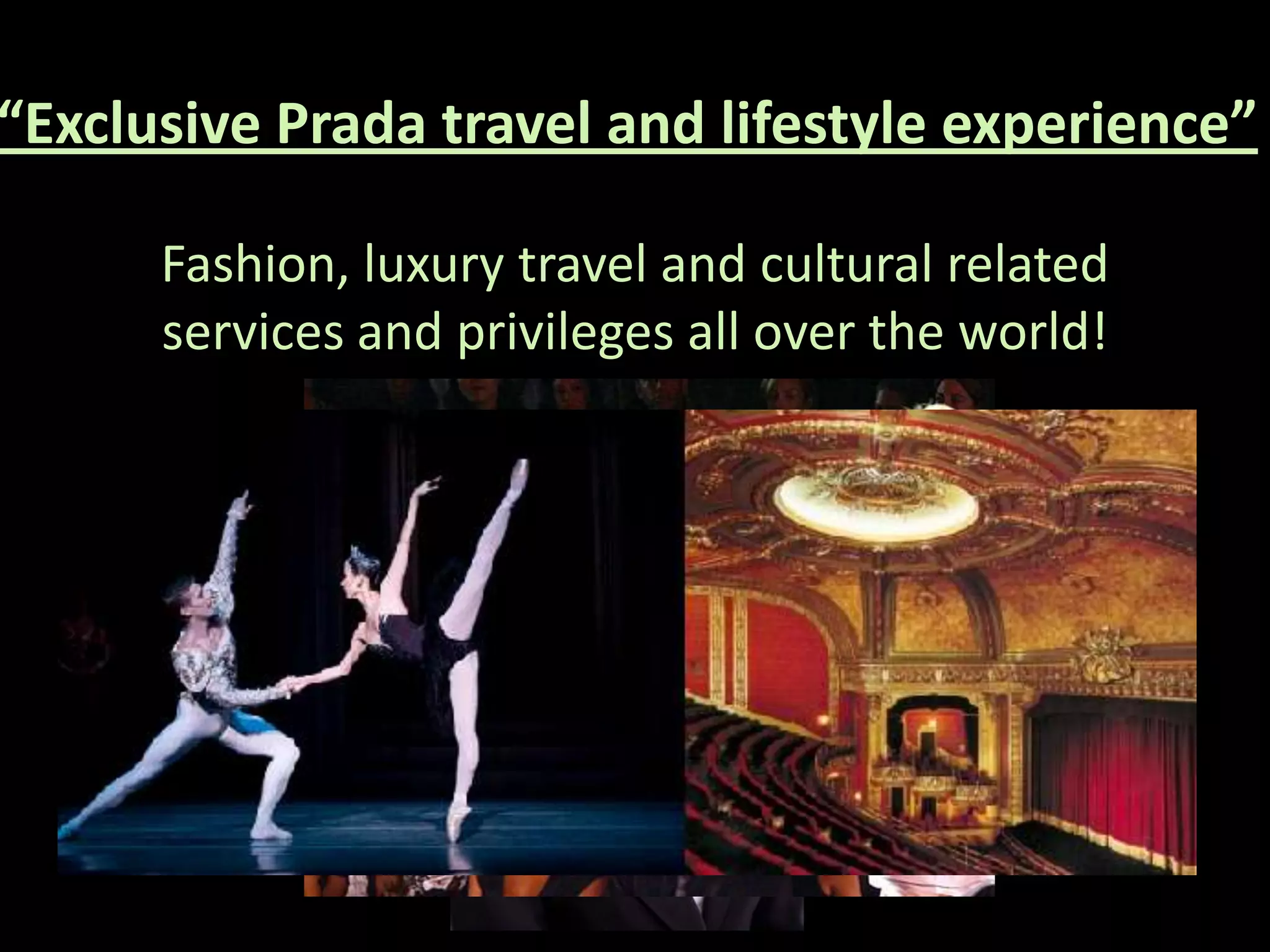

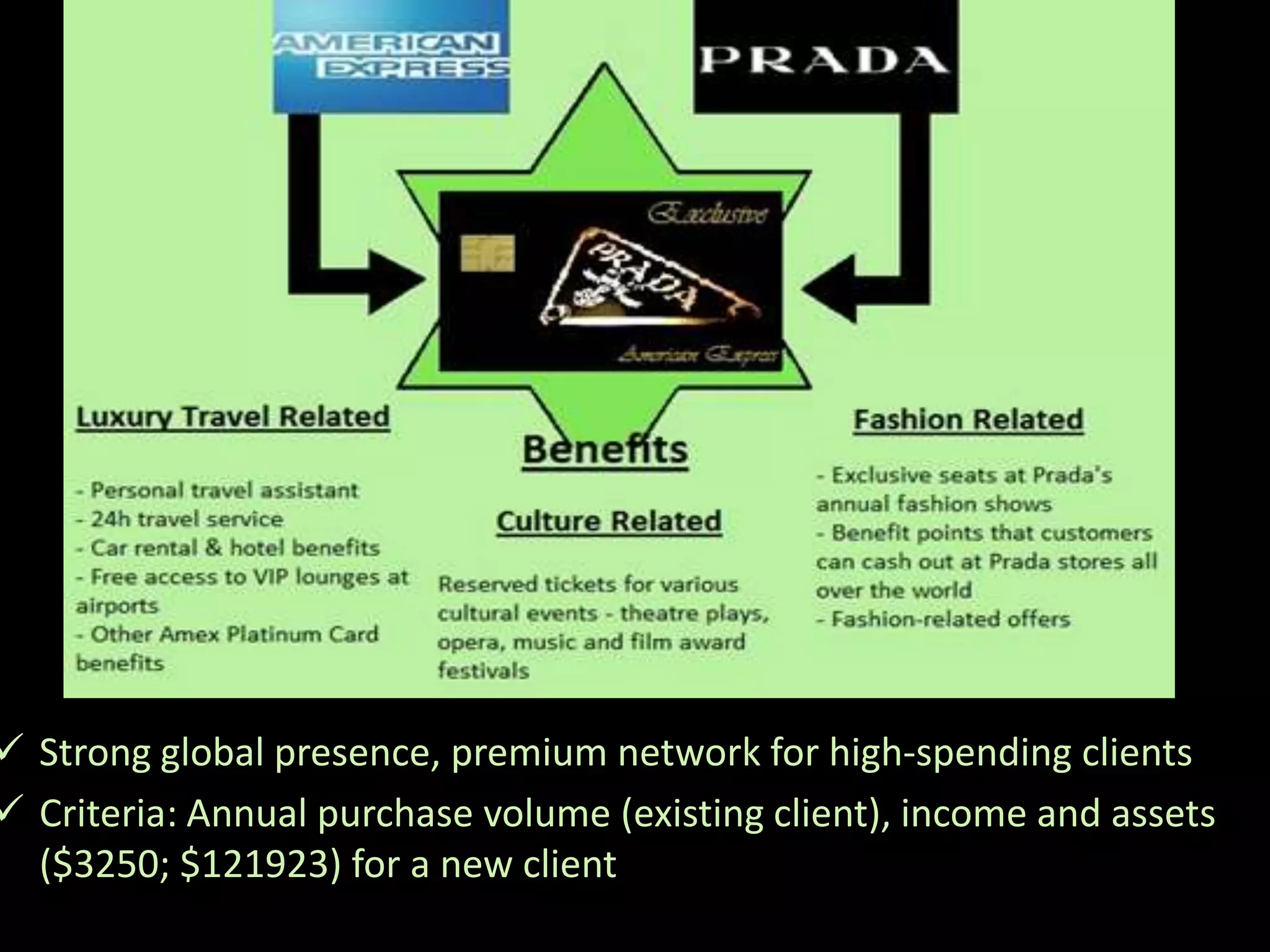

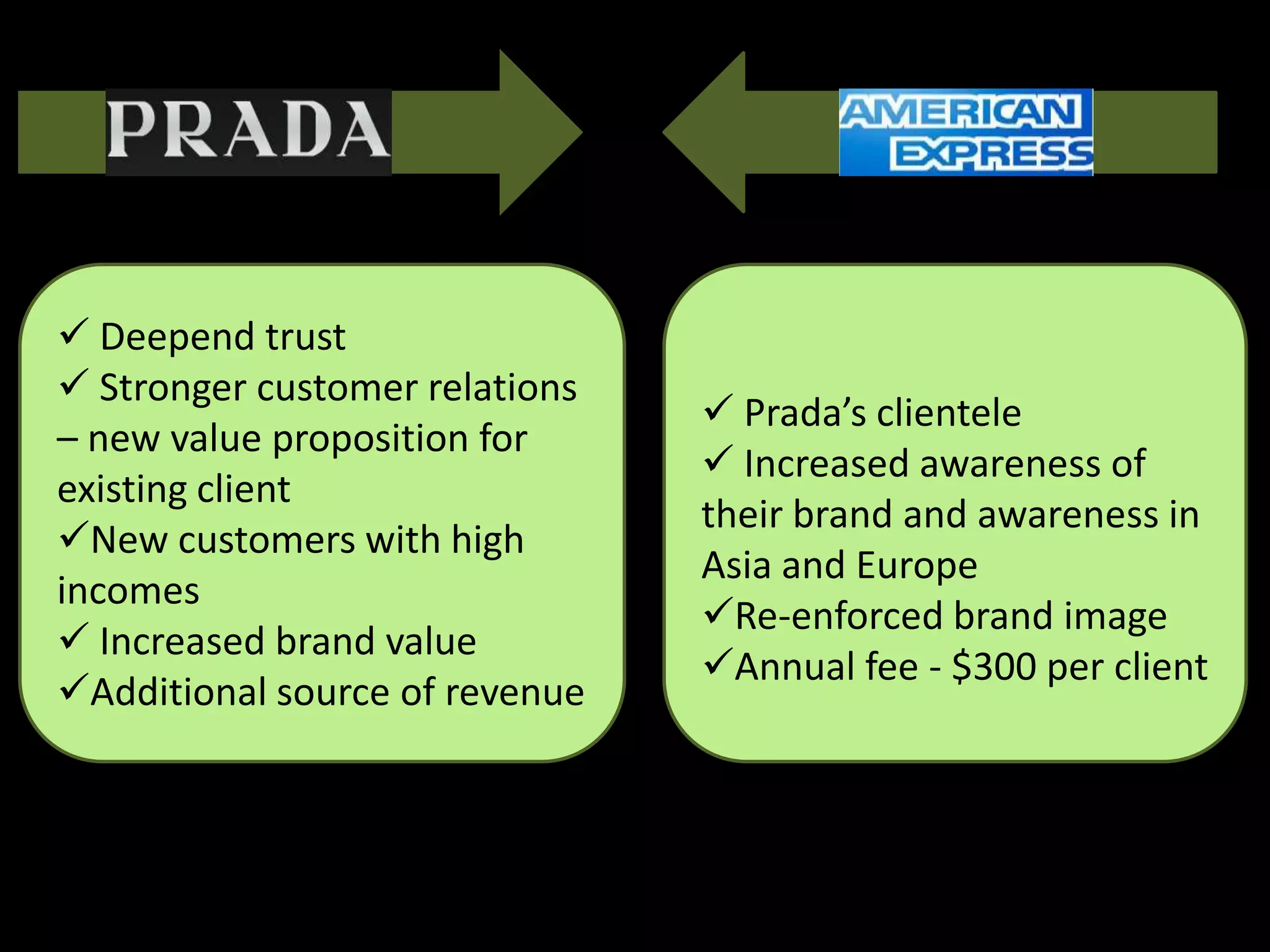

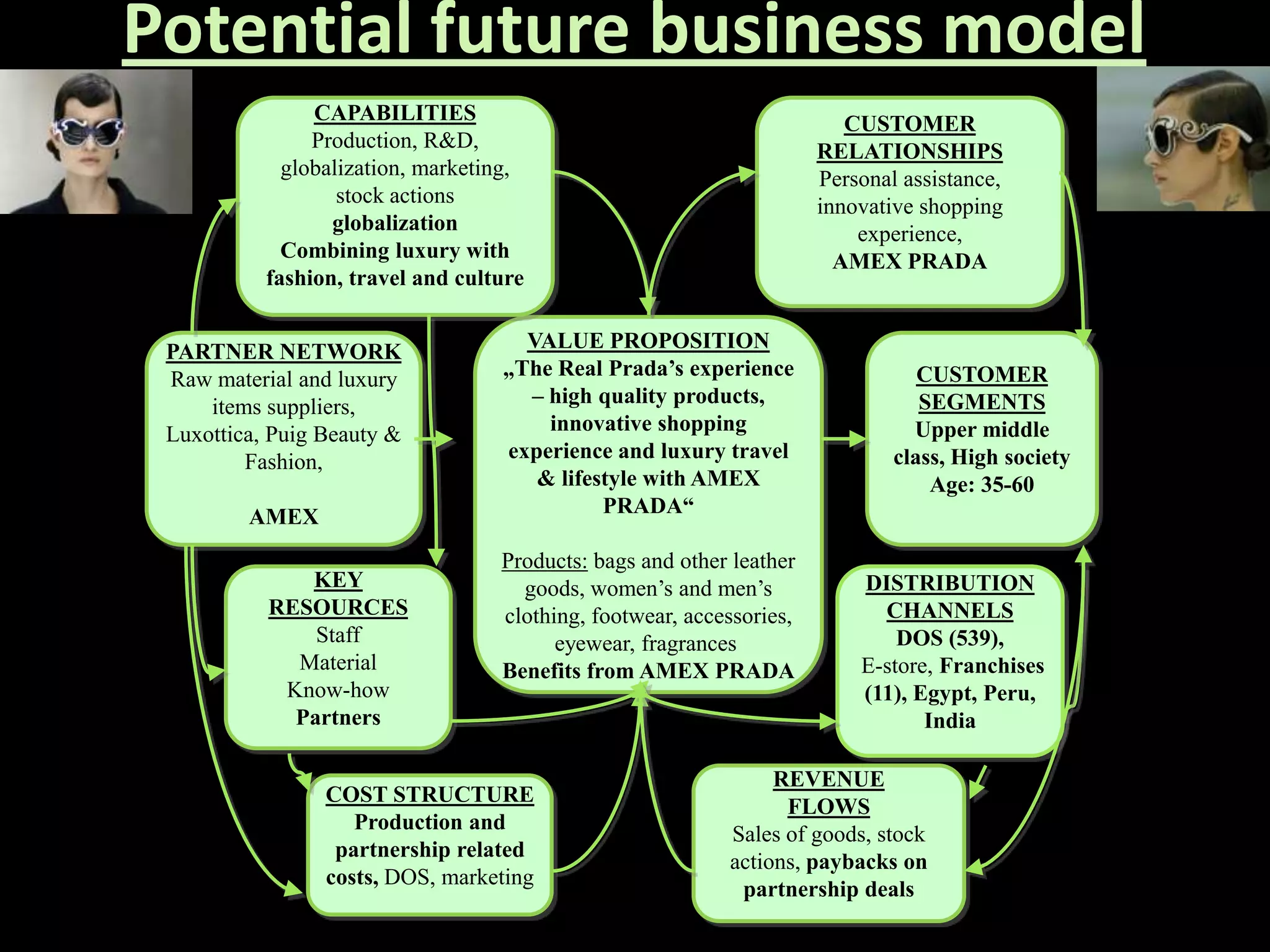

The document outlines the historical progression and business strategy of Prada from its establishment in 1913 to its 2011 status, detailing key phases including the early years, the Prada-Bertelli reign, and the golden age. It highlights the brand's focus on luxury products, customer relationships, market expansion, and innovative marketing strategies. It also presents a SWOT analysis and future business suggestions for enhancing brand value and customer engagement.