- Tata Group is an Indian multinational conglomerate company headquartered in Mumbai, Maharashtra, India. It has interests in various sectors and operates in over 80 countries.

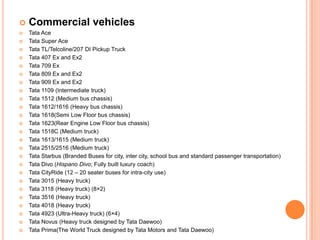

- Tata Motors is an automotive company and part of the Tata Group. It is one of the largest truck and bus manufacturers worldwide. It has manufacturing plants in India as well as other countries.

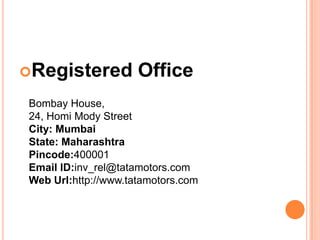

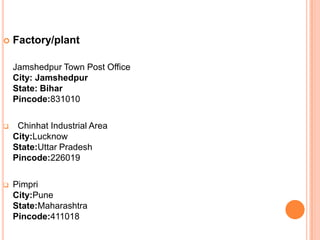

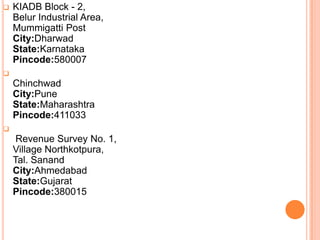

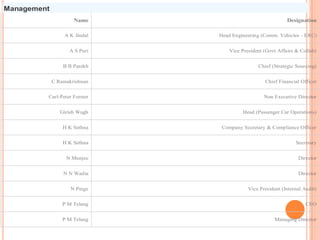

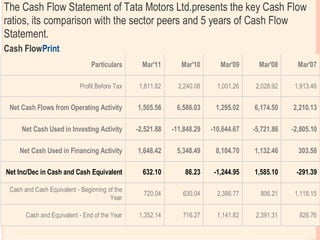

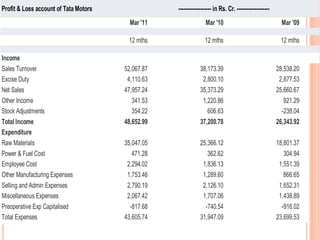

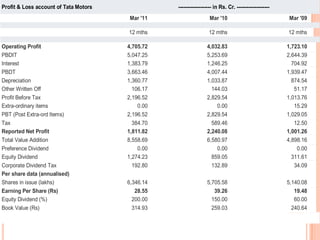

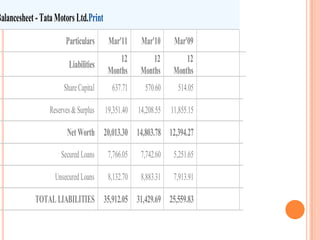

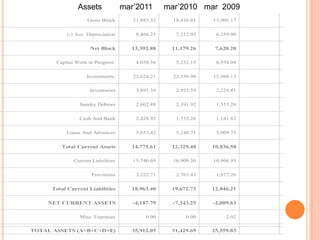

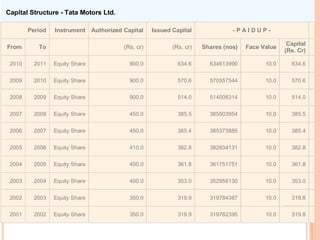

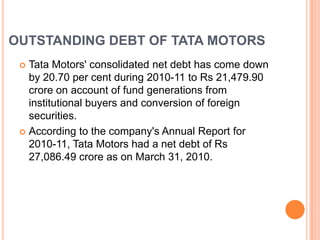

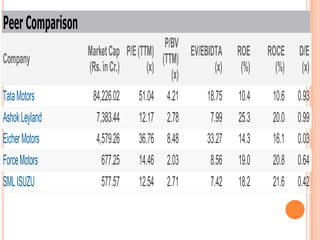

- The document provides details about the management, factories, financial performance and cash flow of Tata Motors for financial years 2007-2011.