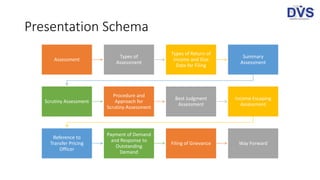

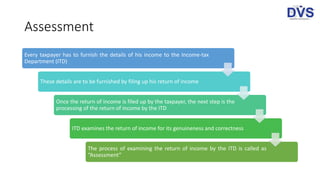

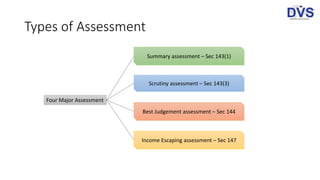

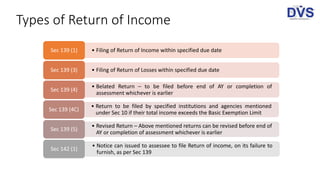

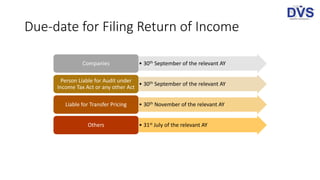

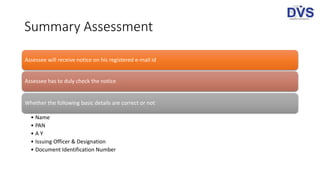

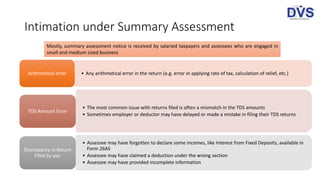

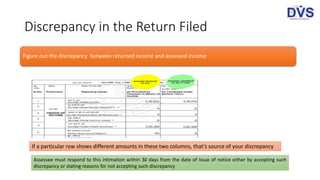

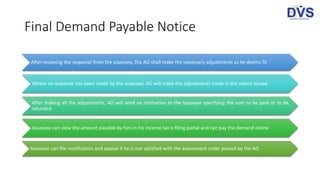

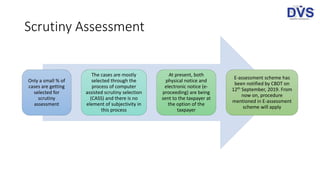

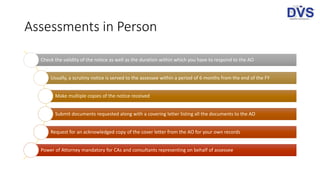

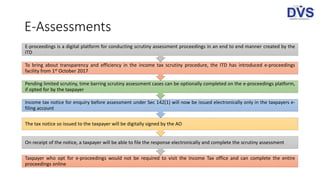

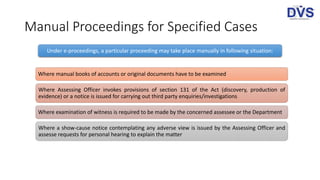

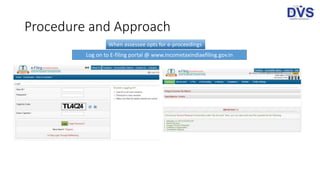

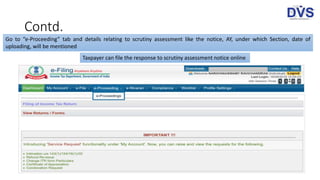

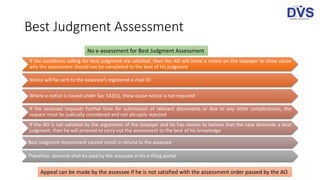

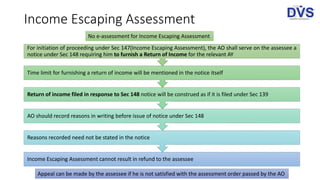

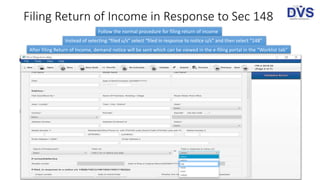

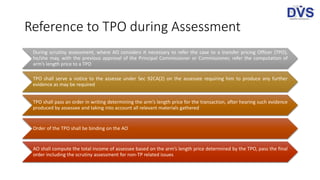

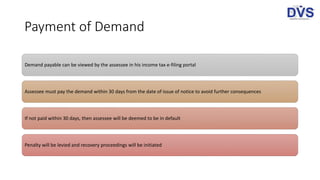

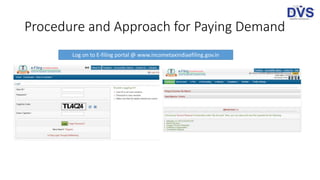

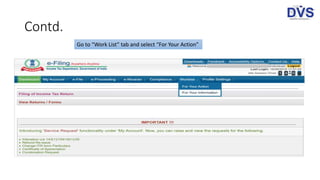

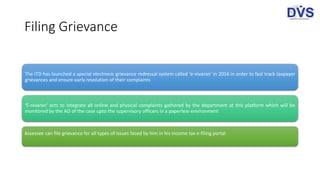

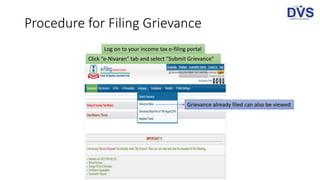

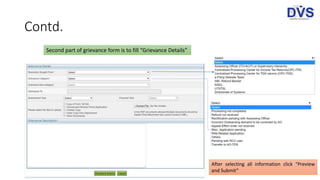

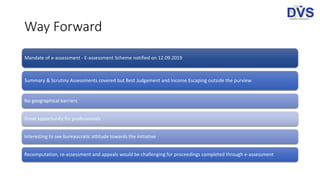

The document provides a comprehensive overview of the various types of income tax assessments, including summary, scrutiny, best judgment, and income escaping assessments. It outlines the procedures for filing returns, responding to notices, and making payments, along with the introduction of e-assessment procedures aimed at improving efficiency. Additionally, it discusses the grievance redressal system and emphasizes the importance of compliance within specified timelines to avoid penalties.