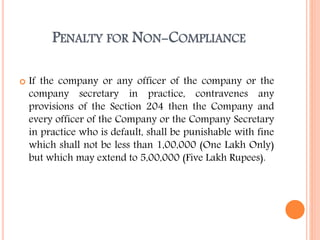

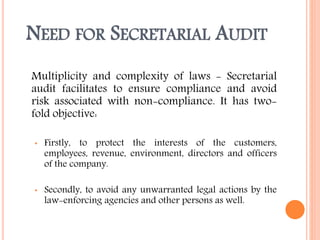

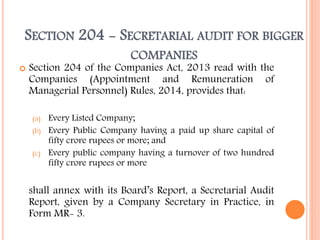

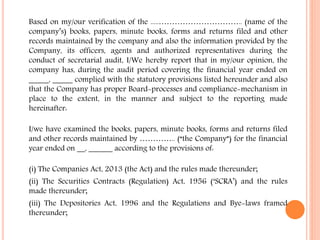

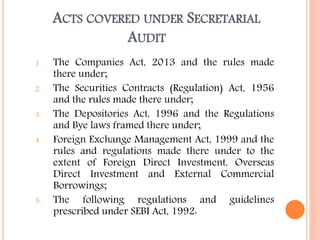

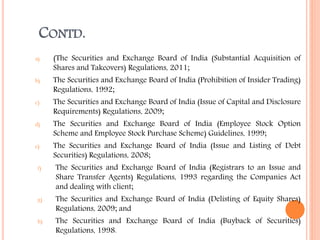

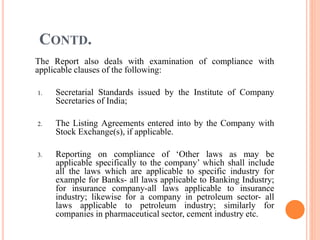

Secretarial audit is the process of verifying a company's compliance with applicable laws. It is mandatory for listed companies and large unlisted public companies. The secretarial auditor, who is an independent company secretary, examines documents like minutes, statutory registers, and approvals to check for compliance. The secretarial audit report details any non-compliances found. It aims to protect shareholder interests and avoid legal issues due to lack of compliance. The secretarial auditor is appointed by the board of directors and files an annual report detailing the company's compliance with laws like the Companies Act, SEBI regulations, and other industry-specific laws. Non-compliance can result in penalties for both the company and its officers.

![INTRODUCTION

Secretarial Audit is a process of checking and verifying the records

and documents of the company and to check whether the company

is in compliance with the provisions of Companies Act, 2013 and

other applicable laws.

The Secretarial Audit Report aims at confirming compliance by the

company with all the applicable provisions of the applicable laws

and pointing out non-compliances and recommendations for better

compliance.

The compliances are verified and checked by an independent

professional [a company secretary in practice] to ensure that the

company has complied with all the legal, secretarial and procedural

requirements as required under various applicable laws.](https://image.slidesharecdn.com/gsssecretarialauditicsi-160729135457/85/Secretarial-Audit-2-320.jpg)

![FORM MR-3

SECRETARIAL AUDIT REPORT

FOR THE FINANCIAL YEAR ENDED … … …

[Pursuant to section 204(1) of the Companies Act, 2013 and rule No.9 of the

Companies (Appointment and Remuneration Personnel) Rules, 2014]

To,

The Members,

……….… Limited

I/We have conducted the secretarial audit of the compliance of

applicable statutory provisions and the adherence to good

corporate practices by……. (name of the company).(hereinafter

called the company). Secretarial Audit was conducted in a manner

that provided me/us a reasonable basis for evaluating the corporate

conducts/statutory compliances and expressing my opinion thereon.](https://image.slidesharecdn.com/gsssecretarialauditicsi-160729135457/85/Secretarial-Audit-5-320.jpg)

![APPOINTMENT OF SECRETARIAL AUDITOR

The Secretarial Auditor would be required to be appointed in the

board meeting of the Company and the remuneration of the Auditor

will also be determined in the aforementioned board meeting

[Section 179(3)].

Company is required to file the certified true copy of the resolution

passed in the aforementioned board meeting with the Registrar of

Companies as an attachment in e-form MGT – 14.

However, prior to the appointment, the Company would be

required to obtain the consent of the Secretarial Auditor.](https://image.slidesharecdn.com/gsssecretarialauditicsi-160729135457/85/Secretarial-Audit-11-320.jpg)

![DUTIES OF SECRETARIAL AUDITOR – FRAUD

REPORTING [SEC 143(12)(14)]

If Company Secretary in Practice, during conduct of Secretarial Audit,

has sufficient reason to believe that an offence involving fraud is being

committed or has been committed against the company by officers or

employees of the company, he shall report the same to the Central

Government immediately but not later than 60 days of his knowledge

with a copy to the Board / Audit Committee seeking their reply within 45

days;

Board / Audit Committee to reply in writing the steps taken to address

the fraud;

The Auditor to forward his report and reply of the Board / Audit

Committee with his Comments to the Central Government within 15

days of reply by Board / Audit Committee;

The Report shall be in Form ADT – 4.

Penalty – 1 lakh to 25 Lakh in case of default in complying of this

section.](https://image.slidesharecdn.com/gsssecretarialauditicsi-160729135457/85/Secretarial-Audit-20-320.jpg)